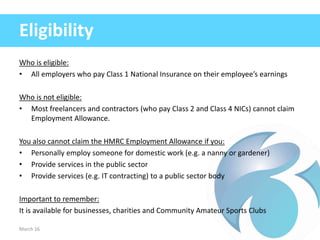

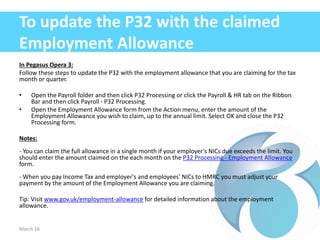

The document explains the Employment Allowance, which allows eligible employers to reduce their National Insurance Contributions (NICs) by up to £3,000 per business for the 2016-17 tax year. Eligibility is primarily for employers paying Class 1 NICs, while freelancers and public sector employers are excluded. The document also outlines the claiming process through payroll software like Pegasus Opera 3, emphasizing the steps needed to inform HMRC and update necessary documentation.