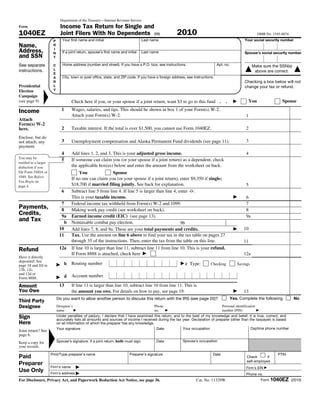

This document is an individual income tax return form (Form 1040EZ) for the year 2010. It provides instructions for a single or married filing jointly taxpayer with no dependents and limited income to file their federal income taxes. The taxpayer, Pronit Dutta, had $55,000 in wages and no other income. After claiming the standard deduction of $9,350, their taxable income was $45,650. With no payments or credits, their tax due was $7,588. However, with a refund of $38,062, no amount was owed.