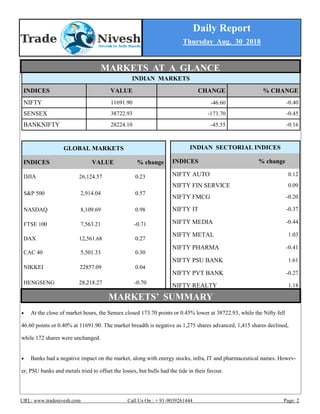

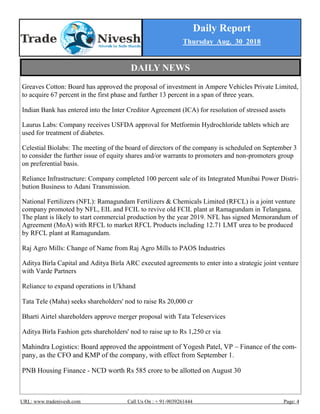

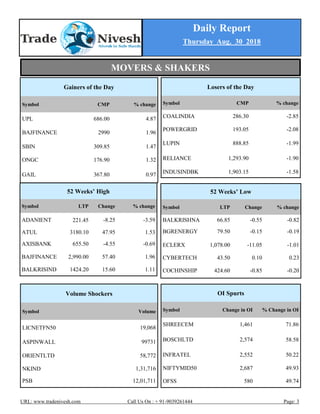

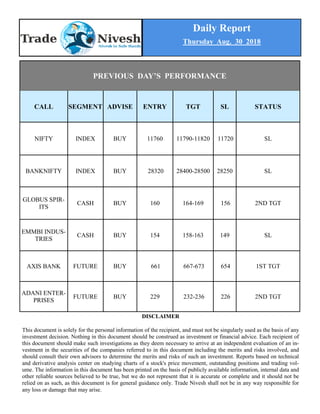

The document is a daily market report published by www.tradenivesh.com on August 30, 2018. It provides a summary of the performance of key global and Indian equity indices, top gainers and losers, futures and options data, and technical recommendations to buy or sell 4 stocks/indices based on technical analysis of their recent price movements and trading volumes.