The document summarizes key aspects of the Employees' State Insurance Act, including:

1) It establishes the Employees' State Insurance Corporation as a separate corporate body to administer the Act. The Corporation consists of representatives from central/state governments, employers, employees, and medical professionals.

2) The Standing Committee and Medical Benefit Council are constituted from members of the Corporation to oversee its work.

3) Employers with 10+ employees must enroll in the insurance program. Contributions are paid by employers and employees, currently at rates of 1.75% and 4.75% of wages respectively.

4) Insured persons and dependents are eligible for benefits like sickness, maternity, disable

![CHAPTER II

CORPORATION, STANDING COMMITTEE AND MEDICAL BENEFIT

COUNCIL

ESTABLISHMENT OF EMPLOYEES’ STATE INSURANCE

CORPORATION. [Section 3]

central government establishes the Corporation to be known

as the Employees' State Insurance Corporation. This

corporation will be having following characteristics

separate corporate body.

Having perpetual succession. (no death)

Have a common seal.

Employees' State Insurance Corporation can sue. (file a suit

in court on other)

Other can sue Employees' State Insurance Corporation.](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-1-320.jpg)

![THE CORPORATION SHALL CONSIST OF THE FOLLOWING MEMBERS. [Section

4]

(a) Chairman, Vice-Chairman to be appointed by the Central Government;

(b) not more than 5 persons to be appointed by the Central Government;

(c) one person each representing each of the States in which this Act is in

force to be appointed by the State Government concerned;

(d) one person to be appointed by the Central Government to represent the

3Union Territories;

(e) 10 persons representing employers to be appointed by the Central

Government in consultation with such organisations of employers.

(f) 10 persons representing employees to be appointed by the Central

Government in consultation with such organisations of employees.

(g) 2 persons representing the medical profession to be appointed by the

Central Government in consultation with such organisation of medical

practitioners.

(h) 3 members of Parliament of whom two shall be members of the House of

the People (Lok Sabha) and one shall be a member of the Council of States

(Rajya Sabha) elected respectively by the members of the House of the

People and the members of the Council of States; and

(i) The Director-General of the Corporation ex-officio.](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-2-320.jpg)

![ CONSTITUTION OF STANDING COMMITTEE. [Section 8]

Standing Committee of the Corporation shall be constituted from among

its members, consisting of

(a) A Chairman, appointed by the Central Government;

(b) three members of the Corporation appointed by the Central

Government;

(bb) three members of the Corporation representing such three State

Governments thereon as the Central Government may, by notification

Gazette, specify from time to time;

(c) eight members elected by the Corporation as follows-

(ii) 3 members from among the members of the Corporation representing

employers;

(iii) 3 members from among the members of the Corporation

representing employees;

(iv) 1 member from among the members of the Corporation representing

the medical profession; and

(v) 1 member from among the members of the Corporation elected by

Parliament;

(d) the Director General of the Corporation, ex officio](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-3-320.jpg)

(a) the Director General, the Employees' State

Insurance Corporation, ex officio as Chairman;

(b) The Director General, Health Services, ex officio as

Co-chairman;".

(c) one member each representing each of the States

(d) 3 members representing employers to be appointed

by the Central Government in consultation with such

organisations of employers.

(e) 3 members representing employees to be appointed

by the Central Government in consultation with such

organisations of employees.

(f) 3 members, of whom not less than one shall be a

woman, representing the medical profession, to be

appointed by the Central Government.](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-4-320.jpg)

![CHAPTER IV- CONTRIBUTIONS

ALL EMPLOYEES TO BE INSURED. [Section 38]

Factory or establishment having more than 10 employees should

be insured under the Employee State Insurance Act

CONTRIBUTION [Section 39]

Employer and employer liable for payment of the contribution to

the Employee State Insurance Corporation.

The rate of contribution paid by employer and employee will be

decided by the central government.

Currently, the employee’s contribution rate (w.e.f. 1.1.97) is

1.75% of the wages and that of employer’s is 4.75% of the wages

paid/payable in respect of the employees in every wage period.

If wage is received every month by employee, the Contribution to

the ESI Corporation should be made by employer and employee

every month without fail.

@ 12% of interest per year should be paid If employer delays in

payment of the contribution to ESI corporation](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-5-320.jpg)

![EMPLOYERS TO FURNISH RETURNS AND MAINTAIN REGISTERS IN CERTAIN

CASES. [Section 44]

SOCIAL SECURITY OFFICERS, THEIR FUNCTIONS AND DUTIES. [SECTION 45] (2010

amendment)

Enquiring into the correctness of any of the particulars stated in any return referred to in

Section 44.

Social Security Officers can demand any principal or immediate employer to furnish to

him such information as he may consider necessary for the purposes of this Act.

Social Security Officers can at any reasonable time enter any office, establishment,

factory or other premises for inspection of examine such accounts, books and other

documents relating to the employment of persons and payment of wages or to furnish to

him such information as he may consider necessary.

He can examine the employer, his agent or servant or any person found in such factory,

establishment, and office.

He can make copies of, or take extracts from, any register, account book or other

document maintained in such factory, establishment, office or other premises.

He can do re-inspection whether the records and returns submitted under Section 44 are

correct or not.](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-6-320.jpg)

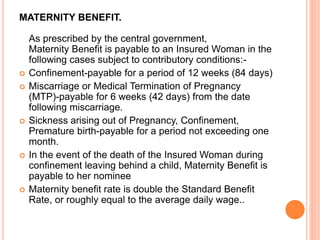

![CONTINUE…..

The following benefits will be paid to insured persons or

to their dependents [Section 46]

Periodical payments to any insured person in case of his

sickness certified by a duly appointed medical

practitioner.

Periodical payments to an insured woman in case of

confinement or miscarriage or sickness arising out of

pregnancy, confinement, premature birth of child or

miscarriage, such woman being certified to be eligible

for such payments.

periodical payments to an insured person suffering from

disablement as a result of an employment injury

periodical payments to such dependants of an insured

person who dies as a result of an employment injury

medical benefits](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-8-320.jpg)

![ FUNERAL BENEFIT. [Section 46]

As prescribed by the central government,

an amount of Rs. 5000/- is payable to the dependents or to the person

who performs last rites from day one of entering insurable employment.

SICKNESS BENEFIT. [Section 49]

As prescribed by the central government,

Sickness Benefit represents periodical cash payments made to an IP

during the period of certified sickness occurring in a benefit period when

IP requires medical treatment and attendance with abstention from work

on medical grounds. Sickness benefit is roughly 60% of the average

daily wages and is payable for 91 days during 2 consecutive benefit

periods.

Qualifying Conditions

To become eligible to Sickness Benefit, an Insured Person should have

paid contribution for not less than 78 days during the corresponding

contribution period.

A person who has entered into insurable employment for the first time

has to wait for nearly 9 months before becoming eligible to sickness

benefit, because his corresponding benefit period starts only after that

interval.](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-9-320.jpg)

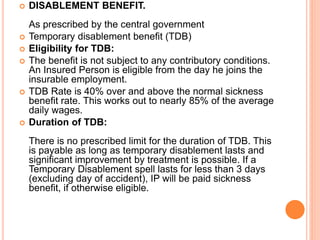

![ Permanent Disablement Benefit (PDB)

PDB is payable to an Insured Person who suffers permanent

residual disablement as a result of EI (including Occupational

Diseases) and results in loss of earning capacity. The PDB rate is

calculated as percentage of loss of earning capacity as assessed

by the Medical Board.

Employer will be liable for the accidents caused to his employer

in the following circumstance

Accident caused to an employee even if he obeyed the safety

instruction of his employer [Section 51B]

Accident caused to employee while travelling in employer’s

transportation vehicles. [Section 51C]

At the time of employment the accident caused to the employee

while protection or rescuing other employer from occurring

accident. [Section 51D]

An accident occurring to an employee while commuting from his

residence to the place of employment for duty or from the place

of employment to his residence after performing duty, shall be

deemed to have arisen out of and in the course of employment.

[Section 51E] (2010 amendment)](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-12-320.jpg)

![ DEPENDANTS' BENEFIT. [Section 52]

As prescribed by the central government,

the dependants’ benefit is payable to the

dependants in cases where an Insured Person dies

as result of Employment Injury. The minimum rate

of dependants’ benefit w.e.f 1.1.90 is Rs.14/- per

day and these rates of the dependants’ benefit are

increased from time to time. The latest

enhancement is with effect from 01.08.2002](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-13-320.jpg)

![ MEDICAL BENEFIT. [Section 56]

As prescribed by the central government,

Employer or his family members are entitled to the

medical benefit. In case of the retirement of the

employer his spouse shall be eligible to receive

medical benefit subject to payment of contribution.

In case of permanent disablement by the employee,

he can get medical benefit till the date of his

retirement. Maximum age for the retirement is 60

years.](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-14-320.jpg)

![ EMPLOYER NOT TO DISMISS OR PUNISH

EMPLOYEE DURING PERIOD OF SICKNESS,

ETC. [Section 73]

No employer shall dismiss, discharge, or reduce or

otherwise punish an employee during the following

circumstances

sickness

maternity leave

pregnancy or confinement

under the treatment in the hospital

temporary disablement](https://image.slidesharecdn.com/esiact-220203160327/85/Esi-act-15-320.jpg)