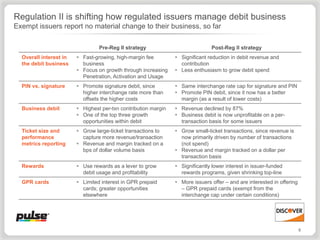

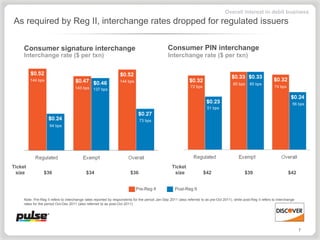

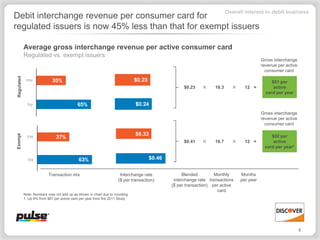

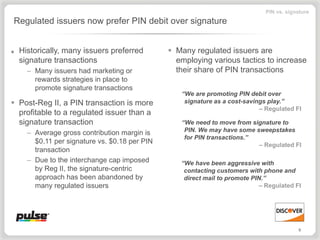

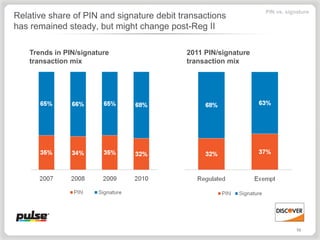

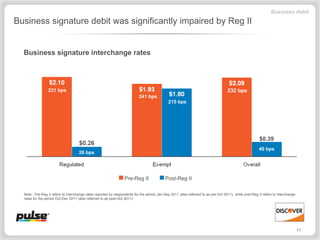

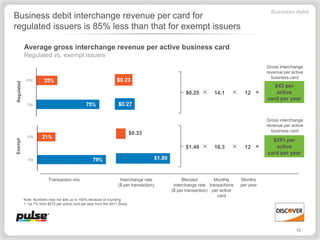

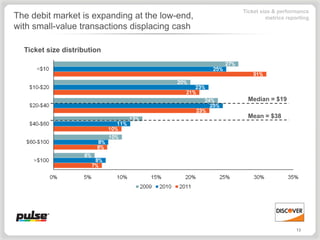

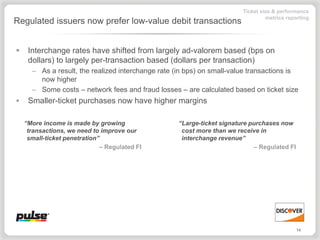

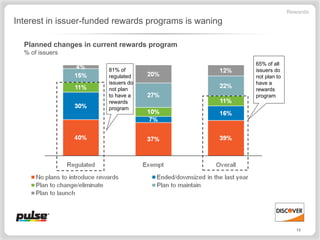

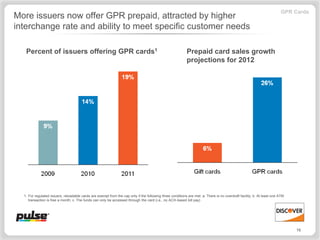

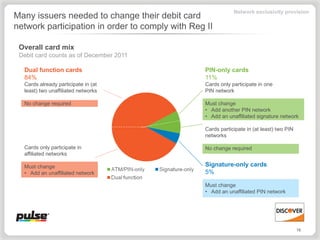

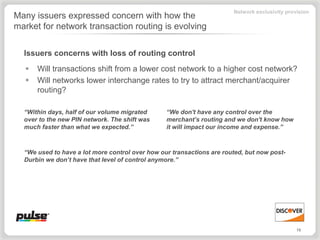

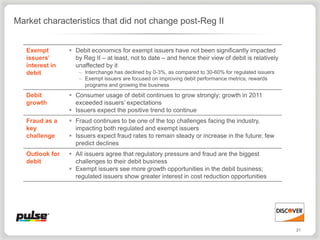

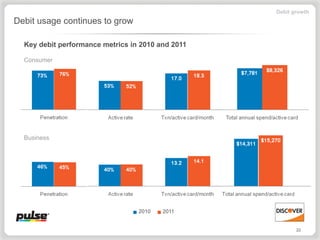

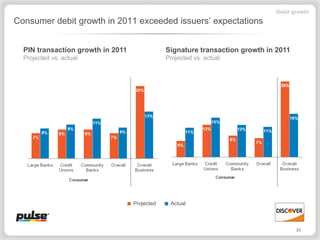

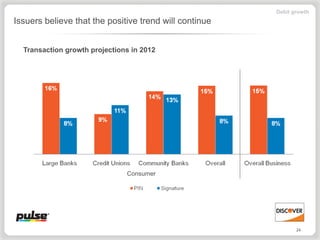

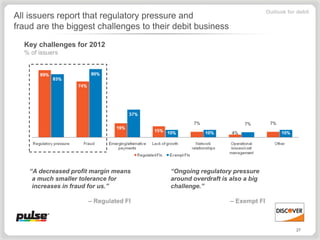

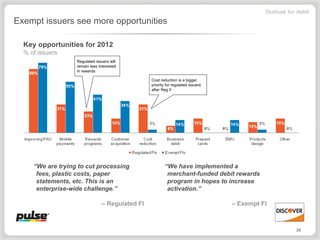

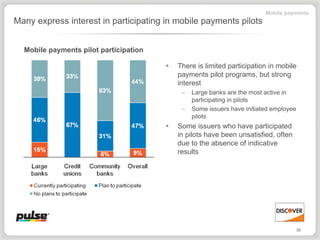

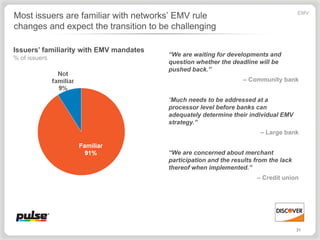

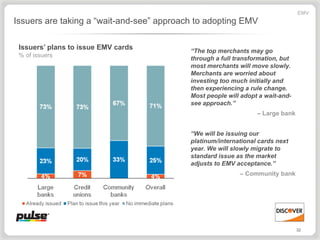

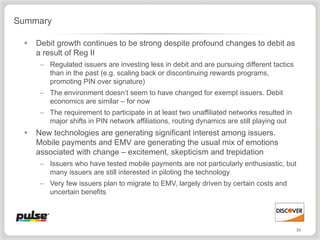

The 2012 Debit Issuer Study, commissioned by Pulse and conducted by Oliver Wyman, indicates that while debit card usage remains strong, regulated issuers are significantly impacted by Regulation II, altering their debit business strategies. Issuers report shifts in transaction types, an increased focus on pin debit transactions over signature transactions, and diminished interest in rewards programs due to reduced revenues. Emerging technologies like mobile payments and EMV card adoption are of interest, but many issuers are hesitant to transition due to costs and uncertainties.