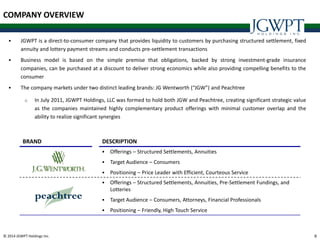

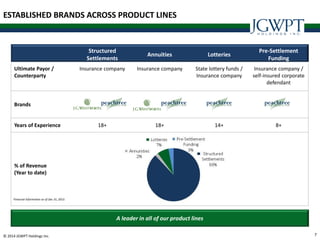

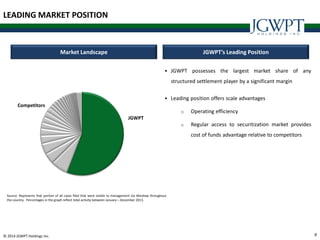

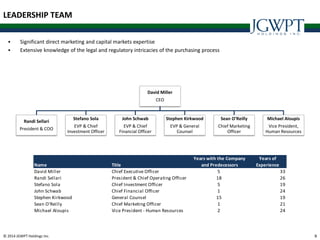

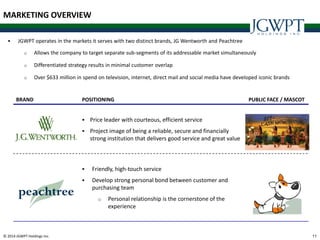

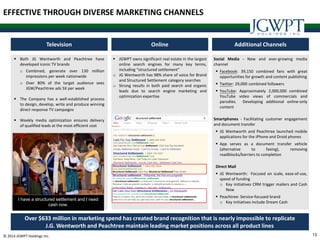

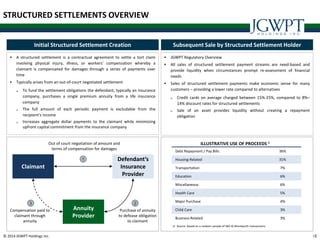

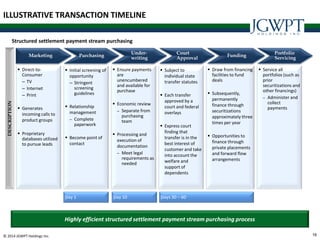

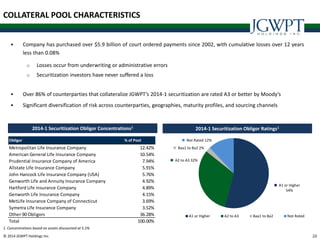

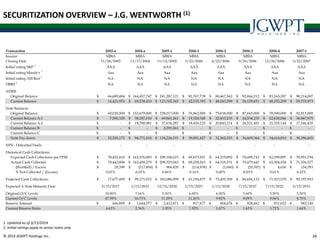

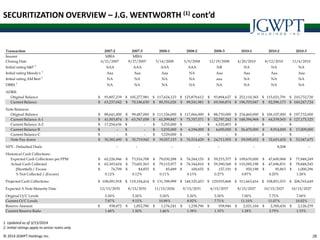

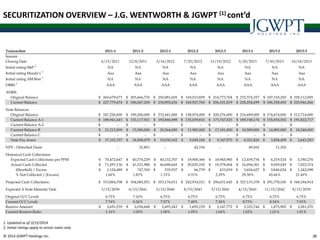

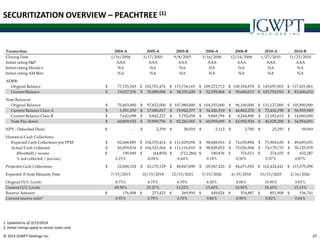

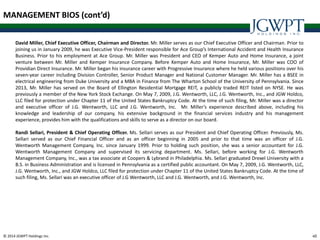

JGWPT Holdings Inc. is a leading purchaser and servicer of structured settlement and annuity payment streams, having gone public in November 2013. The company operates under the brands J.G. Wentworth and Peachtree, focusing on providing liquidity to consumers through structured settlements, annuities, lottery funding, and pre-settlement funding. With a marketing spend of over $633 million, JGWPT maintains a significant market position, leveraging efficient operations and a diverse funding strategy.