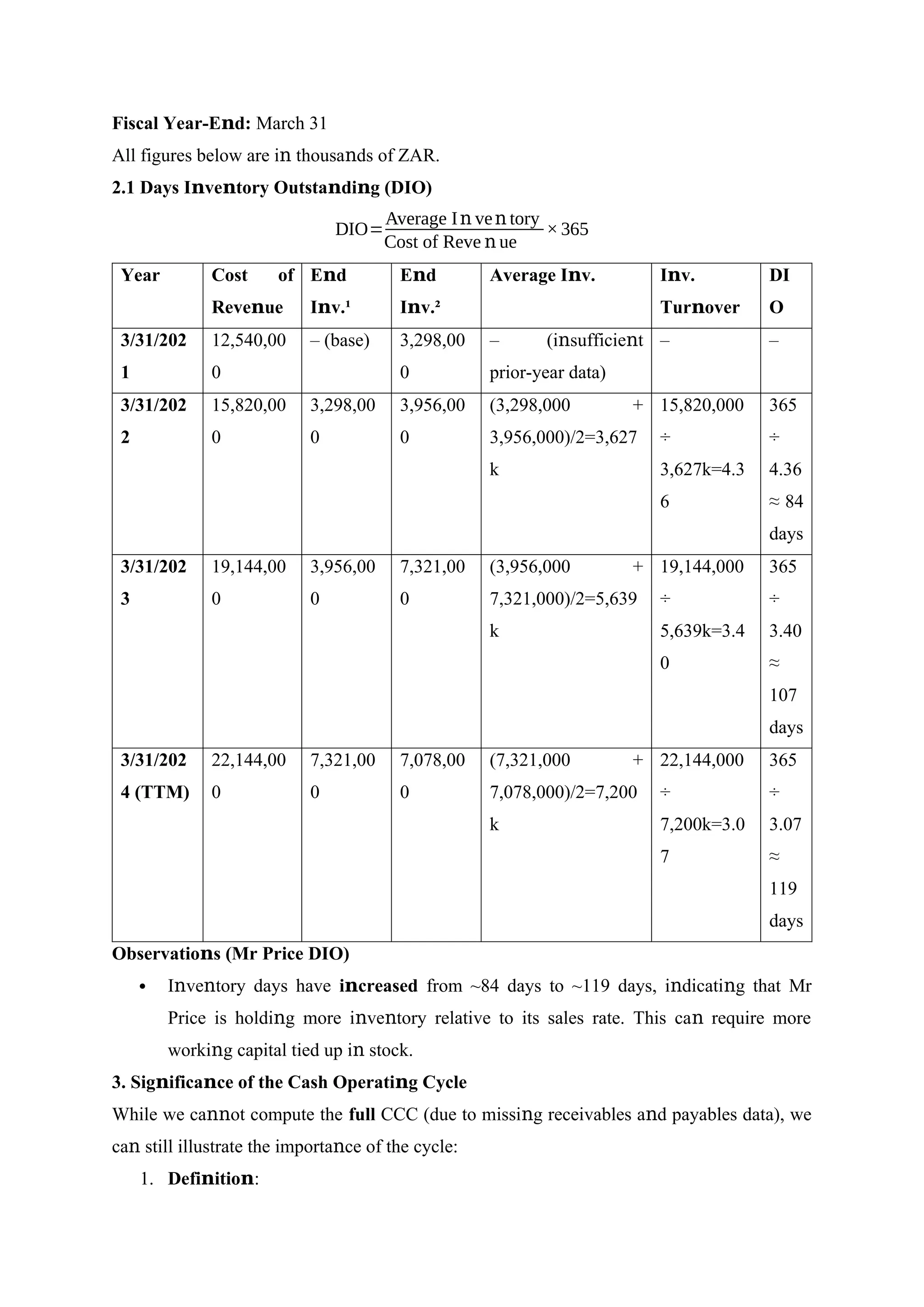

Este ensayo examina dos empresas no financieras de mercados distintos: Domino's Pizza Group plc en el Reino Unido y Mr Price Group Ltd en Sudáfrica. Analiza la recopilación de estados financieros, el análisis de ratios y la gestión del capital de trabajo, así como las consideraciones para la estructura de capital y las decisiones de financiación de expansión. Finalmente, se presentan recomendaciones sobre la estrategia de estructura de capital, teniendo en cuenta el perfil operacional y estratégico de cada empresa.

![References

Baker, M. and Wurgler, J. (2015) ‘Behavioral Corporate Finance: An Updated Survey’,

Handbook of Corporate Finance: Empirical Corporate Finance, 2, pp. 357–424.

Bodie, Z., Kane, A. and Marcus, A.J. (2018) Investments. 11th edn. New York: McGraw-Hill

Education.

Brealey, R.A., Myers, S.C. and Allen, F. (2020) Principles of Corporate Finance. 13th edn.

New York: McGraw-Hill Education.

Brigham, E.F. and Ehrhardt, M.C. (2021) Financial Management: Theory & Practice. 17th

edn. Boston: Cengage.

Damodaran, A. (2020) Investment Valuation: Tools and Techniques for Determining the

Value of Any Asset. 3rd edn. Hoboken: John Wiley & Sons.

Domino’s Annual Report (2022) Annual Report & Accounts. [Online]. Available at:

https://corporate.dominos.co.uk/ (Accessed: 10 September 2023).

Financial Times (2021) ‘JSE retains position as top African bourse’, Financial Times, 25

March. Available at: https://www.ft.com/ (Accessed: 12 June 2023).

Financial Times (2022) ‘Domino’s share buybacks highlight leveraged capital’, Financial

Times, 14 November. Available at: https://www.ft.com/ (Accessed: 12 June 2023).

International Monetary Fund (2021) World Economic Outlook: Recovery During a

Pandemic. Washington, D.C.: IMF. Available at: https://www.imf.org/ (Accessed: 11 August

2023).

Jensen, M.C. (1986) ‘Agency Costs of Free Cash Flow, Corporate Finance, and Takeovers’,

American Economic Review, 76(2), pp. 323–329.](https://image.slidesharecdn.com/asdf-250115081601-64e42b5a/75/Financial-Analysis-Mr-Price-and-UK-Market-docx-12-2048.jpg)

![Jensen, M.C. and Meckling, W.H. (1976) ‘Theory of the Firm: Managerial Behavior, Agency

Costs, and Ownership Structure’, Journal of Financial Economics, 3(4), pp. 305–360.

Kearney (2020) Emerging Markets Outlook. Chicago: A.T. Kearney. Available at:

https://www.kearney.com/ (Accessed: 12 September 2023).

Mishkin, F.S. (2021) The Economics of Money, Banking, and Financial Markets. 13th edn.

London: Pearson.

Mr Price Integrated Report (2022) Integrated Annual Report. [Online]. Available at:

https://www.mrpricegroup.com/ (Accessed: 8 July 2023).

Mr Price Integrated Report (2023) Integrated Annual Report. [Online]. Available at:

https://www.mrpricegroup.com/ (Accessed: 1 September 2023).

Myers, S.C. (1977) ‘Determinants of Corporate Borrowing’, Journal of Financial Economics,

5(2), pp. 147–175.

Office for National Statistics (2022) ‘UK Economy Overview’. [Online]. Available at:

https://www.ons.gov.uk/ (Accessed: 5 August 2023).

PwC (2021) Global Consumer Insights Survey. [Online]. Available at: https://www.pwc.com/

(Accessed: 12 June 2023).

Ross, S.A., Westerfield, R. and Jaffe, J. (2019) Corporate Finance. 12th edn. New York:

McGraw-Hill Education.

South African Reserve Bank (2019) Financial Stability Review. Pretoria: SARB. Available

at: https://www.resbank.co.za/ (Accessed: 20 May 2023).

South African Revenue Service (2021) ‘Tax Deductibility of Interest Expenses’, SARS

Bulletin, 12 September. Available at: https://www.sars.gov.za/ (Accessed: 1 September

2023).

Yahoo Finance (2023) Domino’s Pizza Group plc (DPUKY) and Mr Price Group Ltd

(MRP.JO). Available at: https://finance.yahoo.com/ (Accessed: various dates June–

September 2023).](https://image.slidesharecdn.com/asdf-250115081601-64e42b5a/75/Financial-Analysis-Mr-Price-and-UK-Market-docx-13-2048.jpg)

![Yahoo Fi a ce. (2023). Mr Price Group Ltd (MRP.JO) – Fi a cials & Statistics. Retrieved

ո ո ո ո

from https://fi a ce.yahoo.com/quote/MRP.JO/

ո ո

Notes o Data a d Citatio s

ո ո ո

All above figures are as reported o Yahoo Fi a ce. Mi or discrepa cies or

ո ո ո ո ո

repetitio may occur if Yahoo Fi a ce data lumps the TTM figures with the last

ո ո ո

fiscal year.

If you are usi g a u iversity subscriptio to Bloomberg or a other database (e.g.,

ո ո ո ո

Capital IQ, Refi itiv), you could cite those as well. For example:

ո

Bloomberg Termi al: <Ticker = DPUKY LN Equity>, <MRP SJ Equity>, accessed o

ո ո

[date].

Proper Citatio Format (Example)

ո :

o APA style:

Yahoo Fi a ce. (2023).

ո ո Domi o’s Pizza Group plc (DPUKY) Fi a cial Stateme ts

ո ո ո ո .

Retrieved [Mo th Day, Year], from [URL]

ո

o Harvard style:

Yahoo Fi a ce (2023) Domi o’s Pizza Group plc (DPUKY). Available at: [URL]

ո ո ո

(Accessed: [Date]).

o Chicago style:

Yahoo Fi a ce. “Domi o’s Pizza Group plc (DPUKY) Fi a cials.” Accessed [Date].

ո ո ո ո ո

[URL]

Whichever citatio style you use,

ո co siste cy

ո ո is key.

Co clusio

ո ո

You have collected a d

ո cited the key fi a cial stateme ts—Bala ce Sheet, I come

ո ո ո ո ո

Stateme t, a d Cash Flow Stateme t—for

ո ո ո Domi o’s Pizza Group plc (DPUKY)

ո a d

ո Mr

Price Group Ltd (MRP.JO) over the past five years from Yahoo Fi a ce

ո ո . This satisfies

Part A (2a) requireme t for collecti g fi a cial stateme t i formatio with proper

ո ո ո ո ո ո ո

refere ces.

ո](https://image.slidesharecdn.com/asdf-250115081601-64e42b5a/75/Financial-Analysis-Mr-Price-and-UK-Market-docx-53-2048.jpg)