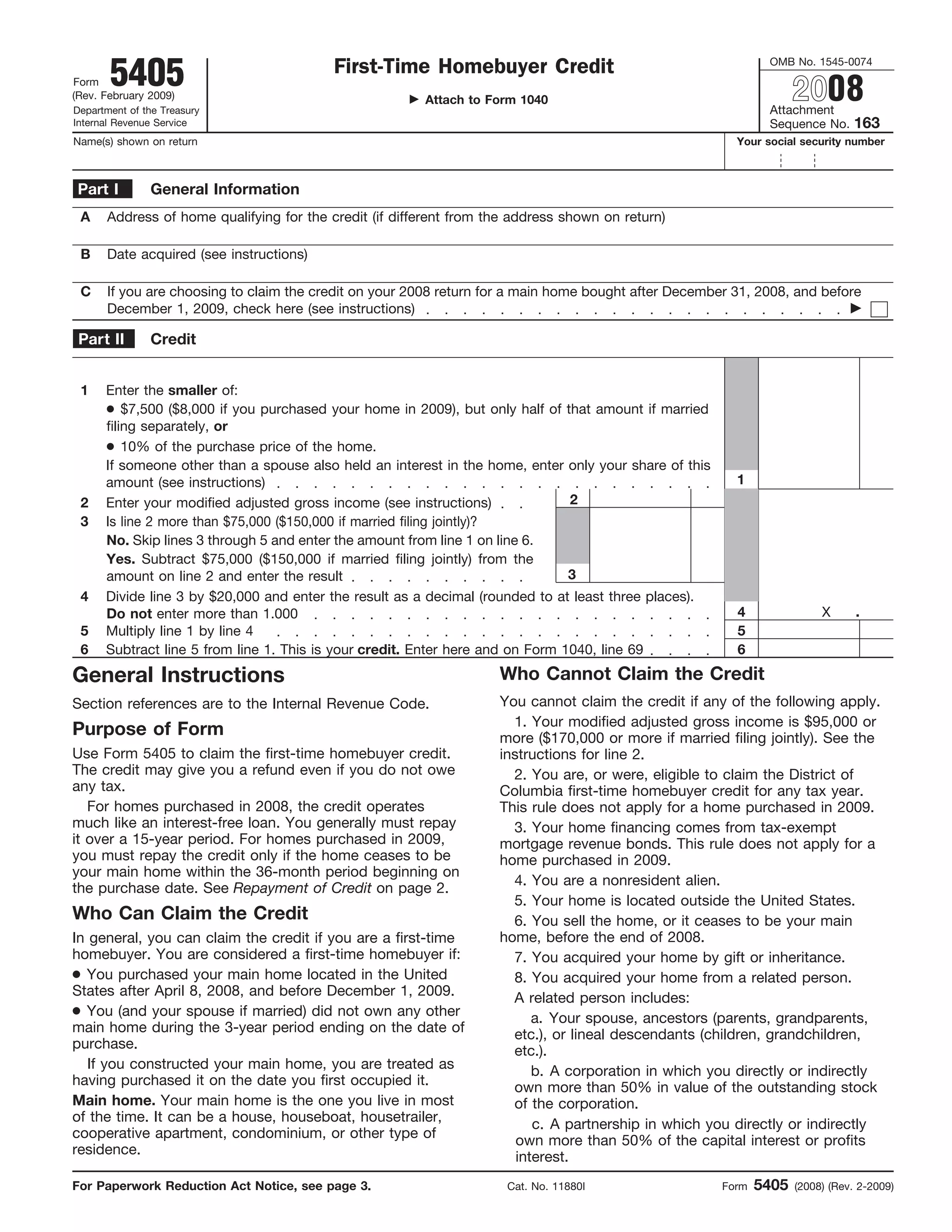

This document provides instructions for claiming the first-time homebuyer credit on IRS Form 5405. Key details include:

1) The credit is available for homes purchased between April 9, 2008 and December 1, 2009. For homes purchased in 2008, the credit must generally be repaid over 15 years. For homes purchased in 2009, the credit only needs to be repaid if the home is no longer the main residence within 36 months.

2) To qualify for the credit, taxpayers must be first-time homebuyers who did not own a principal residence in the last 3 years. The credit amount is the smaller of $7,500 ($8,000 for 2009 purchases) or 10% of the purchase