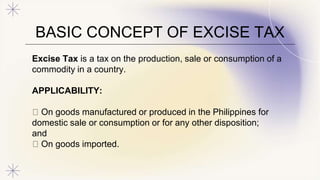

This document provides information on excise taxes in the Philippines, including:

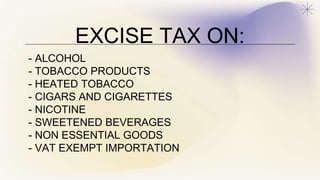

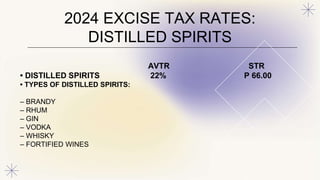

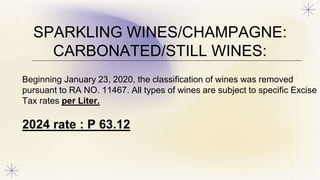

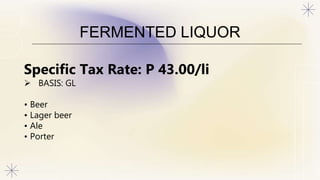

- Excise taxes are imposed on goods like alcohol, tobacco, heated tobacco, cigars, cigarettes, nicotine, sweetened beverages, and non-essential goods.

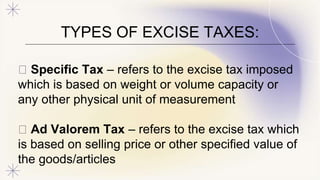

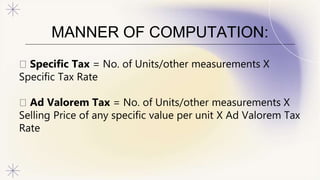

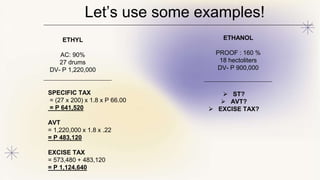

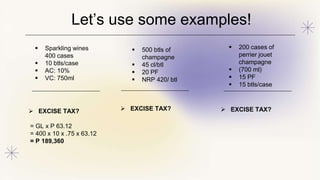

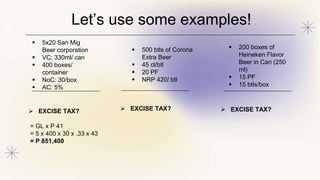

- Excise taxes can be specific taxes based on weight/volume or ad valorem taxes based on selling price.

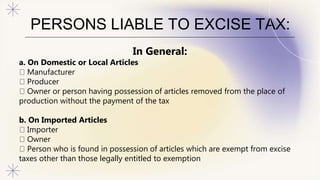

- Manufacturers, importers, and possessors of goods are generally liable for excise taxes, which must be paid before removal from production facilities or release from customs.

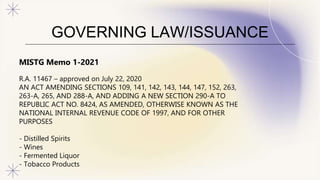

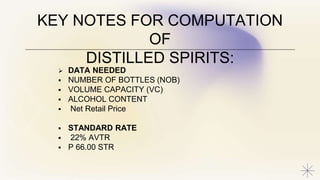

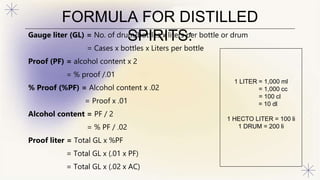

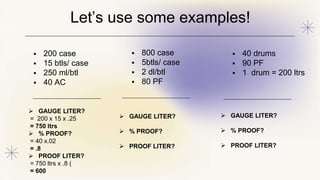

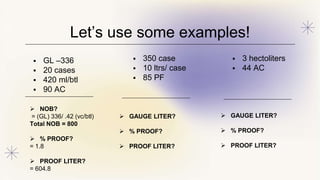

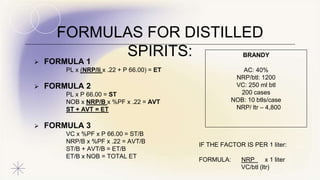

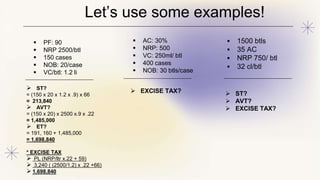

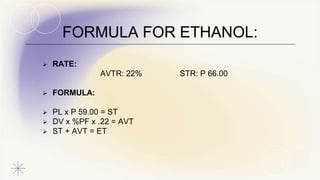

- Excise tax rates and computations are provided for different goods like distilled spirits, wines, fermented liquor, and ethanol. Formulas to calculate specific