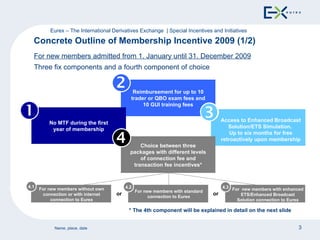

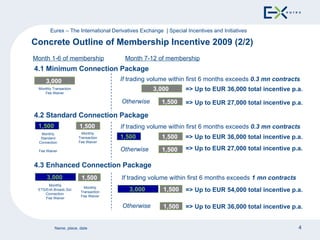

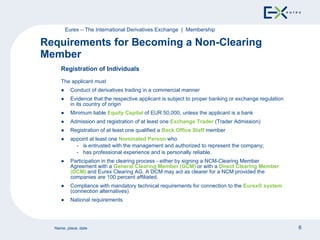

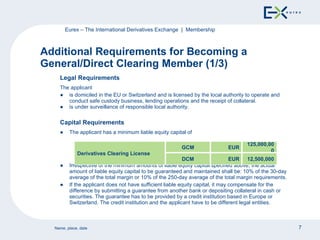

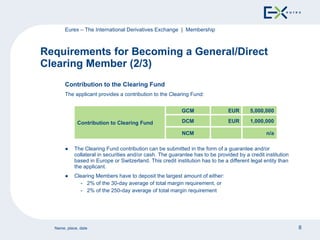

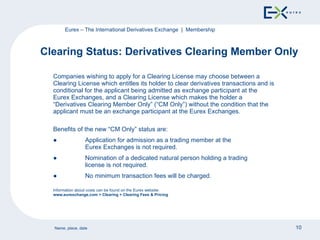

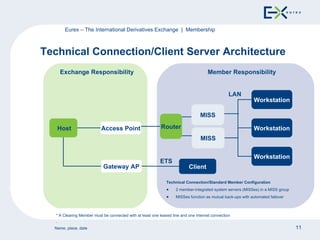

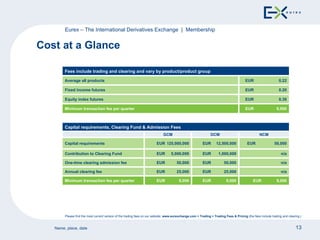

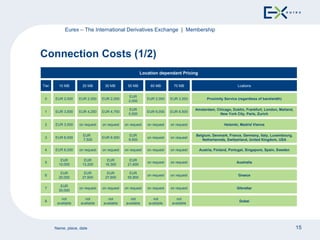

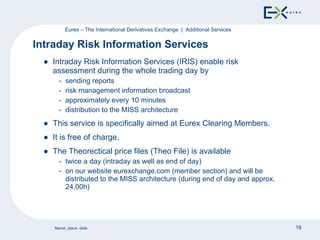

The document provides an overview of membership types and requirements for joining the Eurex derivatives exchange. It describes the different categories of members - Non-Clearing Members, General Clearing Members, Direct Clearing Members - and associated rights and obligations. Requirements include minimum capital, contribution to the clearing fund, technical connectivity, and more. Incentive programs are outlined to encourage new memberships.