Embed presentation

Download to read offline

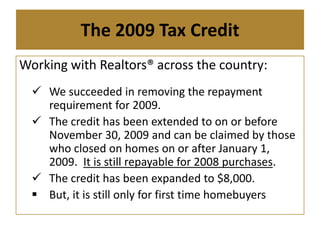

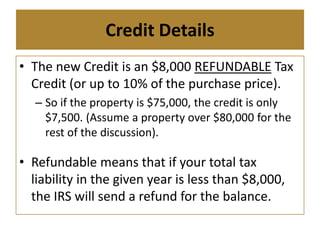

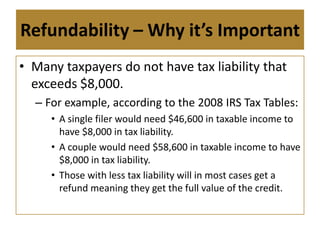

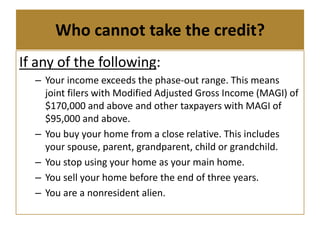

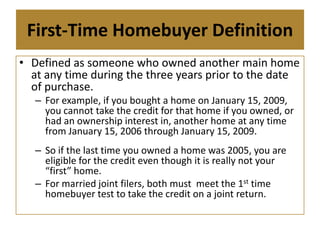

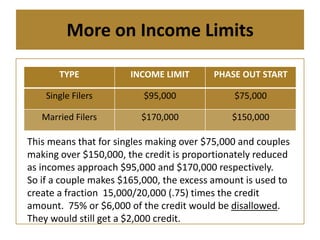

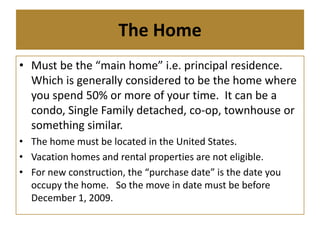

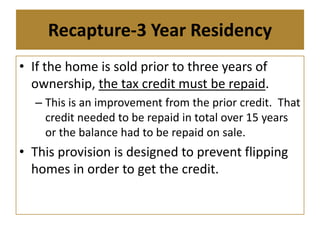

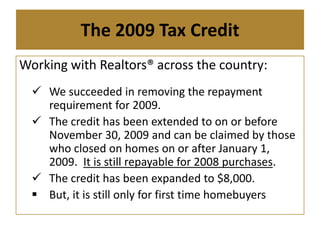

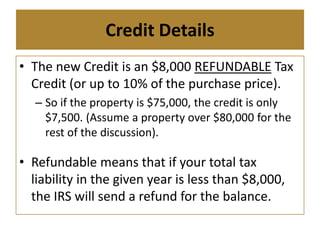

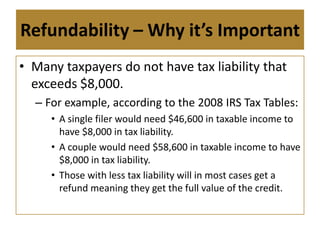

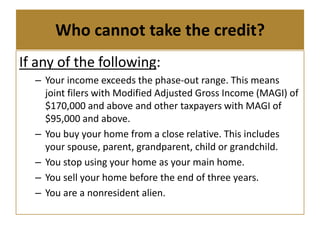

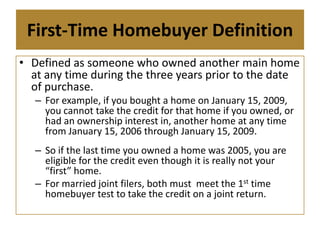

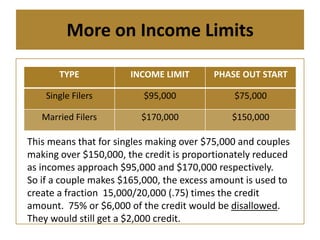

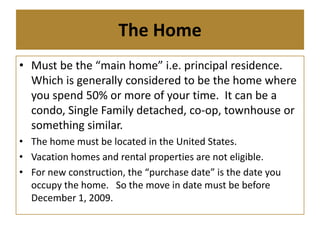

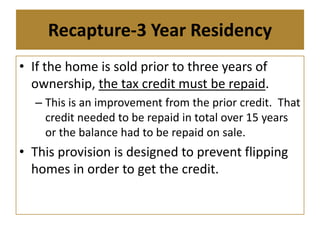

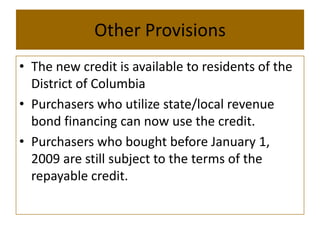

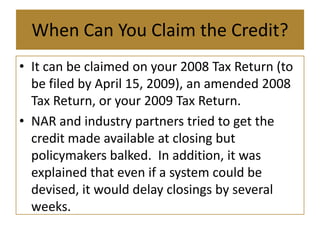

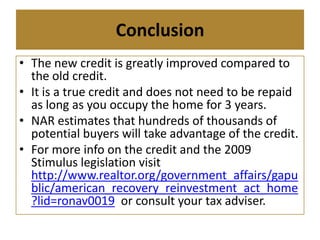

The document summarizes changes to the First-Time Homebuyer Tax Credit that were advocated for by the National Association of Realtors. Key changes included removing the repayment requirement, extending the credit until November 2009, and increasing the amount to $8,000. It provides details on eligibility, including income limits and the requirement to occupy the home as a primary residence for three years to avoid repayment. The revised credit aims to encourage more first-time homebuyers by making the benefit fully refundable for those with tax liability under $8,000.