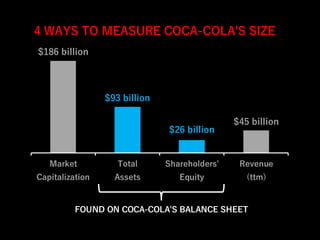

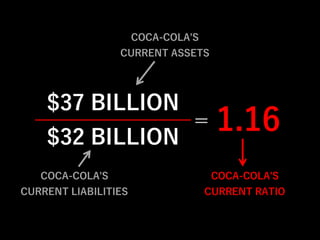

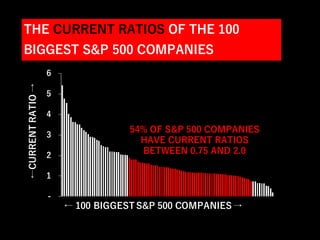

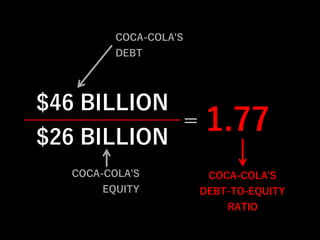

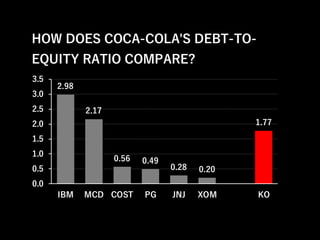

The document summarizes key information from Coca-Cola's balance sheet, including lessons about the company's size, liquidity, and solvency. It measures Coca-Cola's size based on market capitalization, total assets, shareholders' equity, and revenue. It analyzes liquidity using the current ratio and finds Coca-Cola is within the typical range. It evaluates solvency through the debt-to-equity ratio, noting while over 1, it is comparable to many other S&P 500 firms. The balance sheet provides insights into Coca-Cola's growth potential and business model vulnerability.