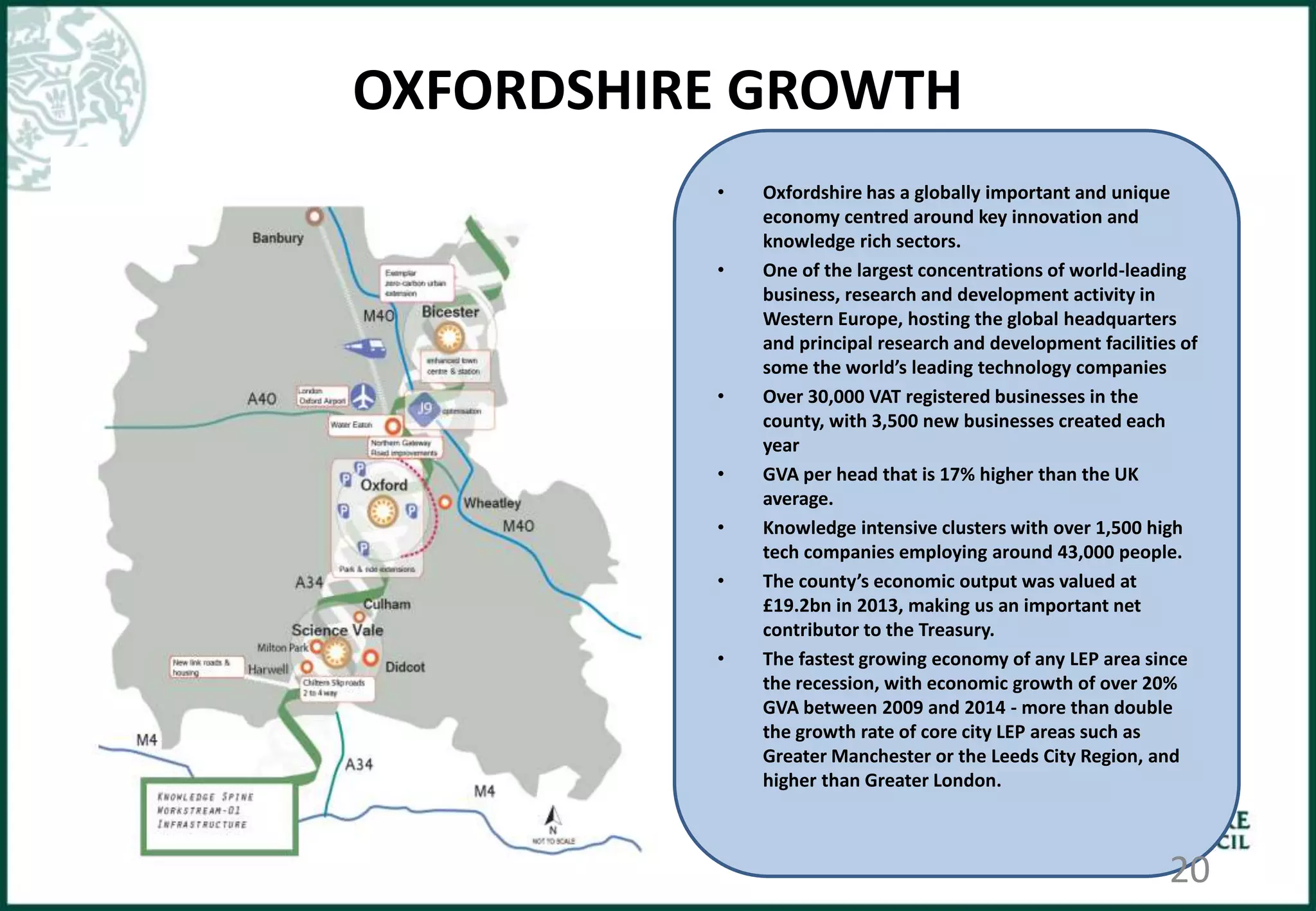

This document discusses strategic planning and devolution in Oxfordshire. It provides an overview of Oxfordshire's economy and the challenges of strategic planning in the region. It outlines Oxfordshire's devolution proposal, which focuses on infrastructure investment and integrated strategic planning through a combined authority. The proposal aims to invest over £6 billion in infrastructure by 2031 to support job and economic growth. However, the criteria for successful devolution deals have changed, emphasizing elected mayors and reorganization. The document discusses next steps for Oxfordshire, including continuing infrastructure planning and local development plans while awaiting further discussion on devolution. It emphasizes getting on with proposed initiatives like the Oxfordshire Strategic Infrastructure Strategy.

![• The response to the Duty was shaped by local context

• For areas with a history of cooperation and a shared /

emerging vision, the Duty was a continuation of

business as normal

“We have a strong bond [with neighbours]. The Duty just

gives us another reason for talking at that strategic level,

for seeing out inter-relationships”.

Local context](https://image.slidesharecdn.com/dtcslideshare-160224223844/75/Duty-to-Cooperate-Composite-9-2048.jpg)

![• The response to the Duty was shaped by local context

• For areas with a history of cooperation and a shared /

emerging vision, the Duty was a continuation of

business as normal.

• For areas with little or such history and / or conflicting

planning goals, the Duty raised issues that were not

being answered – or even addressed

“We have a strong bond [with neighbours]. The Duty just

gives us another reason for talking at that strategic level,

for seeing out inter-relationships”.

Local context](https://image.slidesharecdn.com/dtcslideshare-160224223844/75/Duty-to-Cooperate-Composite-10-2048.jpg)