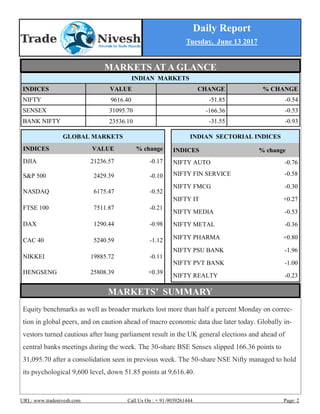

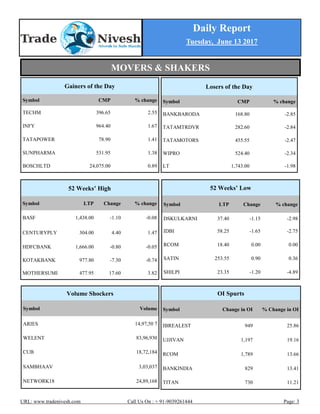

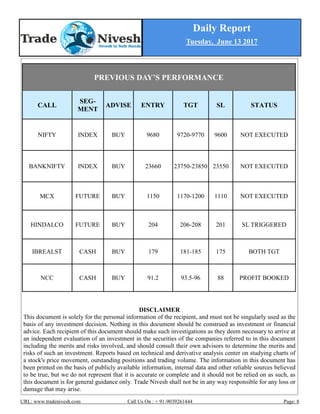

Global indices fell slightly with the Dow down 0.17% and India's key indices, the Nifty and Sensex, also closed lower by around 0.5%. The daily report provides analysis of sectoral movements in India and top gainers and losers. Technical recommendations are given to buy shares of Indiabulls Housing, Apollo Tyres, Shirpur Gold, and Elgie Equipments, as well as to buy Nifty and Bank Nifty futures based on technical indicators.