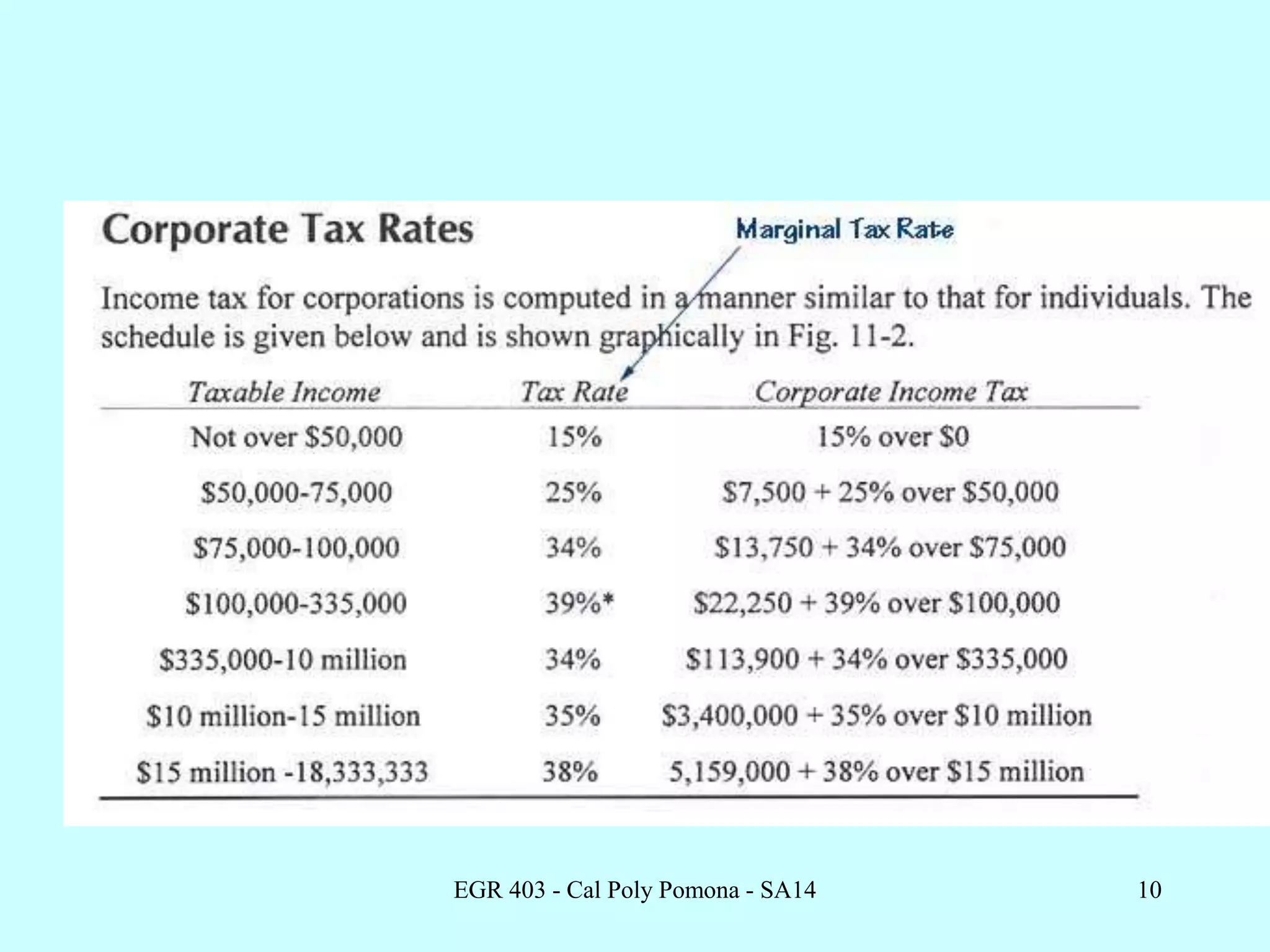

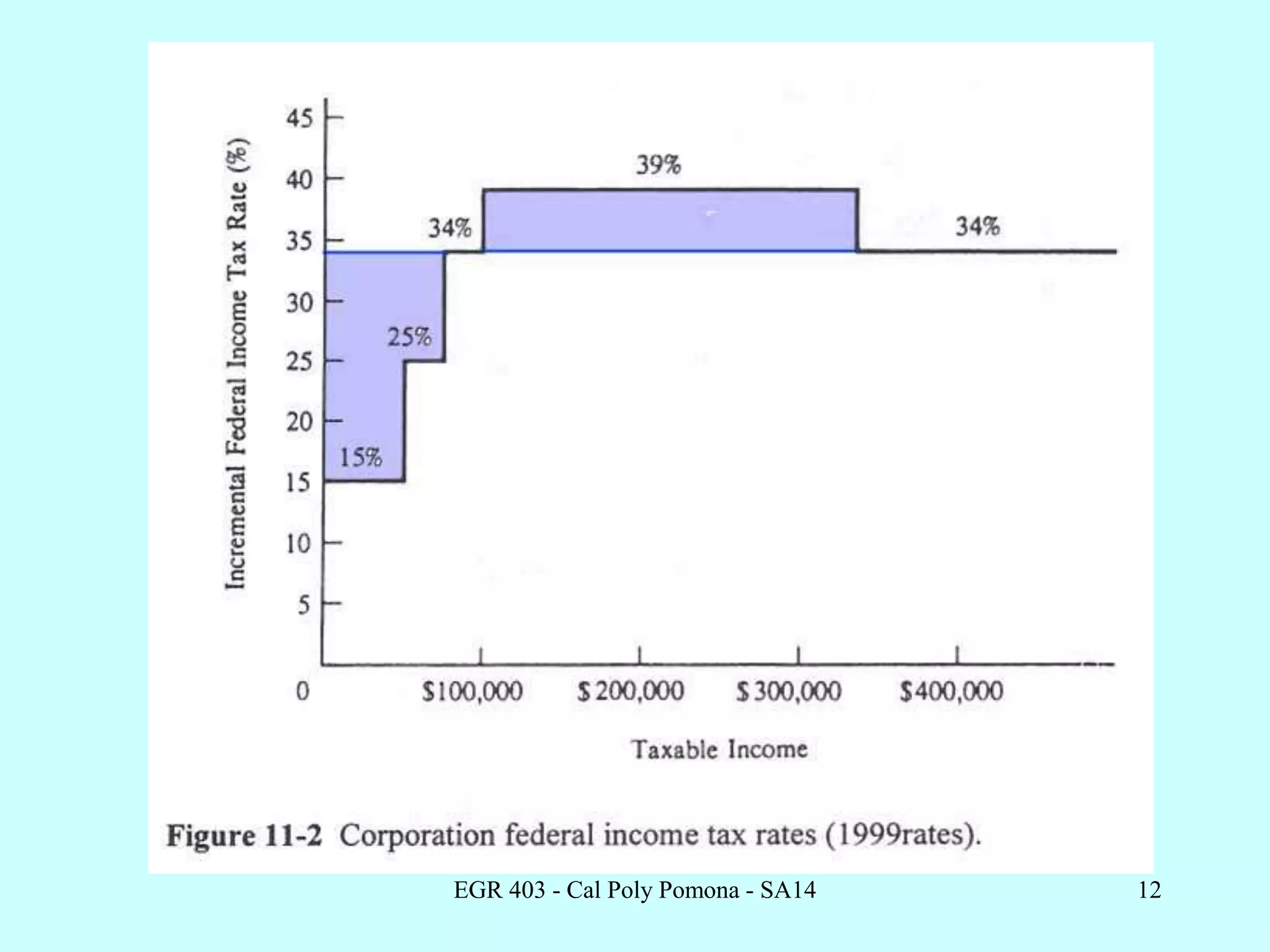

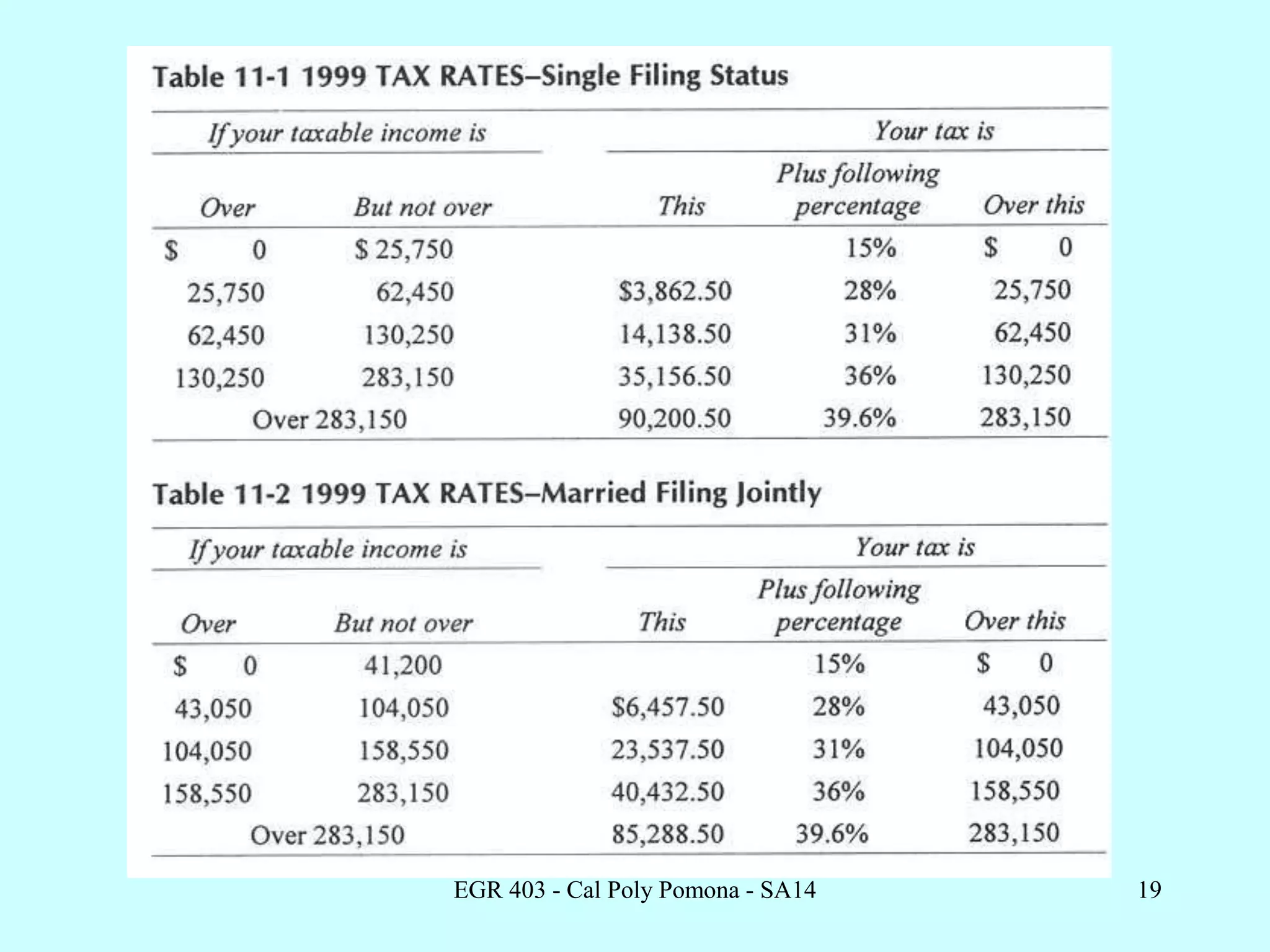

This document discusses income taxes and how they are integrated into economic analysis techniques. It covers how business income taxes are calculated based on gross income, operating expenses, depreciation, and tax rates that vary with taxable income levels. It also discusses how personal income taxes are calculated based on gross income, adjustments, exemptions, and deductions. The document provides examples of calculating business and personal income taxes.

![EGR 403 - Cal Poly Pomona - SA14 20

Figuring Personal Income Taxes

Gross Income (wages, tips, interest, dividends)

Less: Adjustments (tax deferred investments: 401k, IRA)

= adjusted gross income

Less: exemptions (2750/dependent, includes you)

Less: deductions - choose the most favorable of:

Standard deduction: $4300 if single or $7200 if married (1999)

[Note: $4700 single or $7850 (2002)], or

Itemized deductions (donations, some taxes, interest on your

home, major medical expenses and losses)

= Taxable income

Use tables to determine taxes owed on taxable income.](https://image.slidesharecdn.com/egr403sv14chapter11-220801175848-236bc58c/75/egr403_sv14_chapter11-ppt-20-2048.jpg)