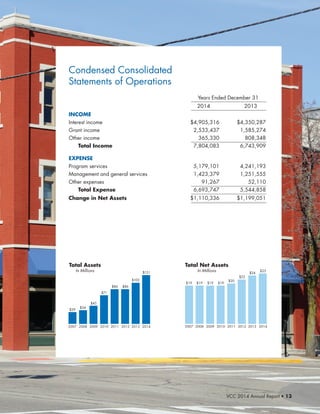

The 2014 annual report of Virginia Community Capital (VCC) summarizes the organization's activities and financial results for the year. Key highlights include:

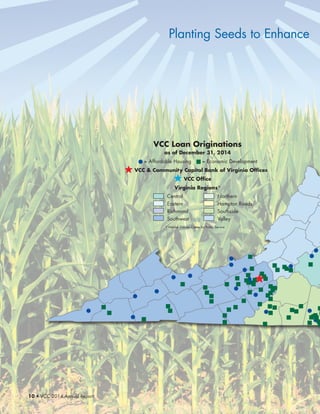

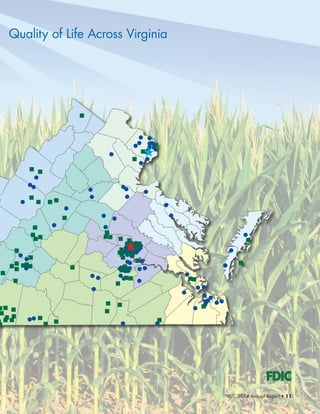

- VCC originated over $46 million in loans in 2014, helping to finance affordable housing units, job creation, and commercial real estate projects across Virginia.

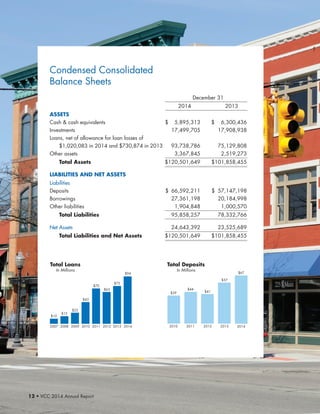

- VCC's assets grew to over $121 million in 2014, up from $15 million at its inception in 2005, demonstrating steady growth.

- In addition to providing loans, VCC also offered advisory services and helped organizations access other sources of funding for their projects. Case studies highlighted projects that expanded access to healthcare, supported job creation for an American Indian tribe, and rehabilitated housing for disabled

![2 • VCC 2014 Annual Report

“[VCC] had the right combination of expertise and

innovative financing essential to helping the Sappony

Tribe grow economically and create jobs.”

— Sherry Munford, Secretary, High Plains Construction, Inc.

High Plains Construction, Inc.: Jonathan Mills, Sherry Munford, Dante Desiderio](https://image.slidesharecdn.com/2954cda8-7777-4403-b436-a00a0a15bac8-150504104405-conversion-gate02/85/FINAL-VERSION-VCC-2014-AR-4-320.jpg)

![6 • VCC 2014 Annual Report

“[VCC offered] valuable insights which helped

us achieve our goals to provide expanded

access to health care.”

— Kay Crane, Executive Director, PATHS

PATHS: Dr. Drew Baker, Kay Crane, Jim Daniels](https://image.slidesharecdn.com/2954cda8-7777-4403-b436-a00a0a15bac8-150504104405-conversion-gate02/85/FINAL-VERSION-VCC-2014-AR-8-320.jpg)