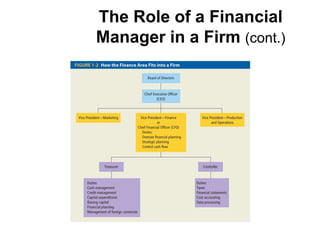

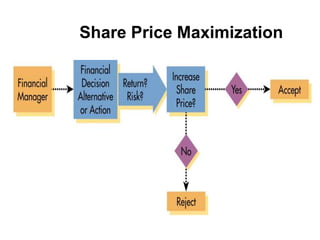

The document provides an introduction to the foundations of financial management. It discusses key topics including the definition of finance, the roles and goals of financial managers, and basic principles and forms of business. Specifically, it outlines that the role of a financial manager is to make decisions regarding capital budgeting, capital structure, and working capital. Additionally, it states the goal of a firm is to maximize shareholder wealth through maximizing share price, rather than profit maximization.