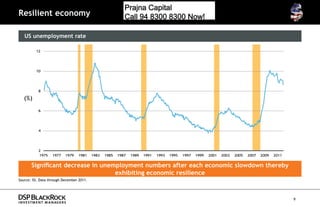

The document summarizes an investment opportunity in the DSP BlackRock US Flexible Equity Fund, an open-ended fund of funds scheme that invests in the BlackRock Global Funds US Flexible Equity Fund. Some key points:

- The NFO period for the fund is July 17, 2012 to July 31, 2012.

- The underlying BlackRock fund has $1.3 billion in assets under management, providing Indian investors access to one of BlackRock's flagship US equity funds.

- The document makes the case that US equities are a good investment opportunity now due to attractive valuations and the large size and diversity of the US equity market.