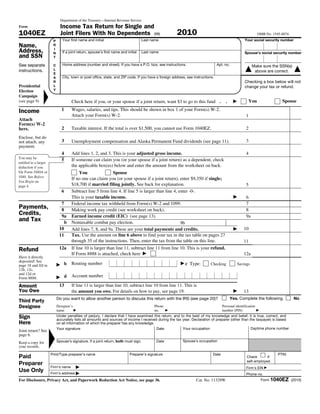

1) The document is an IRS Form 1040EZ for filing an individual income tax return for 2010. It provides lines to report wages, taxable interest, unemployment compensation, and adjusted gross income.

2) The taxpayer, Jae Hun Kim, reports $40,000 in wages on Line 1. With the standard deduction of $9,350, the taxpayer's taxable income is $30,650.

3) Based on the tax table, the taxpayer's tax is $4,183. Since the taxpayer had no tax withheld or credits, the full $4,183 amount is owed.