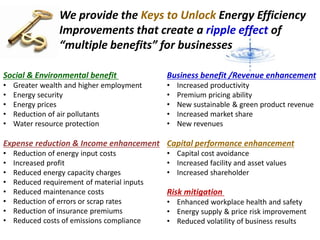

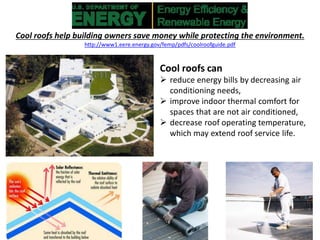

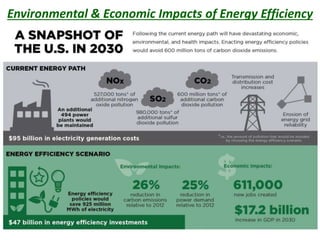

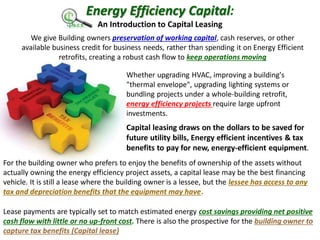

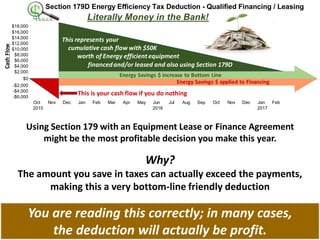

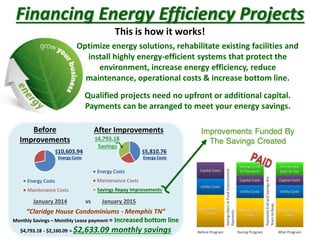

The document outlines Sustainable Green Creative Solutions' (SGCS) approach to improving energy efficiency in buildings through various methods like lifecycle retro-commissioning, energy assessments, and capital leasing for upgrades. It emphasizes cost savings, enhanced productivity, and environmental benefits that come from implementing energy-efficient systems, such as improved HVAC and LED lighting. Additionally, it highlights potential tax deductions and financial incentives available for businesses undertaking these retrofits.