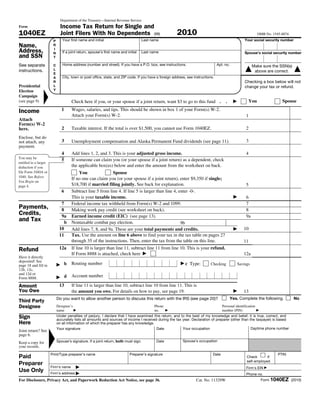

1) The document is an IRS Form 1040EZ, which is a simplified tax return for single and married filing jointly taxpayers with no dependents. It provides lines to report wages, taxable interest, unemployment compensation, and adjusted gross income.

2) The form allows the taxpayer to claim standard deductions based on filing status. It provides a table to look up tax liability based on taxable income. Payments, credits, and the amount of tax owed or refunded are also calculated.

3) Worksheets are included to help calculate amounts that can be entered for the standard deduction if being claimed as a dependent, as well as for the making work pay credit.