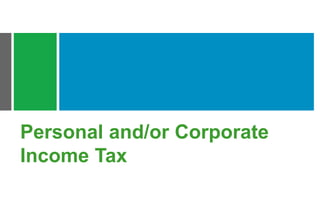

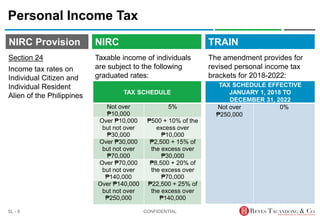

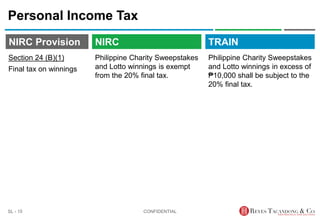

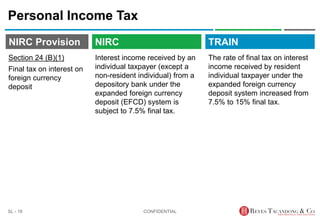

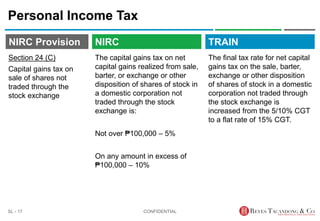

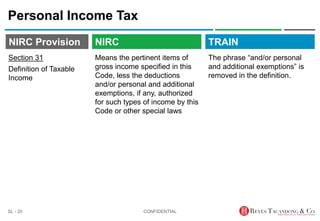

This document provides a summary of key amendments to the personal income tax provisions in the TRAIN Law (Republic Act No. 10963) as compared to the previous tax code under Republic Act No. 8424. Some of the key changes summarized include the introduction of new personal income tax brackets from 2018 to 2022 and for 2023 onwards, changes to the tax treatment of certain types of income like lottery winnings, interest income from foreign currency deposits, and capital gains from the sale of non-traded stocks. It also discusses the tax treatment of self-employed individuals and mixed income earners. One amendment related to preferential tax rates for certain regional headquarters and petroleum contractors was vetoed by the President.

![TRAIN

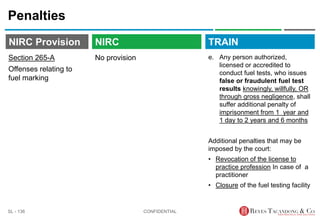

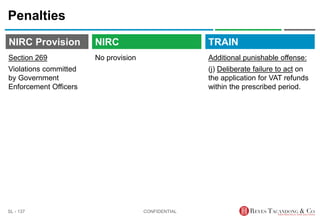

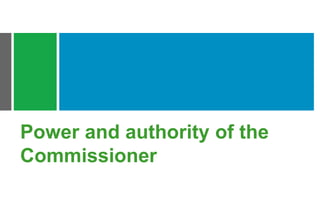

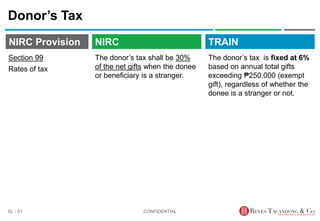

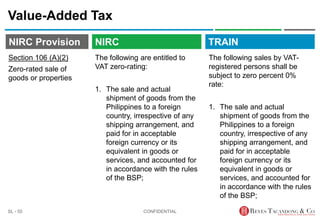

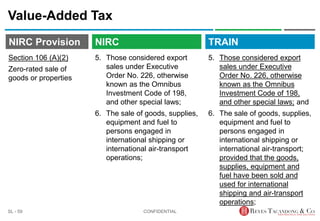

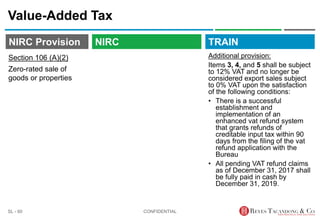

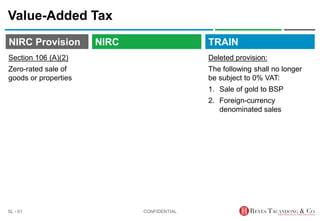

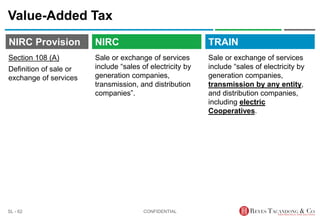

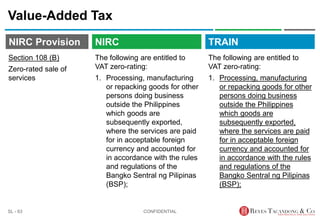

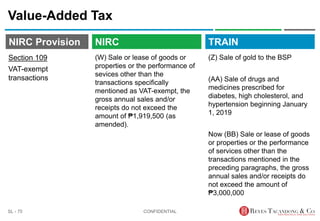

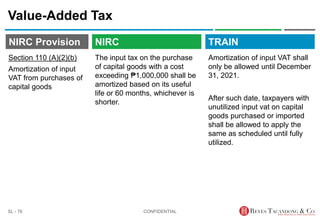

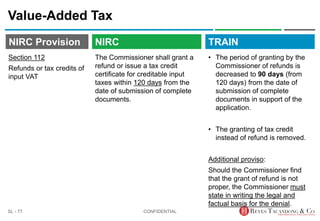

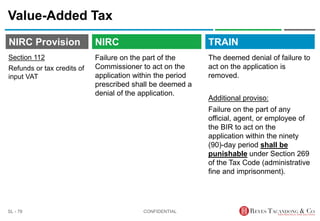

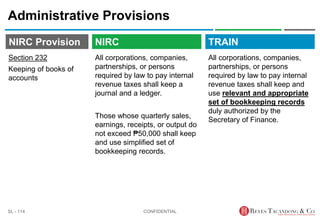

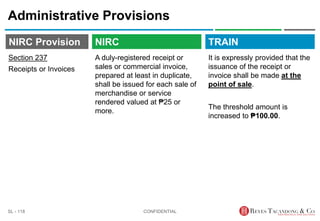

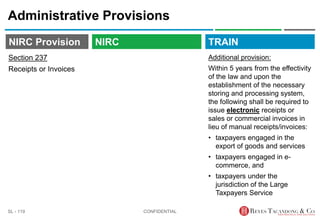

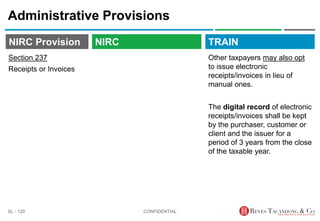

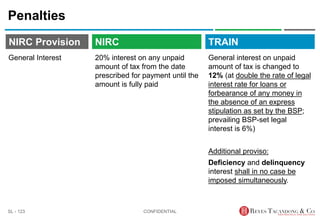

NIRC Provision

Alien individuals and qualified

Filipino employees employed by

1. Regional or area and

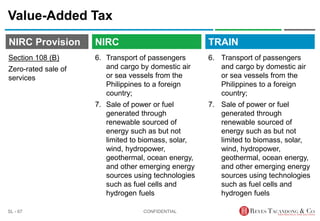

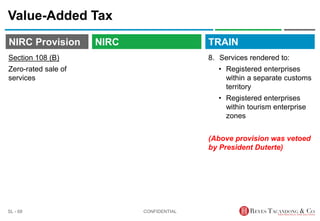

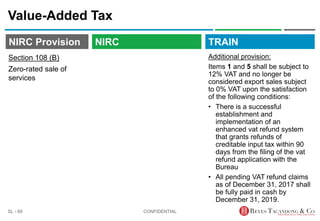

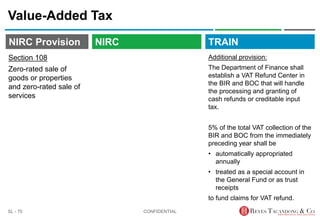

Regional Operating

headquarters of multinational

companies (RHQs and

ROHQs) [Subsection (C)]

2. Offshore banking units

(OBUs) [Subsection (D)]

3. Petroleum Service contractor

and subcontractor

[Subsection (E)]

are subject to a preferential tax

of 15% final withholding tax on

gross compensation income.

Personal Income Tax

Additional provision

[Subsection (F)]:

The 15% preferential tax rate

provided in Subsections (C), (D),

and (E) shall not be applicable to

RHQs, ROHQs, OBUs or

Petroleum service contractor and

subcontractor registering with the

SEC after January 1, 2018.

But existing RHQs, ROHQs,

OBUs or Petroleum service

contractor and subcontractor

shall continuously be entitled to

avail of the preferential tax

treatment for their present and

future qualified employees.

CONFIDENTIAL

SL - 18

NIRC

Section 25 (C), (D), (E)

Preferential tax rate for

individuals employed

by RHQ, ROHQ, OBU

and Petroleum

Contractors and

subcontractors](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-18-320.jpg)

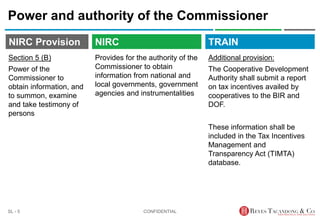

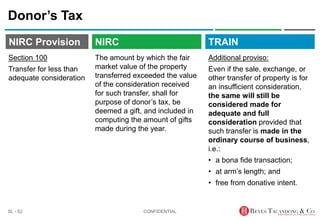

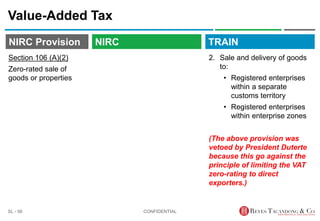

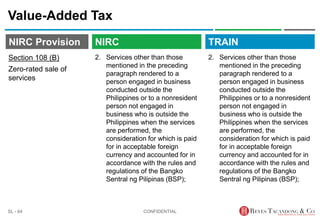

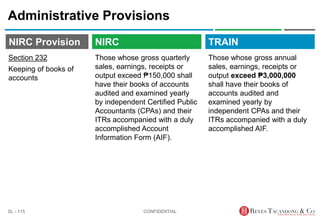

![TRAIN

NIRC Provision

Personal Income Tax

Presidential Veto:

The President vetoed this line item

under Subsection (F):

“But existing RHQs, ROHQs, OBUs

or Petroleum service contractor and

subcontractor shall continuously be

entitled to avail of the preferential tax

treatment for their present and future

qualified employees.”

for being violative of equal protection.

The President stated in his letter that

“[g]iven the significant reduction in

the personal income tax, the

employees of these firms should

follow the regular tax rates applicable

to other individual taxpayers.”

CONFIDENTIAL

SL - 19

NIRC

Section 25 (C), (D), (E)

Preferential tax rate for

individuals employed

by RHQ, ROHQ, OBU

and Petroleum

Contractors and

subcontractors](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-19-320.jpg)

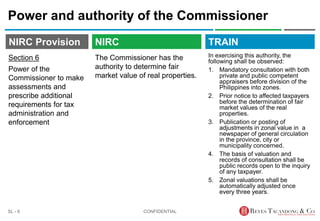

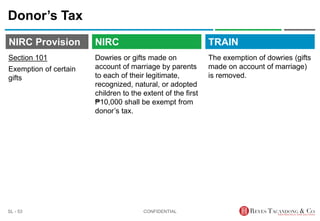

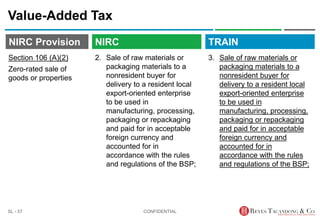

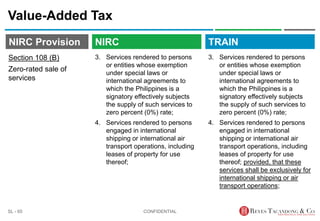

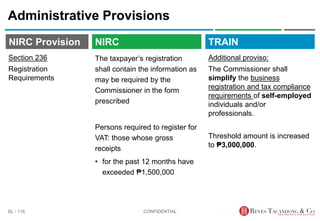

![TRAIN

NIRC Provision

The return for FWT and the

return for creditable withholding

taxes (EWT returns) shall be

filed within ten (10) days after

the end of each month [Sec.

2.58 of RR No. 2-98)]

Final Withholding Tax and Expanded Withholding

Tax Returns

FWT and EWT returns shall be

filed and the payment made not

later than the last day of the

month following the close of

the quarter during which the

withholding was made.

The provision that the

Commissioner may require the

payment of the taxes withheld

at more frequent intervals is

removed.

CONFIDENTIAL

SL - 37

NIRC

Section 58

Return and payments

of taxes withheld at

source](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-37-320.jpg)

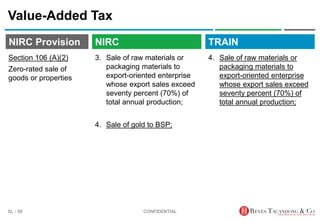

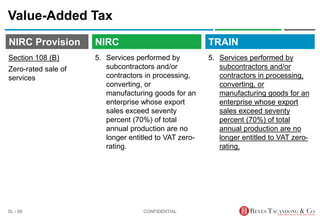

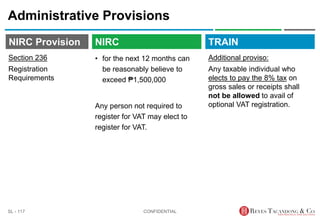

![TRAIN

NIRC Provision

No provision

Estate Tax

In case the available cash of

the estate is insufficient to pay

the total estate tax due,

payment by installment shall be

allowed within two (2) years

from the statutory date of

payment, without civil

penalty and interest.

CONFIDENTIAL

SL - 47

NIRC

Section 91 (C)

Payment by installment

of estate tax [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-47-320.jpg)

![TRAIN

NIRC Provision

Excise Taxes

CONFIDENTIAL

SL - 85

Section 145 (B) and

(C)

Excise tax on

cigarettes packed by

hand and by machine

The rates of excise tax shall be increased by 4% every year

effective January 1, 2024, through revenue regulations issued by

the Secretary of Finance.

Duly registered cigarettes packed by hand shall only be packed

in 20s [previously allowed in 30s] and other packaging

combinations of not more than 20.

Effective Tax

Jan 1, 2018 – Jun 30, 2018 ₱32.50 per pack

Jul 1, 2018 – Dec 31, 2019 ₱35.00 per pack

Jan 1, 2020 – Dec 31, 2021 ₱37.50 per pack

Jan 1, 2022 – Dec 31, 2023 ₱40.00 per pack](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-85-320.jpg)

![TRAIN

NIRC Provision

No provision

Excise Taxes

The Secretary of Finance shall

require the use of an official

fuel marking or similar

technology on petroleum

products that are refined,

manufactured or imported into

the Philippines, and that are

subject to the payment of taxes

and duties.

CONFIDENTIAL

SL - 90

NIRC

Section 148-A

Marking of petroleum

products [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-90-320.jpg)

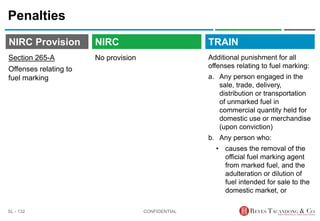

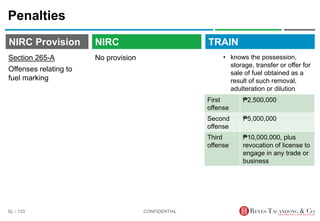

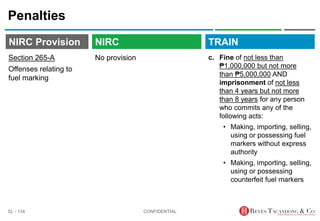

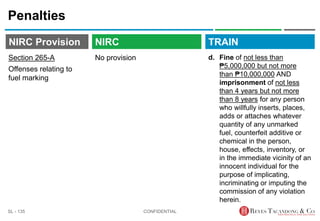

![TRAIN

NIRC Provision

No provision

Excise Taxes

Absence of official or dilution of

the official marker on petroleum

products shall raise the

presumption that the products

were withdrawn with the

intention to evade the payment

of the taxes and duties thereon.

The use of fraudulent marker

on the petroleum products shall

be considered prima facie

evidence that the same have

been withdrawn or imported

without the payment of taxes

and duties due thereon.

CONFIDENTIAL

SL - 91

NIRC

Section 148-A

Marking of petroleum

products [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-91-320.jpg)

![TRAIN

NIRC Provision

No provision

Excise Taxes

Invasive cosmetic procedures,

surgeries, and body enhancements

for aesthetic reasons shall be

subject to 5% excise tax based on

the gross receipts derived from

the performance of services, net of

excise tax and VAT.

Body enhancements shall refer to

those:

• Directed solely towards

improving, altering or enhancing

a patient’s appearance,

• That do not meaningfully

promote the function of the body

or prevent or treat illness or

disease.

CONFIDENTIAL

SL - 94

NIRC

Section 150-A

On non-essential

services [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-94-320.jpg)

![TRAIN

NIRC Provision

Excise Taxes

The tax shall not apply to nor

cover:

1. Procedures necessary to

ameliorate a deformity arising

from, or directly related to:

• a congenital or

developmental defect or

abnormality

• a personal injury resulting

from an accident or

trauma

• a disfiguring disease,

tumor, virus or infection

2. Cases or treatments covered

by the National Health

Insurance Program

CONFIDENTIAL

SL - 95

NIRC

Section 150-A

On non-essential

services [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-95-320.jpg)

![TRAIN

NIRC Provision

No provision

Excise Taxes

Effective January 1, 2018:

CONFIDENTIAL

SL - 96

NIRC

Section 150-B

On sweetened

beverages [new] Basis

Tax (Per Liter

of Volume

Capacity)

Sweetened

beverages using

• purely caloric

sweeteners and

• purely non-caloric

sweeteners, or

• a mix of caloric

and non-caloric

sweeteners

₱ 6.00

Sweetened

beverages using

purely high fructose

corn syrup or in

combination with any

caloric or non-caloric

sweetener

₱ 12.00](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-96-320.jpg)

![TRAIN

NIRC Provision

No provision

Excise Taxes

The rate of ₱6.00 shall not

apply to sweetened beverages

using high fructose corn

syrup

Exempt: Sweetened

beverages using

1. purely coconut sap sugar

2. purely steviol glycosides

CONFIDENTIAL

SL - 97

NIRC

Section 150-B

On sweetened

beverages [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-97-320.jpg)

![TRAIN

NIRC Provision

No provision

Excise Taxes

Sweetened beverages – non-

alcoholic beverages of any

constitution (liquid, powder, or

concentrates) pre-packaged

and sealed according to FDA

standards, containing caloric

and/or non-caloric sweeteners

added by the manufacturers.

CONFIDENTIAL

SL - 98

NIRC

Section 150-B

On sweetened

beverages [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-98-320.jpg)

![TRAIN

NIRC Provision

No provision

Excise Taxes

List of sweetened beverages

(not exclusive):

1. Sweetened juice drinks

2. Sweetened tea

3. All carbonated beverages

4. Flavored water

5. Energy and sports drink

6. Other powdered drinks not

classified as milk, juice, tea,

and coffee

7. Cereal and grain beverages

8. Other non-alcoholic

beverages that contain

added sugar

CONFIDENTIAL

SL - 99

NIRC

Section 150-B

On sweetened

beverages [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-99-320.jpg)

![TRAIN

NIRC Provision

No provision

Excise Taxes

Excluded products:

1. All milk products, including

plain milk, infant formula milk,

follow-on milk, and growing up

milk, powdered milk, ready to

drink milk and flavored milk,

fermented milk, soymilk, and

flavored soymilk

2. 100% natural fruit juices

3. 100% natural vegetable juices

4. Meal replacement and

medically indicated beverages

5. Ground coffee, instant soluble

coffee, and pre-packaged

powdered coffee products (with

or without added sugar)

CONFIDENTIAL

SL - 100

NIRC

Section 150-B

On sweetened

beverages [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-100-320.jpg)

![TRAIN

NIRC Provision

No provision

Administrative Provisions

The taxpayers that will be

mandated under Section 236 to

issue electronic

receipts/invoices shall be

required to electronically

report their sales data to the

BIR through the use of

electronic point of sales

systems.

The machines, fiscal devices,

and fiscal memory devices

shall be at the expense of the

taxpayers.

CONFIDENTIAL

SL - 121

NIRC

Section 237 (A)

Electronic Sales

Reporting System

[new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-121-320.jpg)

![TRAIN

NIRC Provision

No provision

Penalties

Any taxpayer required to

transmit sales data to the BIR’s

electronic sales reporting

system but fails to do so, shall

pay:

For each day of violation:

1/10 of 1% of the annual net

income as reflected in the

Audited FS for the second year

preceding the current taxable

year OR ₱10,000, whichever is

higher.

CONFIDENTIAL

SL - 128

NIRC

Section 264-A

Failure to Transmit

Sales Data Entered on

Cash Register

Machine/Point of Sales

System (POS)

Machines to the BIR’s

Electronic Sales

Reporting System

[new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-128-320.jpg)

![TRAIN

NIRC Provision

No provision

Penalties

IF the aggregate number of

days of violation exceed 180

days within a taxable year,

additional penalty shall be:

permanent closure of the

Taxpayer

The penalty shall not apply if

the failure to transmit is due to

force majeure or any causes

beyond the control of the

taxpayer

CONFIDENTIAL

SL - 129

NIRC

Section 264-A

Failure to Transmit

Sales Data Entered on

Cash Register

Machine/Point of Sales

System (POS)

Machines to the BIR’s

Electronic Sales

Reporting System

[new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-129-320.jpg)

![TRAIN

NIRC Provision

No provision

Penalties

Covered person shall be any

person who purchase, use,

possess, sell or offer to sell, install,

transfer, update, upgrade, keep, or

maintain such automated sales

suppression device or software

designed for or is capable of:

• Suppressing the creation of

electronic records of sale

transactions that a taxpayer is

required to keep under existing

tax laws and/or regulation; or

• Modifying, hiding, or deleting

electronic records of sales

transactions and providing a

ready means of access to them.

CONFIDENTIAL

SL - 130

NIRC

Section 264-B

Sales suppression

devices [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-130-320.jpg)

![TRAIN

NIRC Provision

No provision

Penalties

Penalty:

Administrative Fine of not less

than ₱500,000 but not more

than ₱10,000,000 and

imprisonment of not less than

2 years but not more than 4

years.

Cumulative suppression of

electronic sales record in

excess of ₱50,000,000 shall be

considered as economic

sabotage and shall be subject

to maximum penalty.

CONFIDENTIAL

SL - 131

NIRC

Section 264-B

Sales suppression

devices [new]](https://image.slidesharecdn.com/train-vs-240112025719-0d6f4b34/85/TRAIN-vs-NIRC-by-Reyes-Tacandong-Co-pdf-131-320.jpg)