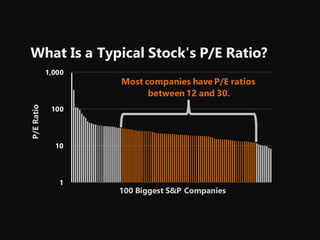

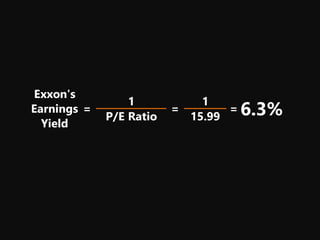

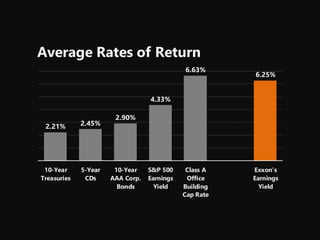

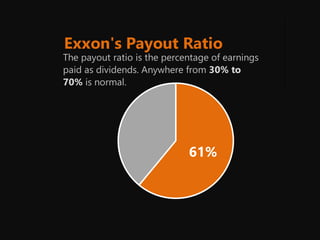

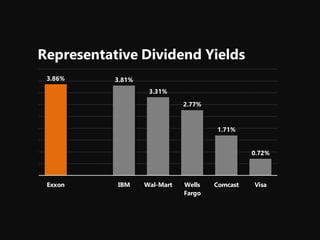

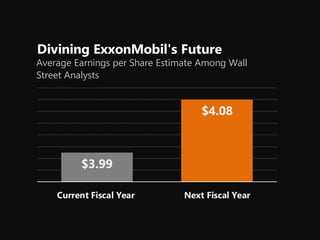

ExxonMobil's stock price and earnings per share can be used to calculate the company's price-to-earnings ratio of 15.99. This ratio represents how much it costs to buy $1 of the company's annual earnings. While ExxonMobil's quarterly dividends only account for around 61% of total earnings, its current dividend yield of 3.86% compares favorably to other large companies. Looking ahead, analysts expect the company's earnings to grow modestly in the current and next fiscal years.