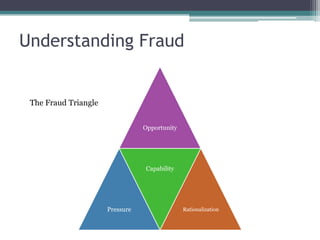

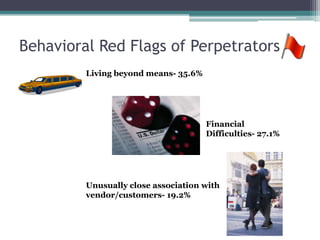

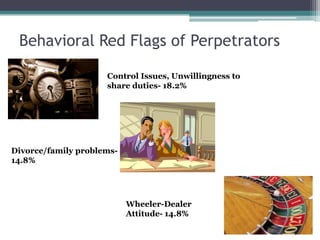

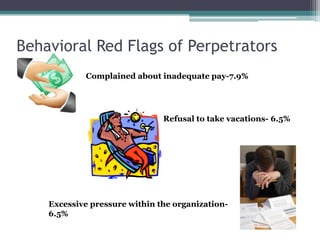

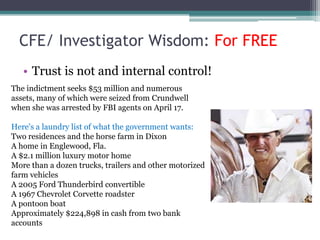

This document discusses protecting businesses from fraud through various prevention methods. It notes that the typical organization loses 5% of its revenues to fraud each year, totaling over $3.5 trillion globally. Occupational fraud cases have a median loss of $140,000, with 1/5 causing over $1 million in losses. Red flags for potential perpetrators include living beyond means, financial difficulties, and behavioral issues. The document recommends physical controls like background checks, access restrictions, audits and monitoring to prevent fraud, as well as cultivating an ethical corporate culture.