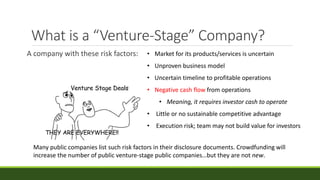

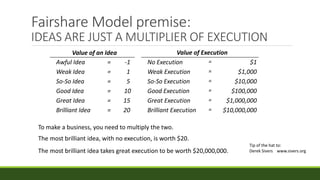

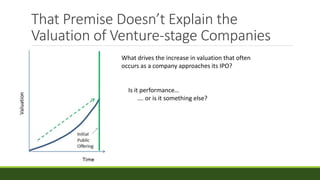

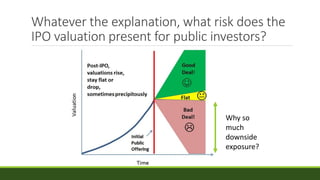

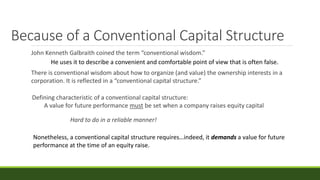

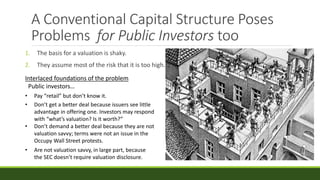

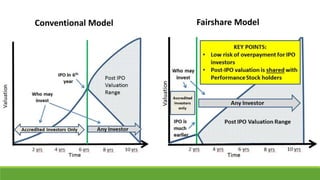

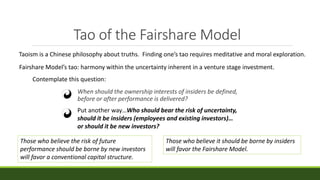

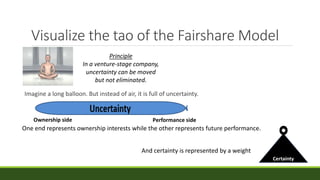

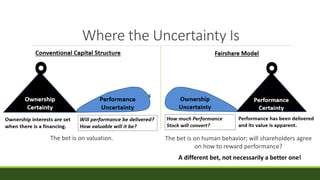

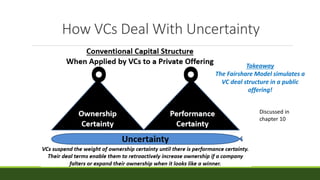

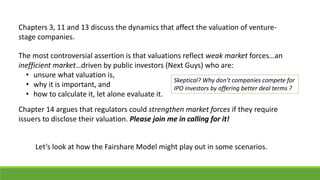

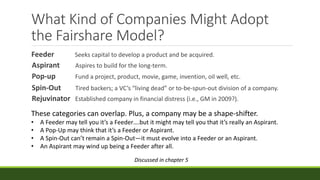

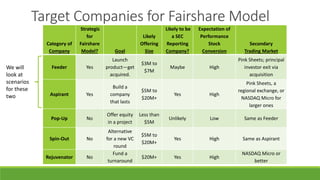

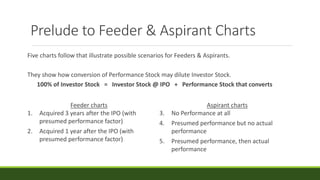

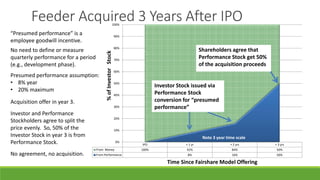

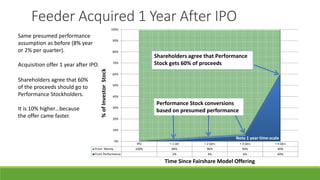

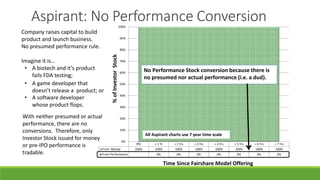

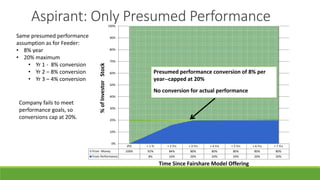

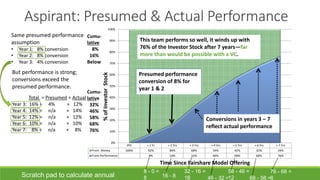

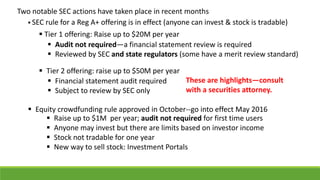

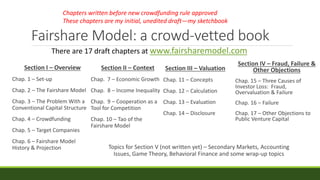

The document outlines the Fairshare Model, a performance-based capital structure for companies seeking venture capital through public offerings. It discusses various SEC rules, crowdfunding regulations, and the dynamics of company valuations, emphasizing how the model benefits average investors by allowing them to partake in IPOs on more equitable terms compared to traditional VC structures. Additionally, it contrasts the Fairshare Model with conventional capital structures, highlighting its unique approach to risk and performance evaluation.

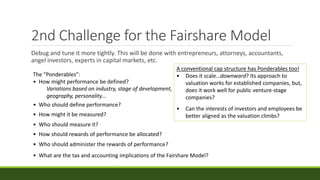

![Vision, Goals and Perspective

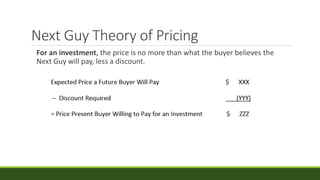

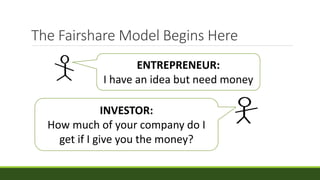

Vision

Middle Class investors can invest in the IPOs of venture-stage companies…

on terms comparable to those that venture capitalists get in a private offering.

Goals

1. Alternative to a VC round (for companies).

2. Liquidity for pre-IPO investors (limited if offering is small).

3. Attractive option for public investors to be “mini-angels.”

Perspective is that of average investors. Ranking of interests:

1st Place --- Average IPO investors (i.e. what is best for them?)

2nd Place --- [Tie] Entrepreneurs and pre-IPO investors

3rd Place --- Secondary market investors

Fairshare Model

is an idea.

It has not been

used before.

Look at IPOs from this angle and

you’ll have an intuitive sense for

the Fairshare Model.](https://image.slidesharecdn.com/fairsharemodelcannabispresentation11-151219214058/85/Fairshare-model-cannabis-presentation-11-19-15-6-320.jpg)