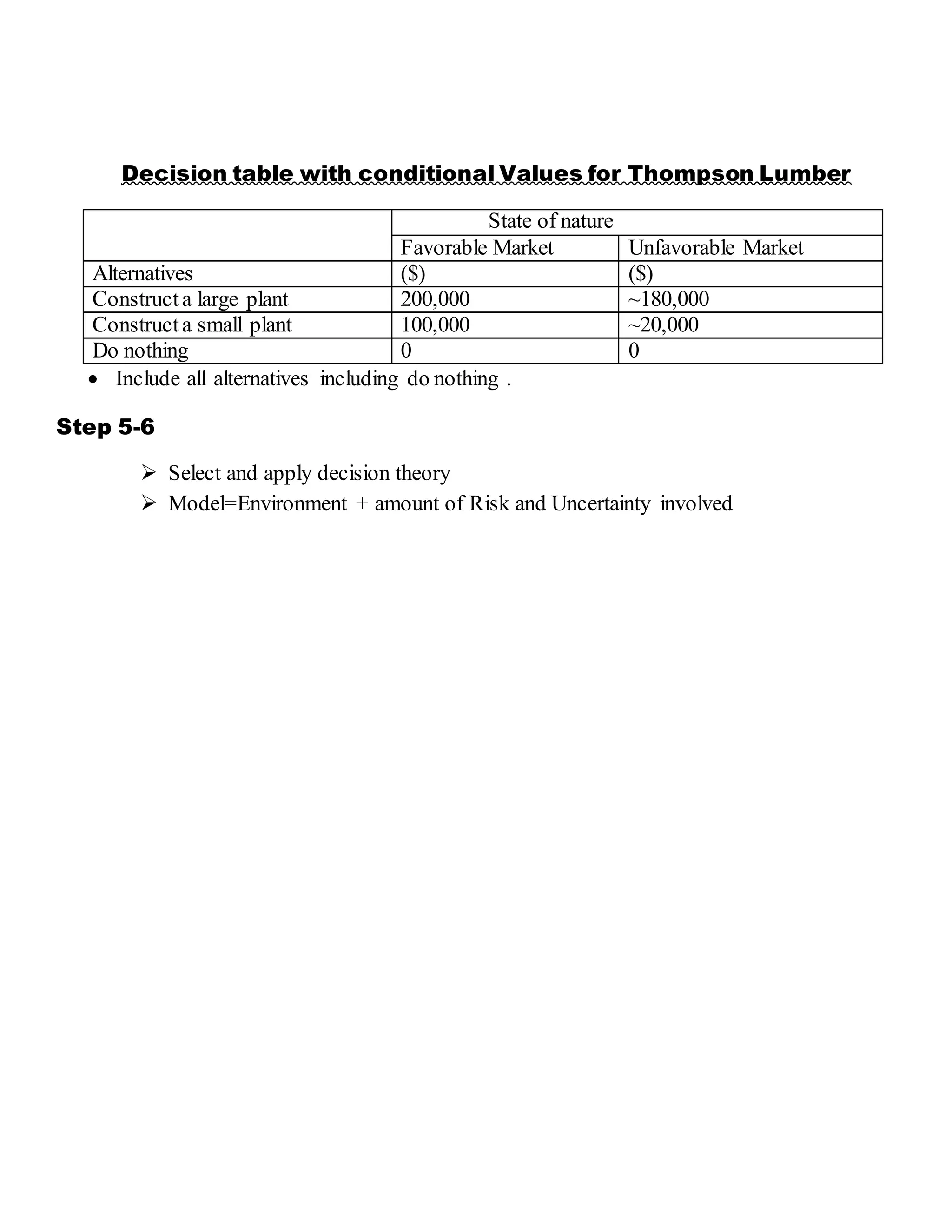

Thompson Lumber Company is considering expanding into manufacturing backyard storage sheds. They must decide whether to build a large new plant, a small plant, or do nothing. They evaluate the potential profits and losses for each option under favorable and unfavorable market conditions. Thompson will use a decision table to determine the conditional expected values for each alternative based on the probability of different market outcomes to help decide the best option for maximizing profits while minimizing risk.