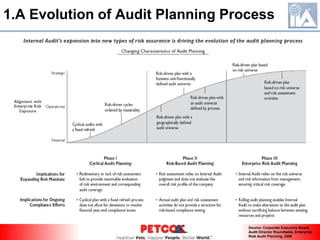

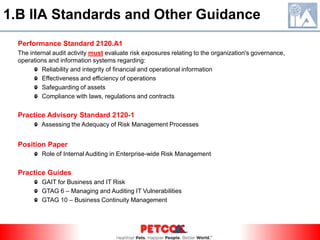

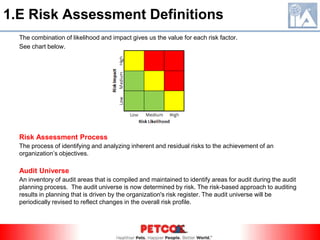

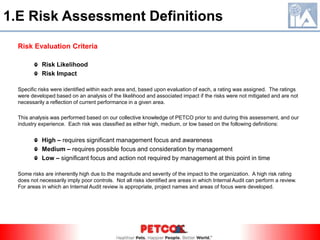

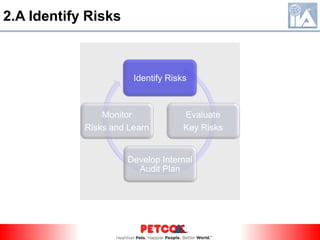

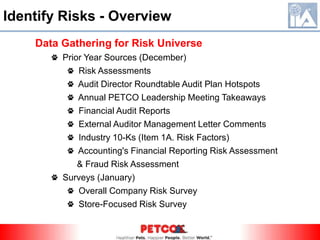

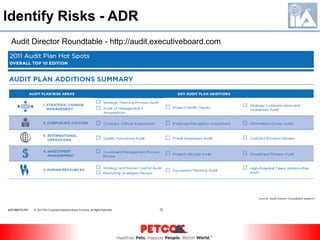

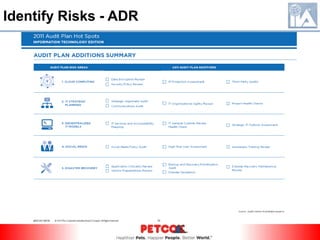

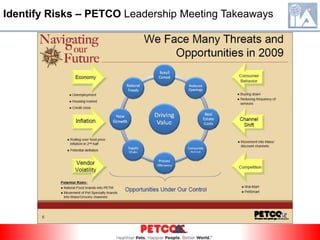

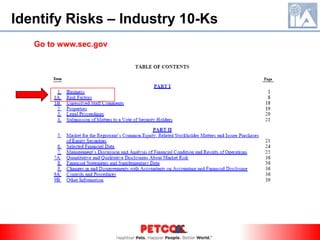

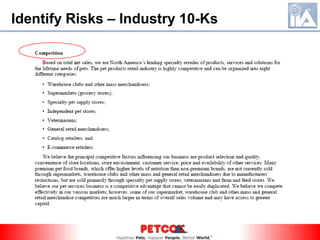

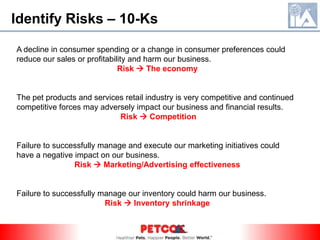

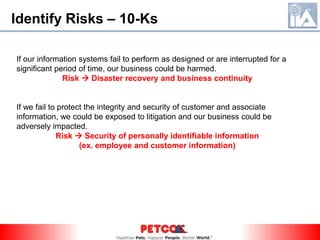

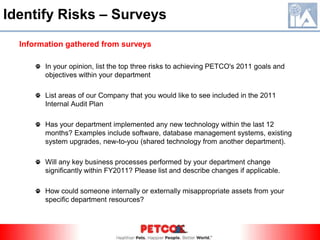

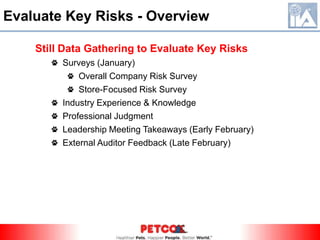

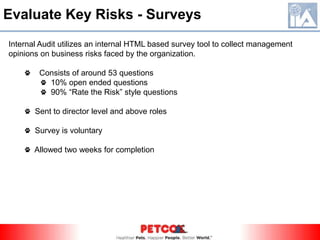

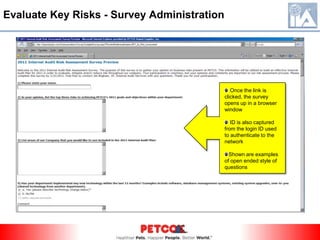

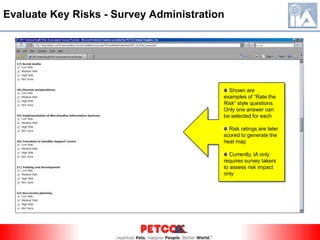

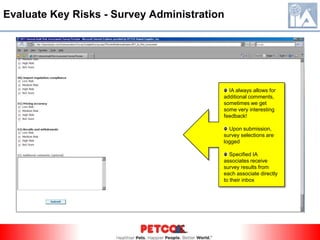

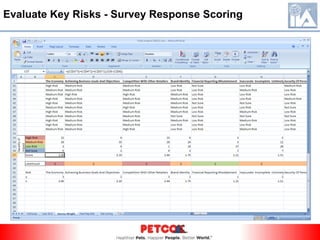

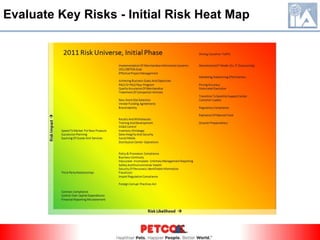

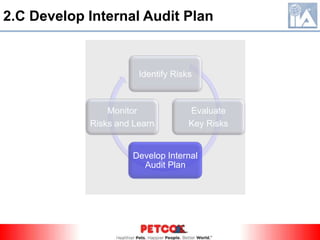

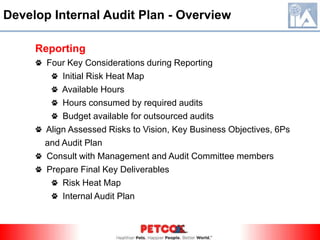

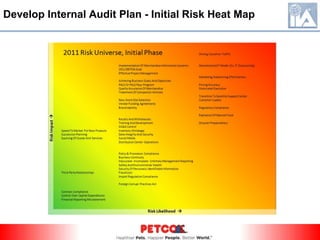

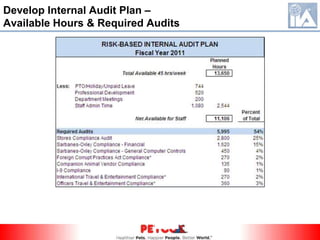

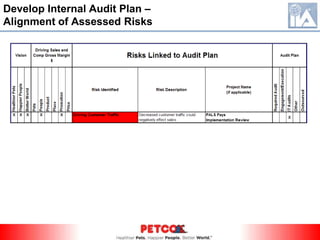

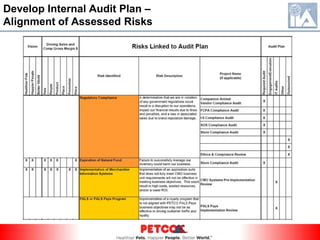

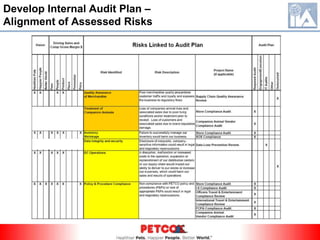

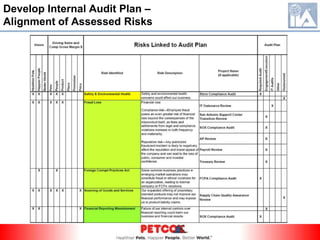

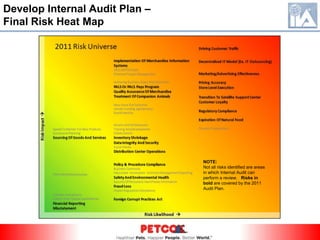

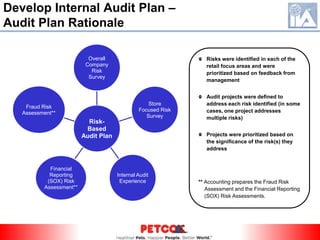

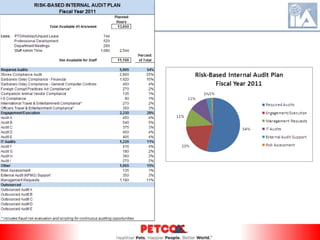

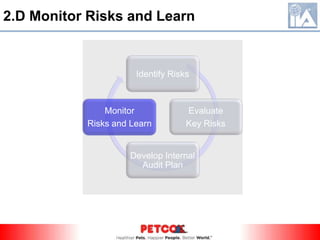

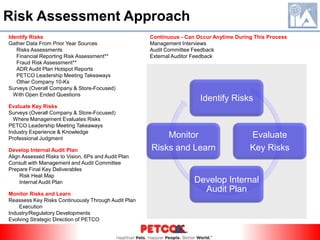

The document provides an overview of PETCO's enterprise-wide risk assessment and internal audit plan presentation. It discusses the risk assessment approach, which includes identifying risks through various data sources, evaluating key risks through surveys and management feedback, developing the internal audit plan by aligning risks to objectives and consulting with management, and continuously monitoring risks as the audit plan is executed. The presentation covers defining risk likelihood and impact, administering surveys to gather management's perceived risks, developing an initial risk heat map, and prioritizing audit projects to address key risks. The goal is to identify the highest risks to PETCO and focus internal audit resources on those areas.