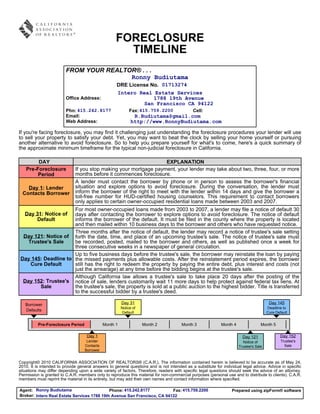

1) If a borrower stops making mortgage payments, the lender may wait 2-4 months before starting the foreclosure process.

2) On day 31, the lender can file a notice of default to inform the borrower.

3) On day 121, the lender can record a notice of trustee's sale setting the date, time and location of the upcoming foreclosure auction.