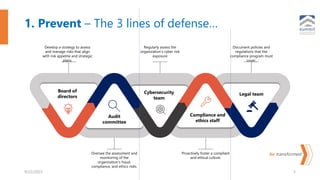

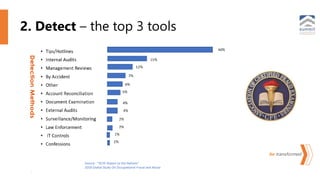

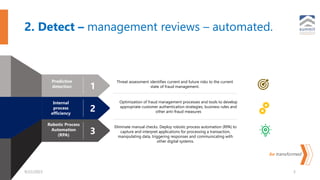

The document outlines a comprehensive fraud risk management strategy termed 'PDR'—Prevent, Detect, Respond—emphasizing the importance of fostering a culture of fraud awareness and implementing preventive controls. It highlights the roles of various teams and tools for managing fraud risk, including predictive detection, robotic process automation, and advanced analytics. The strategy aims to align with organizational risk appetite while ensuring compliance and ethical standards.