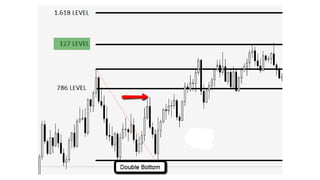

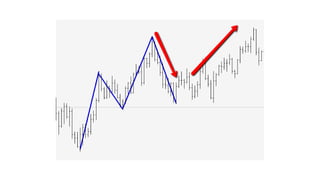

The document discusses using Fibonacci ratios to determine exit points when trading. Specifically, it recommends using the .786, 1.272, and 1.618 Fibonacci ratios projected from swings into a trade setup to determine profit taking levels. The .786 ratio acts as a confirming level, where if the ratio is broken in the direction of the trade, the 1.272 ratio comes into play for partial profit taking. If still in the trade, the 1.618 ratio can be a final extended target. Examples are provided of trades in EURUSD where price action corresponds well to taking profits at these Fibonacci ratio levels. Consistency is achieved by keeping exits objective and data-driven using this method.