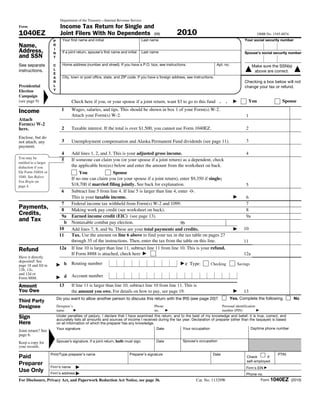

1. Sebastian Roberts filed a 2010 Form 1040EZ tax return as a single filer reporting $55,000 in wages.

2. His filing status was single and his standard deduction of $9,350 and taxable income of $45,650 were calculated.

3. No taxes were withheld from his wages and he did not qualify for the making work pay or earned income tax credits, resulting in $9,931 owed in taxes.