Employer Security Clearance Costs Tax Credit

•

0 likes•388 views

The document summarizes Maryland's Employer Security Clearance Costs Tax Credit, which provides a tax credit for businesses that incur costs to obtain federal security clearances or construct sensitive compartmented information facilities. To qualify, businesses must submit an application by September 15 of the year after costs are incurred. The credit can be taken for tax years 2013-2016 and is calculated based on limited security clearance administrative and construction/equipment costs. Documentation like a certification from the Maryland Department of Business and Economic Development must be attached to tax forms to claim the credit.

Report

Share

Report

Share

Download to read offline

Recommended

XXXPPP & Other SBA Funding Resources - Information Session

PPP & Other SBA Funding Resources - Information SessionDC Department of Small & Local Business Development (DSLBD)

The tax reform bill was signed into law on Dec. 22, 2017, bringing sweeping and historic changes to our country’s tax laws. These changes generally are effective in 2018 and impact every taxpayer, including many provisions that will significantly impact the construction sector.

We will focus on the manner in which construction businesses are impacted by the new law, and will offer insight about how the sector should respond to the new provisions.Webinar Slides: Tax Reform and the Effect on the Construction Industry

Webinar Slides: Tax Reform and the Effect on the Construction IndustryMHM (Mayer Hoffman McCann P.C.)

More Related Content

Similar to Employer Security Clearance Costs Tax Credit

XXXPPP & Other SBA Funding Resources - Information Session

PPP & Other SBA Funding Resources - Information SessionDC Department of Small & Local Business Development (DSLBD)

The tax reform bill was signed into law on Dec. 22, 2017, bringing sweeping and historic changes to our country’s tax laws. These changes generally are effective in 2018 and impact every taxpayer, including many provisions that will significantly impact the construction sector.

We will focus on the manner in which construction businesses are impacted by the new law, and will offer insight about how the sector should respond to the new provisions.Webinar Slides: Tax Reform and the Effect on the Construction Industry

Webinar Slides: Tax Reform and the Effect on the Construction IndustryMHM (Mayer Hoffman McCann P.C.)

Similar to Employer Security Clearance Costs Tax Credit (20)

Cellulosic Ethanol Technology Research and Development Tax Credit

Cellulosic Ethanol Technology Research and Development Tax Credit

PPP & Other SBA Funding Resources - Information Session

PPP & Other SBA Funding Resources - Information Session

Webinar Slides: Tax Reform and the Effect on the Construction Industry

Webinar Slides: Tax Reform and the Effect on the Construction Industry

Bulletin #42 - Canadian Government to Support SR&ED Lenders

Bulletin #42 - Canadian Government to Support SR&ED Lenders

Congressional Update on Potential Tax Legislation For You and Your Business.pptx

Congressional Update on Potential Tax Legislation For You and Your Business.pptx

PPP Loan Forgiveness and Tax Considerations For the Construction Industry

PPP Loan Forgiveness and Tax Considerations For the Construction Industry

Speeding Through 2020 Auto Webinar Series - What's Next for PPP?

Speeding Through 2020 Auto Webinar Series - What's Next for PPP?

How Your Company is Affected by the CARES Act and Related Legislation

How Your Company is Affected by the CARES Act and Related Legislation

More from The McMillan Companies

More from The McMillan Companies (20)

Logic Models....Not Just for Big Foundations Anymore

Logic Models....Not Just for Big Foundations Anymore

Recently uploaded

Recently uploaded (20)

IPTV Subscription UK: Your Guide to Choosing the Best Service

IPTV Subscription UK: Your Guide to Choosing the Best Service

Luxury Artificial Plants Dubai | Plants in KSA, UAE | Shajara

Luxury Artificial Plants Dubai | Plants in KSA, UAE | Shajara

India’s Recommended Women Surgeons to Watch in 2024.pdf

India’s Recommended Women Surgeons to Watch in 2024.pdf

5 Things You Need To Know Before Hiring a Videographer

5 Things You Need To Know Before Hiring a Videographer

Global Interconnection Group Joint Venture[960] (1).pdf![Global Interconnection Group Joint Venture[960] (1).pdf](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

![Global Interconnection Group Joint Venture[960] (1).pdf](data:image/gif;base64,R0lGODlhAQABAIAAAAAAAP///yH5BAEAAAAALAAAAAABAAEAAAIBRAA7)

Global Interconnection Group Joint Venture[960] (1).pdf

12 Conversion Rate Optimization Strategies for Ecommerce Websites.pdf

12 Conversion Rate Optimization Strategies for Ecommerce Websites.pdf

Employer Security Clearance Costs Tax Credit

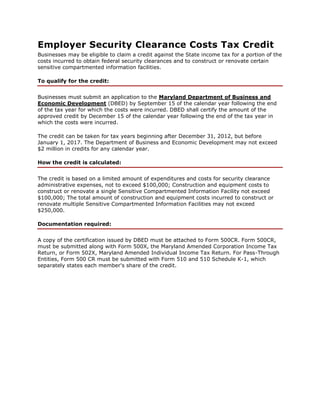

- 1. Employer Security Clearance Costs Tax Credit Businesses may be eligible to claim a credit against the State income tax for a portion of the costs incurred to obtain federal security clearances and to construct or renovate certain sensitive compartmented information facilities. To qualify for the credit: Businesses must submit an application to the Maryland Department of Business and Economic Development (DBED) by September 15 of the calendar year following the end of the tax year for which the costs were incurred. DBED shall certify the amount of the approved credit by December 15 of the calendar year following the end of the tax year in which the costs were incurred. The credit can be taken for tax years beginning after December 31, 2012, but before January 1, 2017. The Department of Business and Economic Development may not exceed $2 million in credits for any calendar year. How the credit is calculated: The credit is based on a limited amount of expenditures and costs for security clearance administrative expenses, not to exceed $100,000; Construction and equipment costs to construct or renovate a single Sensitive Compartmented Information Facility not exceed $100,000; The total amount of construction and equipment costs incurred to construct or renovate multiple Sensitive Compartmented Information Facilities may not exceed $250,000. Documentation required: A copy of the certification issued by DBED must be attached to Form 500CR. Form 500CR, must be submitted along with Form 500X, the Maryland Amended Corporation Income Tax Return, or Form 502X, Maryland Amended Individual Income Tax Return. For Pass-Through Entities, Form 500 CR must be submitted with Form 510 and 510 Schedule K-1, which separately states each member's share of the credit.

- 2. Contact: Maryland Department of Business and Economic Development Division of Business Development, Tax Incentives Group World Trade Center 401 East Pratt Street, 17th Floor Baltimore, MD 21202 Phone: 1-888-ChooseMD or 410-767-4980 E-mail: taxincentives@choosemaryland.org http://www.choosemaryland.org/businessresources/Pages/MarylandESCCTaxCre dit.aspx McMillan Consulting 828A E. Baltimore St. Baltimore, MD 21202 Phone: 410-775-6226 Web: http://mcmillancos.com E-mail: info@mcmillancos.com McMillan Consulting is not affiliated with the state of Maryland. This document is for informational purposes. Contact us, the appropriate agency for this credit or your tax professional for further assistance. You can view Maryland's tax credits by visiting http://macadvises.net/mdtaxsignal.php and clicking on the MD Business Tax Credits link. We can send you a hard copy of this or any of our info sheets for Maryland tax credits.