This document summarizes an analysis of electrochemical energy storage systems (EESS) in the Italian power industry. It finds that EESS can help address issues caused by increasing renewable energy penetration, such as providing reserves when renewable output fluctuates. The document evaluates the potential market size and applications of EESS across the Italian power system, including the transmission grid, traditional generation, renewable generation, and distribution grid. It concludes that widespread adoption of EESS is needed to support Italy's transition to more renewable energy and smart grids, and that supporting policies and regulations must consider the entire industry to ensure orderly development.

![- 9 -

plants, which are the technologies that best respond to the increase of flexibility required

by the system.

5. New dynamics on the Day-Ahead Market: The increase of renewable sources has

reduced tradable demand on the market and created new hour profiles of the energy

price (PUN). The figure shows two Sundays in which there was a high variability of the

PUN profile. The price profile of the two Sundays of 2013 compared to 2012 decreased

substantially, reaching a null value in the hours when energy produced by photovoltaic

systems is at its maximum; at the same time has increased the price in the evening

hours.

Figure 1 – Price (PUN) in two 2012-2013 significant days (Sundays)

6. Reduction in the availability of primary reserve after markets negotiations: changes

in the operational management for system safety. In order to comply with the safety

standards in the exercise of the electrical system, an adequate capacity of primary

reserve must be provided, able to ensure the stability of the power supply in all operating

conditions. The rise of NPRES power plants and DG occurred in Italy in recent years

involves a substantial reduction in the primary reserve due to the lack of inertia of most

of the systems used to produce energy from NP sources (full-converter wind turbines and

PV generators).

The issues raised can be resolved or effectively limited by the implementation of systems that

allow greater interaction between grid, users and generation. Such systems are called smart

grids: they consist in a clever use of communication systems that allow to overcome the present

limitations of energy grids and that enable a significant increase in the contribution of DG, while

maintaining a high level of security and reliability of the entire system.

-60

-40

-20

0

20

40

60

80

100

120

140

1 2 3 4 5 6 7 8 9 101112131415161718192021222324

delta PUN 02/06/2013 e

03/06/2012 [€/MWh]

delta PUN 16/06/2013 e

17/06/2012 [€/MWh]

PUN 02/06/2013

[€/MWh]

PUN 16/06/2013

[€/MWh]

PUN 03/06/2012

[€/MWh]

PUN 17/06/2012

[€/MWh]](https://image.slidesharecdn.com/3a739d7b-eac4-4d4e-9a34-c4bbe0e7cd94-160102133228/85/EESS-Bip-Paper_Short_1-0-10-320.jpg)

![- 37 -

The overall sizing of the market for NPRES plants is summarized in Table:

RES Optimization &

Integration

RES Dispatching

Potential market 3.100 MWh 2.800 MWh

Table 13 – Market Potential - Renewable Generation. SOURCE: Bip Estimate

4.2.4 DISTRIBUTION GRID

Bip has identified two market segments deriving from DSO needs:

1. DSO dispatching: DSO plays an active role, releasing stored energy to solve grid

criticalities (mainly power applications), optimizing the uncertainties in load prediction /

dispatching (DSO similar to TSO). It is assumed to install EESSs on 30% of Enel

Distribuzione’s substation and 12% on other distributors’ substations.

2. DSO Peak shaving: DSO releases the stored energy to avoid congestion on the

distribution grid [energy demand]. In the market sizing, standard penetration rates have

been hypothesized based on the transformer size.

DSO Dispatching

Management

DSO Peak Shaving

Potential market 1.000 MWh 2.040 MWh

Table 14 – Market Potential – Distribution grid. SOURCE: Bip Estimate

4.3 CONSIDERATIONS AND CONCLUSIONS

In this chapter estimates of the market size for EESS have been presented, broken down by

application and service. The total potential market is expected to be 9 GWh in 2020 and 18 GWh

in 2030, and this potential will be divided unevenly between different actors. Especially since

many players, even on different stages of the value chain electric, will contend market shares for

the same services.

The global market for storage systems has increased substantially in recent years and will

continue to growth more and more in the future, both for its potential to support the grid in its

transformation into a Smart Grid and for the evolution of the electricity market. The major

beneficiaries of the growth of the EESS market will be the electric mobility market and NPRES

generation, while the traditional generation will lose further market shares in the electricity

market.

The electric mobility will drive the development of the storage market as it will enable scale

effects in the production of these technologies that will lead to a reduction in costs and an

increase in the competitiveness of EESS.](https://image.slidesharecdn.com/3a739d7b-eac4-4d4e-9a34-c4bbe0e7cd94-160102133228/85/EESS-Bip-Paper_Short_1-0-38-320.jpg)

![- 44 -

The solution analyzed is characterized by the following technical parameters:

Tecnical parameters Value

Rated power: 0,4 MW

C-rate 2

Energy 0,2 MWh

ηPCS charge/discharge 95%

ηbatteria carica/scarica 97,5%

N° of cycles 4.000

Table 18 – Application per RES integration

The EESS management for power limitation application is shown in Figure 14.

Figure 14 – Power limitation application

For the application if error forecasting reduction, the control of the phase of charging and

discharging takes place as in Figure 15.

Figure 15 – Forecast error reduction application

0,30

0,35

0,40

0,45

0,50

0,55

0,60

1 2 3 4 5 6 7 8 9 10 11 12

Produzione producibile Produzione immessa

[MWh]

Scarica

Carica](https://image.slidesharecdn.com/3a739d7b-eac4-4d4e-9a34-c4bbe0e7cd94-160102133228/85/EESS-Bip-Paper_Short_1-0-45-320.jpg)

![- 46 -

Figure 16 – (a) Critical areas for Enel Distribuzione (b) reverse power flow HV/MV e MV/LW

The benefits guaranteed by the storage system consist in the deferral of grid

investment/expansion and improvement of the electrical system programming, thanks to the

better forecasting of energy flows through the primary substations. The battery break-even is

384 €/kWh.

This application is the one with higher Breakeven price, closer to the market price and it will

probably be one of the initiatives that will faster spread in the coming years.

2. Peak shaving

The load profile of the solution applied to the distribution grid (substation) is represented in

figure, by adopting the ESS system optimized management.

Figure 17 – Load profile with/without storage

61 orange areas

18 white areas

Reverse power flow

> 1% of a year’s

time

14 critical areas

Reverse power flow

> 5% of a year’s

time

Not violated grid constrain

15 yellow areas

Enel Distribuzione critical areas (update 30/06/2011)

Note: 1

Bip Estimation based on DSOs data

2010 20162008

HV/MV substation in

critical areas [#]

MV/LV substation in

orange areas [#]

# of HV/MV Substation observing a Reverse Power Flow

About 17% of

HV/MV substations

observe a reverse

power flow

About 25% of

HV/MV substations

observe a reverse

power flow1

258

374

76

110

0

400.000

800.000

1.200.000

1.600.000

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

Charge

ESS

Discharge

ESS

Load Profile [storage/no storage]

Hours

kW](https://image.slidesharecdn.com/3a739d7b-eac4-4d4e-9a34-c4bbe0e7cd94-160102133228/85/EESS-Bip-Paper_Short_1-0-47-320.jpg)

![- 47 -

The simulation algorithm has been implemented considering the benefits deriving from the

reduction of grid losses, and to the deferral of investment in upgrading infrastructure. The

break-even price for the batteries has been estimated in 259 €/kWh.

5.5.1 JOINT APPLICATION FOR DISTRIBUTION GRID SERVICES

Bip developed a simulation model of the storage system, operation on the basis of real data of

active and reactive power of some Primary substations, evaluating the benefits related with the

application of such systems in the electricity distribution grids.

The services considered are:

1. Peak Shaving: use of the EESS to reduce the peak on the Primary Substation lines, in

order to reduce the capital exposure;

2. Dispatching: minimization of forecasting errors of energy in transit on the primary

substations, in order to ensure a proper planning of the exchange with the HV grid and

properly manage the dispatching activities of the TSO;

3. Power factor correction: provide reactive power in order to restore appropriate levels of

power factor and limit the overall losses of the area served by the Primary Substation.

For the Peak Shaving application, the operation algorithm has been developed in order to

reduce the power closer to the upper safety limit of the Primary cabin transformer (Figure 18). In

the analyzed cabins energy flows approached the safety limit both in normal flow (from HV to

MV) and in reverse flow (from MV to HV).

Figure 18 – Power profile with ESS application for Peak Shaving application. Source: Bip

The use of the energy storage systems delays the investment for the replacing the HV/MV

transformer in primary substation (upgrade deferral).

In order to facilitate the dispatching activities and contain the forecasting errors in Primary

Substation, battery realigns the effective energy transits in PS to the previous forecast, giving a

-80.000

-60.000

-40.000

-20.000

0

20.000

40.000

60.000

0:00 6:00 12:00 18:00

[kW]

Consuntivo Previsione

Erogazione

Accumulo

Accumulo

Erogazione

Erogazione

Accumulo

Erogazione

Potenza Apparente Trasformatore

Potenza Apparente Trasformatore](https://image.slidesharecdn.com/3a739d7b-eac4-4d4e-9a34-c4bbe0e7cd94-160102133228/85/EESS-Bip-Paper_Short_1-0-48-320.jpg)

![- 48 -

reduction of forecast errors and thus providing a higher reliability of the HV transit

programming. Hereafter the profile to the operation modes of the batteries:

Figure 19 – Operation mode for the reduction of forecast errors

Finally, the simulation algorithm takes into account that the bidirectional inverter is capable of

handling reactive power each time the battery is being charged or discharged, and in this way it

can improve the power factor of the grid.

The simulation model also takes into account the realized costs and benefits of different storage

systems technologies, as well as technical performance, applied to the distribution grid within

the primary substations analyzed.

The possible benefits are:

1. Deferral investment for transformer replacement;

2. Reducing forecast error of the energy transits (quantified by the spread between the price

of energy on the day ahead market MGP and balancing market MB);

3. Reduction of reactive energy in transit on the grid (quantified as the penalties provided

by TSO for the use of reactive power from the HV grid);

The results obtained show that for the 4 analyzed technologies (PbA, Li-Ion, NaS, Zebra) the

investment is not profitable at present prices. This is mainly due to the high investment costs of

the batteries. However, the technologies that show the greatest potential for possible

experimental applications are the NaS and lithium ion batteries. NaS batteries present the

cost/benefit ratio closer to unity, although they do not guarantee very high benefits. The lithium

ion, because of their flexibility, can ensure the highest benefits (in absolute value double

compared to the other technologies), although their current cost is almost 3 times the possible

benefits. In addition, a prospective analysis of the prices of these technologies shows that both

NaS and lithium ion will reach the break-even price in 2018.

-800

-600

-400

-200

0

200

400

600

800

1000

01:00 04:00 07:00 10:00 13:00 16:00 19:00 22:00

Errore[kW]

Errore Previsione

Accumulo

Accumulo

Erogazione

Erogazione

Soglia accettabilità dell’errore

Soglia accettabilità dell’errore](https://image.slidesharecdn.com/3a739d7b-eac4-4d4e-9a34-c4bbe0e7cd94-160102133228/85/EESS-Bip-Paper_Short_1-0-49-320.jpg)

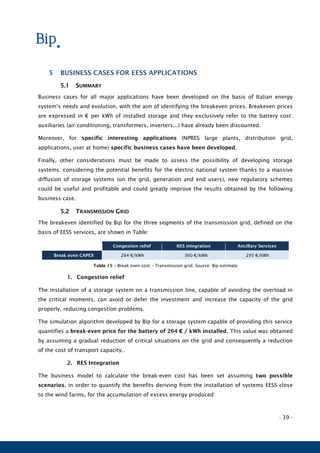

![- 50 -

The plant is dimensioned in order to generate the energy consumed by the user during the year.

The battery management is performed in order to charge during the day, up to 100%, and

discharge as soon as energy demand rises, down to 0% (consistent with the availability of

generation and energy demand from the user). The simulation algorithm includes the rule that

the storage system does not interact directly with the grid (does not charge and discharge

energy within the grid), the performance of the battery is 90% in discharging and the storage

system is characterised by dimensions that optimize the self consumption of energy. The daily

average profile of the storage system is the following:

Figure 21 – Average daily profile for a PV + EESS system, home user, South area

5.6.2 ANALYSIS RESULTS

The results of the analysis are the following:

1. An estimate of annual benefits obtainable by the Italian user, in terms of revenue

from the sale of energy and reduction of the bill, and an estimate of the

consumer/domestic producer new interaction profile with the grid.

2. An estimate of annual benefits obtainable for the Italian electrical system (reduction

of thermal power installed capacity, improvement of the predictability of the DG,

reduction of grid losses, reduction of the modulation of the NPRES plants, investment

deferral of the distribution grid, fewer interruptions, reduction of CO2 emissions,

enabling an increasing penetration of RES).

The storage system allows a complete independence from the grid for about 64% of the time and

it increases the share of self consumption from 32% (without storage system) to 73% (with

accumulation).

Considering the investment and maintenance costs of photovoltaic system and EESS, the result is

that prices of battery technologies on the market are today too high to allow massive

-50%

-25%

0%

25%

50%

75%

100%

-1

-0,5

0

0,5

1

1,5

2

1 3 5 7 9 11 13 15 17 19 21 23

Charge (Discharge) [Kwh] Generazione [Kwh]

Consumo [Kwh] Stato di Accumulo [ %]](https://image.slidesharecdn.com/3a739d7b-eac4-4d4e-9a34-c4bbe0e7cd94-160102133228/85/EESS-Bip-Paper_Short_1-0-51-320.jpg)

![- 51 -

deployment of this sector: the lithium-ion battery solutions have a break-even value around

1,562 €/year in 2012, while in the future the breakeven will be 828 €/year in 2020, as a result

of the cost decrease of the batteries. NaS technology, instead, has a breakeven value of 999.3

€/year 2012 and 844.7 €/year in 2020. Both technologies in 2020 will be a profitable

investment, in fact, the cost of residential customers who will not have photovoltaic nor storage

system will be significantly higher.

Figure 22 – Break even cost 2012-2020 for Li-Ion and NaS

The benefits for the system have been quantified by assuming different scenarios of PV

penetration in Italian households, but only the more protective scenario is here summarized. In

this scenario 1% of the families will install a PV system with an integrated EESS, for a total of

250,000 households systems (PV and storage). In such Scenario, the electrical system will

benefit 89.4 €/year for each unit installed.

5.7 CONSIDERATIONS AND CONCLUSIONS

Bip has done many studies on the possible applications of the storage systems in the electrical

value chain in Italy and identified the breakeven prices required for such systems (and batteries)

to enable the full return of the investment.

The results obtained show that to date storage systems are not cost-effective solutions, mainly

due to the high cost of batteries. However, a decrease of the batteries prices is expected for the

next years and it will allow realizing profitable applications by the end of this decade. In the next

few years there will probably be a reduction of batteries production cost, a reduction in raw

material costs and auxiliary components and, moreover, there will be heavy investment in R&D

that will enable an increased storage capacity, better energy efficiency and better performing

management algorithms.

It is also important to underline that the low breakeven prices for many applications are not an

obstacle to the development of such systems, because in many contexts the needs are urgent

1.561,2

999,3

828,4 844,7

FV+RESS (Li-Ion) FV+RESS (NaS)

Costo senza nessun sistema 873,74 [€/anno]](https://image.slidesharecdn.com/3a739d7b-eac4-4d4e-9a34-c4bbe0e7cd94-160102133228/85/EESS-Bip-Paper_Short_1-0-52-320.jpg)