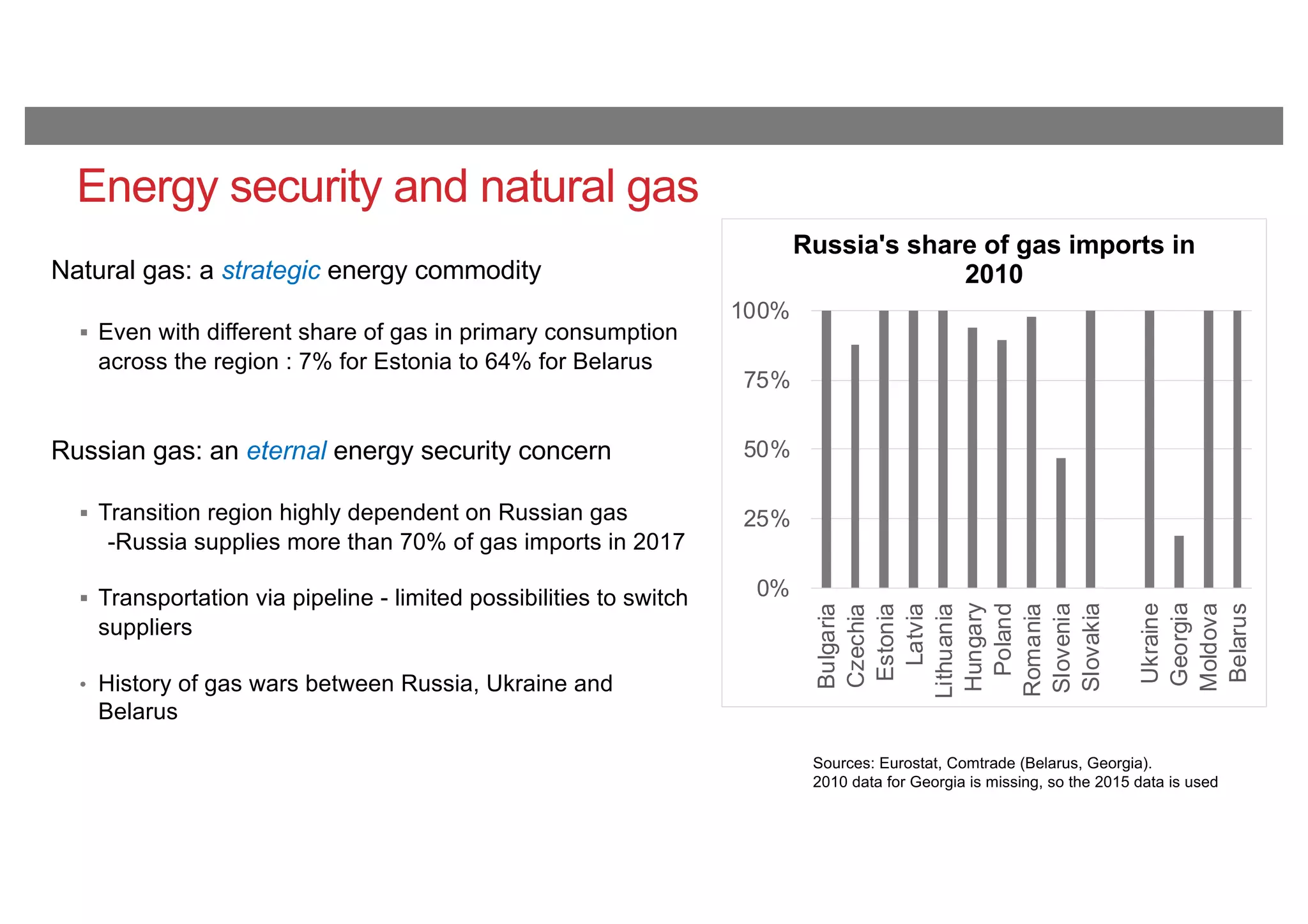

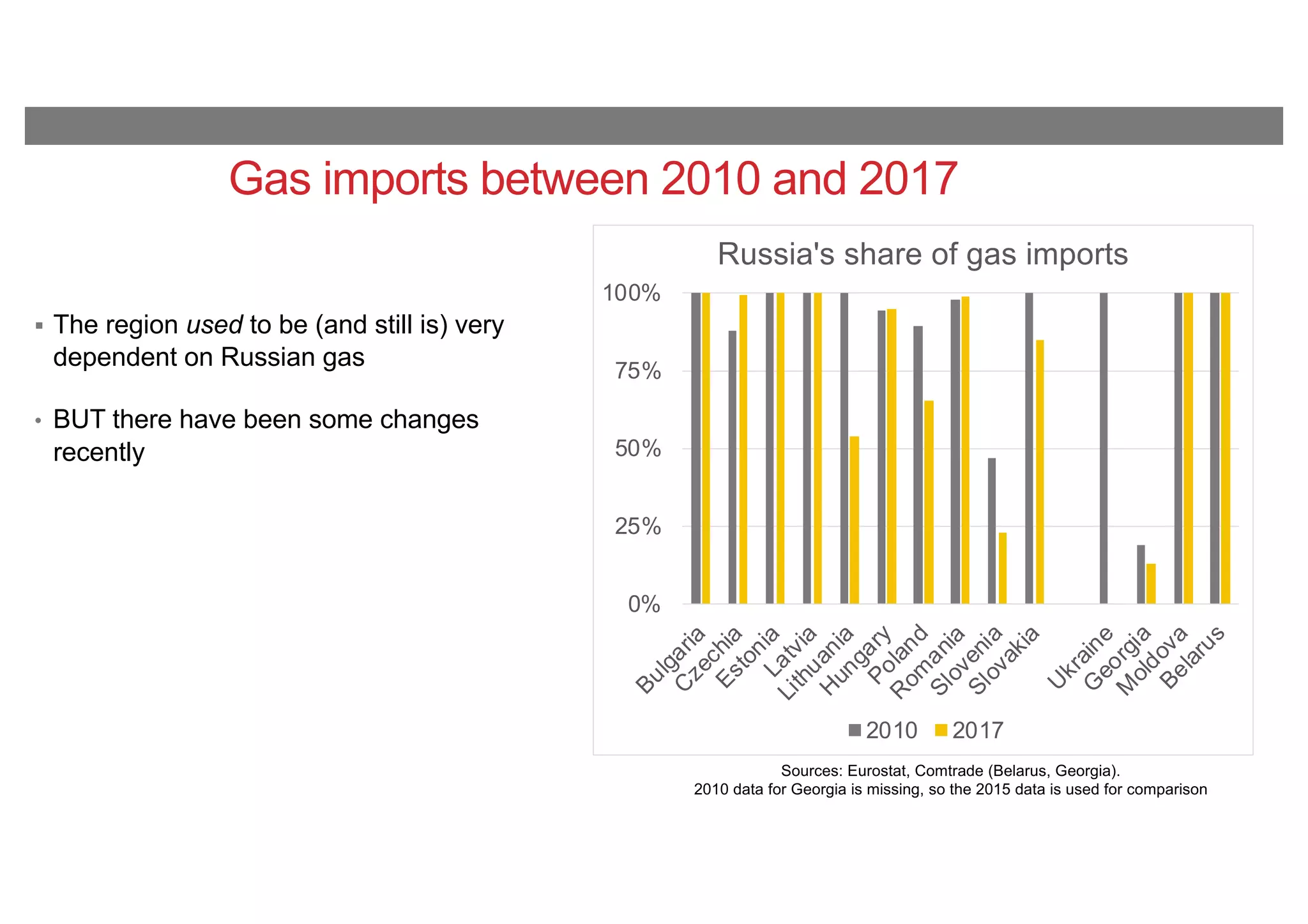

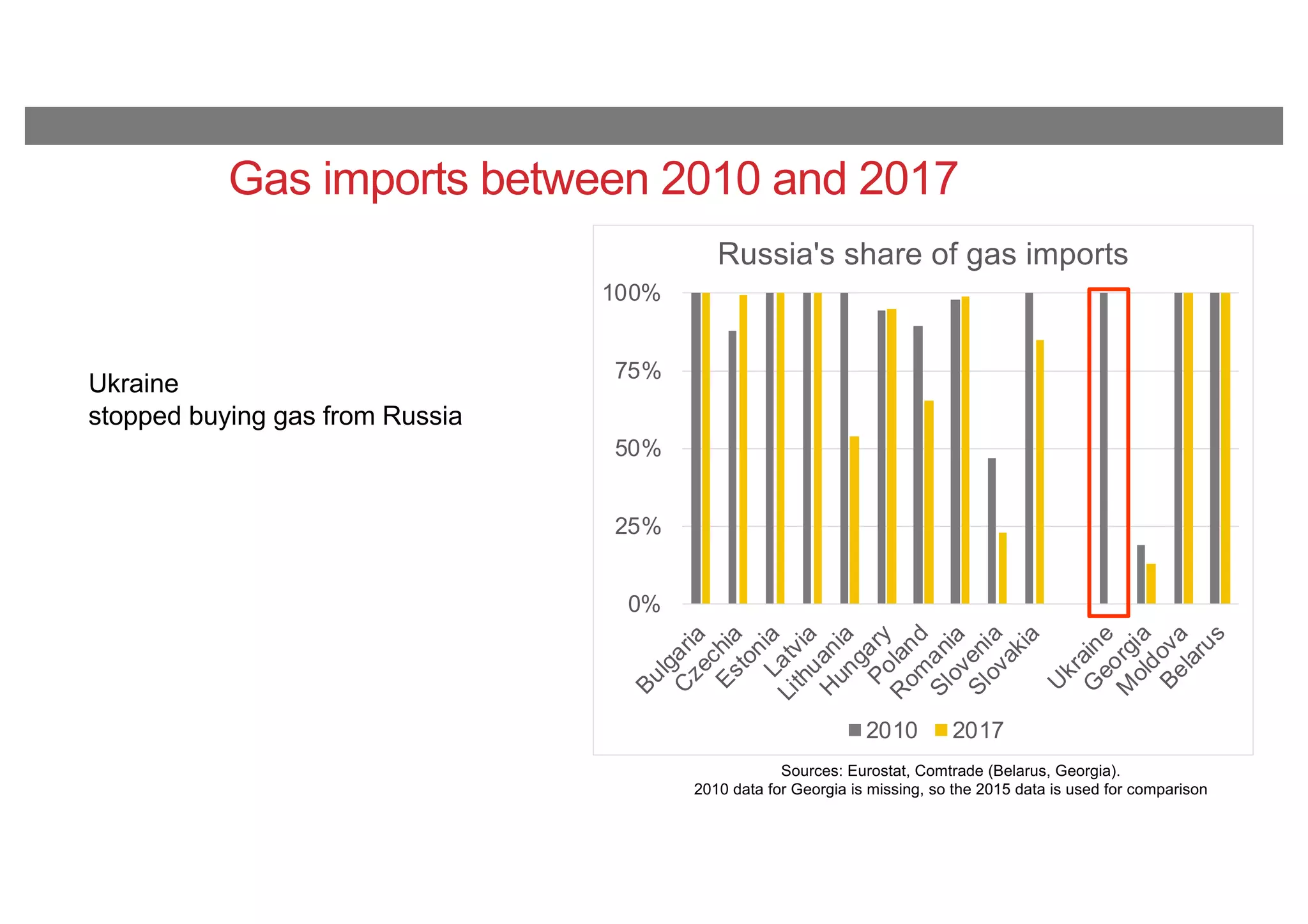

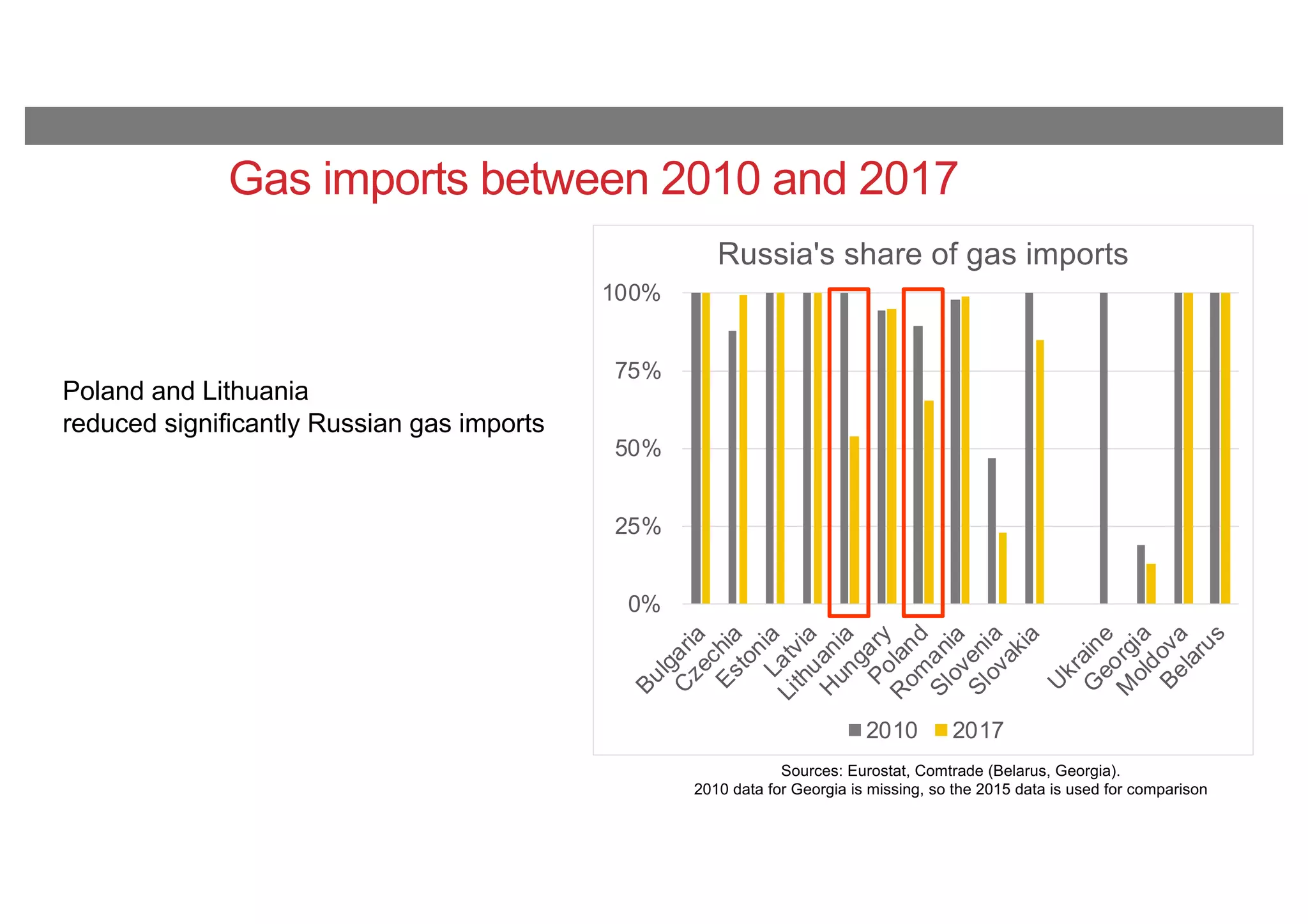

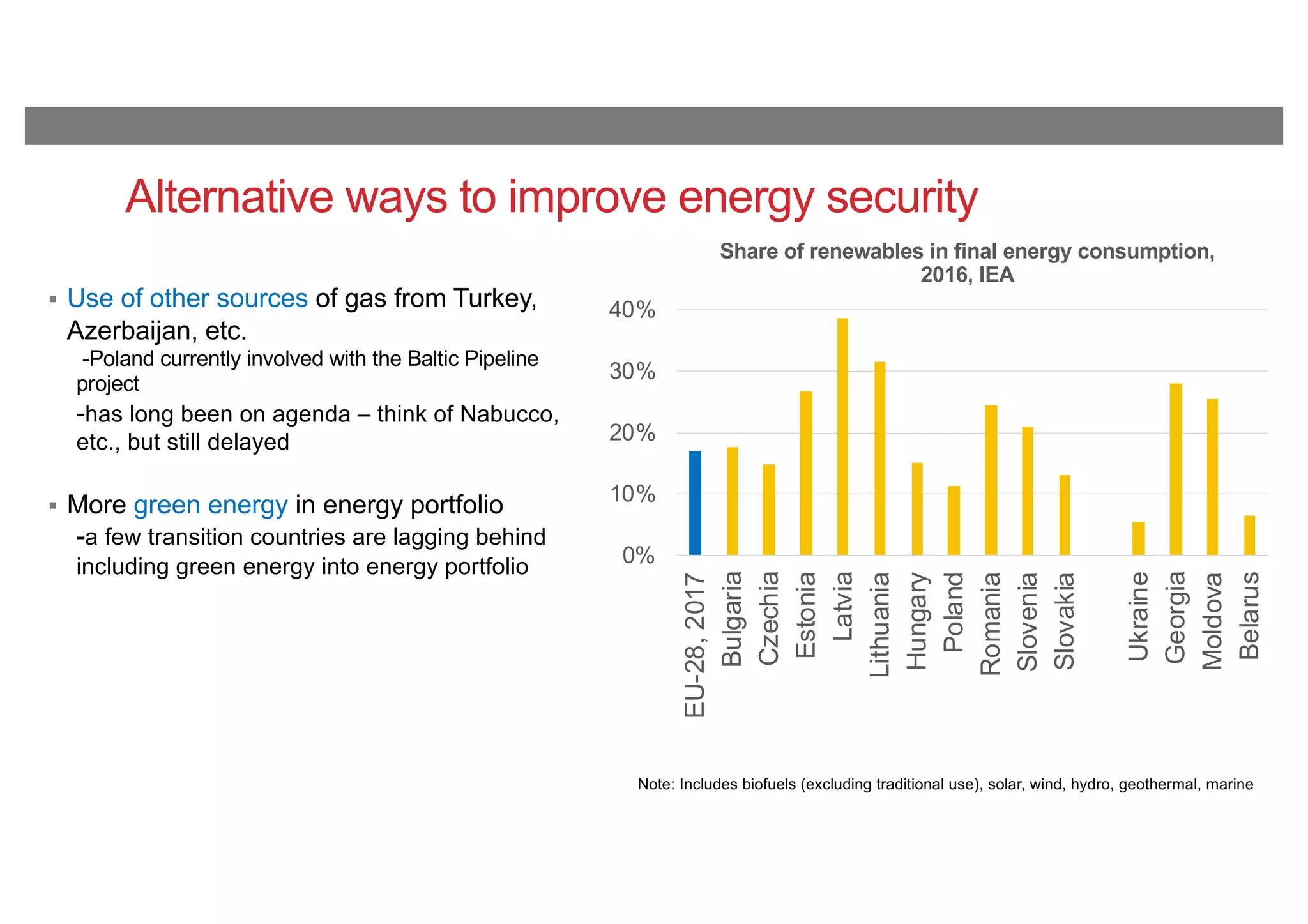

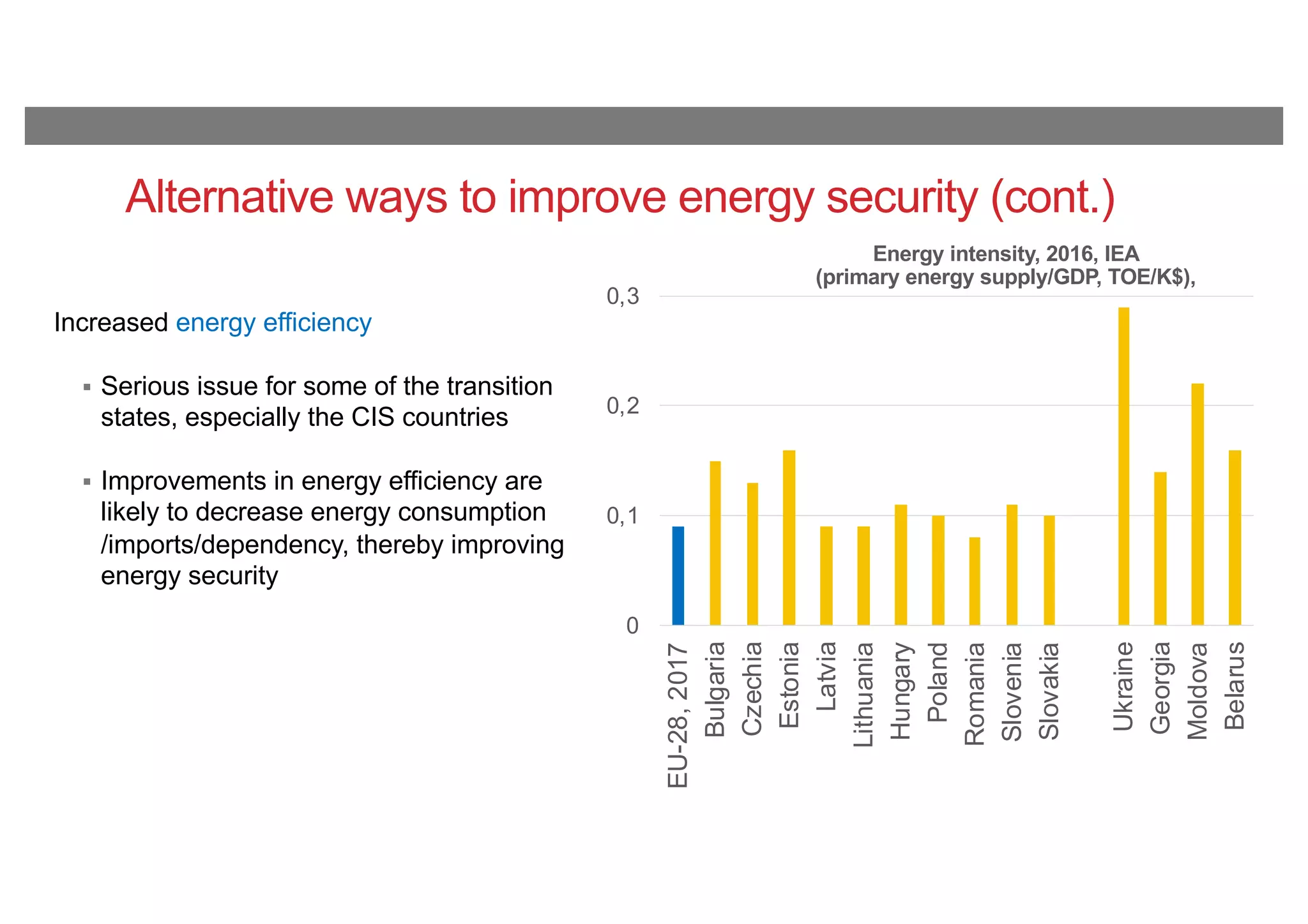

The document discusses energy security in a subset of transition countries in Eastern Europe, highlighting their dependency on Russian natural gas for energy supply. It reviews recent changes, such as Ukraine's shift to European gas suppliers and the investments made by Poland and Lithuania in liquefied natural gas (LNG) terminals to reduce Russian gas dependence. The potential for improved energy security through diversification and increased energy efficiency is also examined, alongside the environmental implications of these strategies.