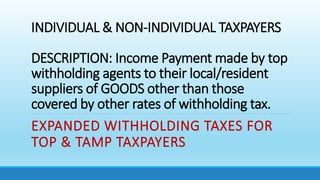

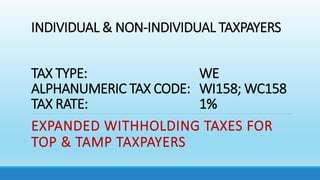

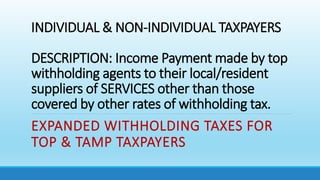

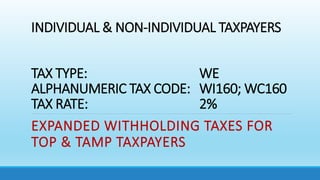

This document provides an overview of expanded withholding taxes in the Philippines. It discusses the classification of withholding taxes, including creditable and final withholding taxes. It also outlines the expanded withholding taxes for top taxpayers and those under the Taxpayer Account Management Program. Specific rates and codes are provided for withholding taxes on payments made by top taxpayers to local suppliers of goods (1%) and services (2%). Agricultural suppliers earning over 300,000 PHP are also subject to a 1% withholding tax.

![Income payment made by top withholding agents, either private

corporations or individuals, to their local/resident supplier of goods and

local/resident supplier of services other than those covered by other

rates of withholding tax. [formerly under letters (M) and (W)] – Income

payments made by any of the top withholding agents, as determined by

the Commissioner, to their local/resident supplier of GOODS/SERVICES,

including non-resident aliens engaged in trade or business in the

Philippines, shall be subjected to the following withholding tax rates:

Supplier of Goods: One Percent (1%) and Supplier of Services (2%)

RR 11-2018 SECTION 2.57.2(I)](https://image.slidesharecdn.com/expandedwithholdingtaxes-220803041554-6eda5115/85/EXPANDED-WITHHOLDING-TAXES-pptx-13-320.jpg)

![Income payments made to suppliers of agricultural products

[formerly under letter (S)] – Income payments made to agricultural

suppliers such as those, but not limited to, payments made by

hotels, restaurants, hotels, restaurants, resorts, caterers, food

processors, canneries, supermarkets, livestock, poultry, fish and

marine product dealers, hardwares, factories, furniture shops, and

all other establishments, in excess of the cumulative amount of

Three hundred thousand pesos (₱300,000.00) within the same

taxable year. - One percent (1%)

RR 11-2018 SECTION 2.57.2(N)](https://image.slidesharecdn.com/expandedwithholdingtaxes-220803041554-6eda5115/85/EXPANDED-WITHHOLDING-TAXES-pptx-18-320.jpg)