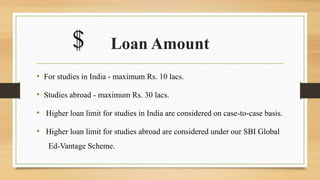

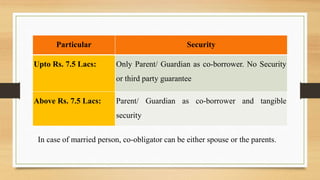

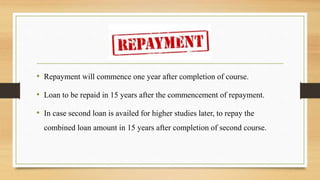

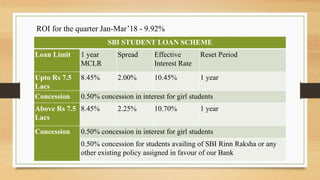

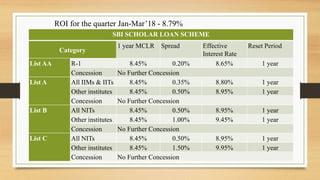

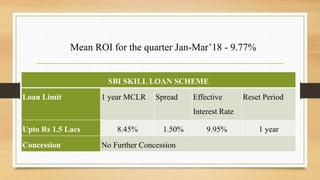

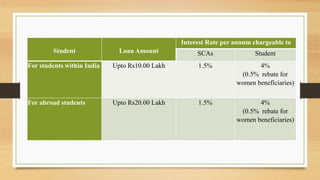

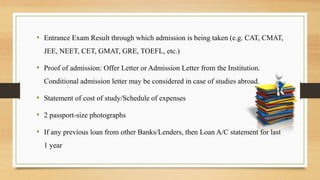

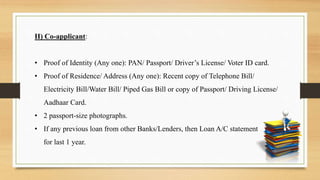

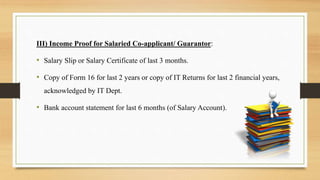

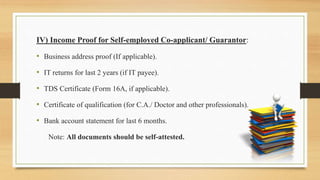

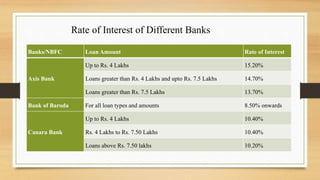

This document provides information about an education loan offered by SBI. It details the eligibility requirements, courses covered, expenses covered, loan amounts, interest rates and required documents. Students pursuing higher education in India or abroad can receive loans up to Rs. 10 lacs or Rs. 30 lacs respectively. Interest rates start from 8.45% and loan repayment begins 1 year after course completion over 15 years. Documentation includes proof of identity, residence, income, admission and academic records.