- Second quarter earnings call held on August 14, 2017 to discuss financial results

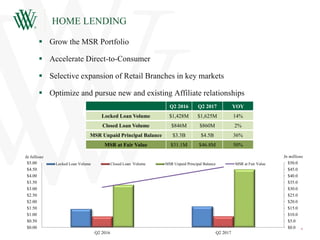

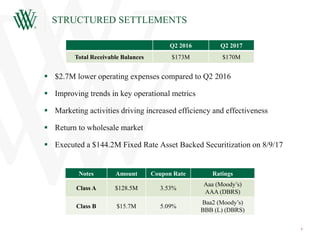

- Home lending segment saw growth in mortgage servicing rights portfolio and origination volumes, while structured settlements benefited from cost savings initiatives and improved marketing and operations

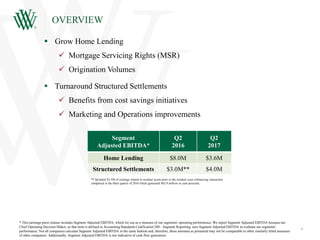

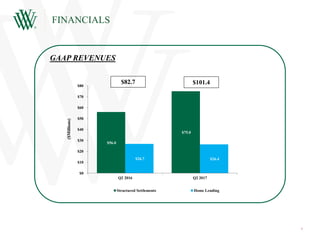

- Home lending adjusted EBITDA was $3.6 million compared to $8 million in prior year, while structured settlements adjusted EBITDA grew to $4 million from $3 million

- Company is focused on growing its mortgage servicing rights portfolio and loan origination volumes in home lending segment through various strategic initiatives