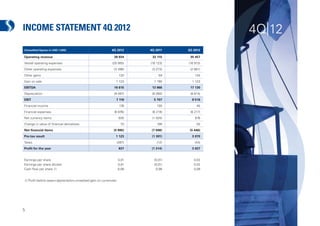

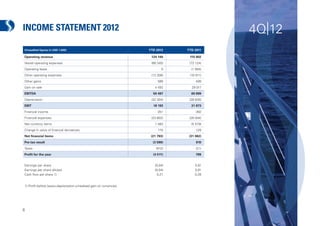

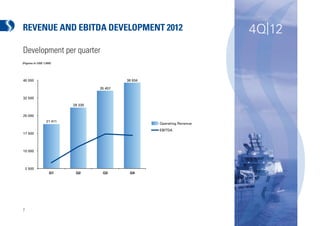

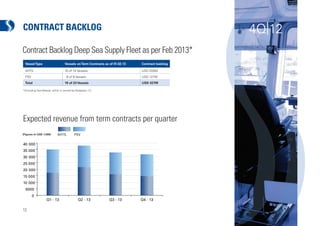

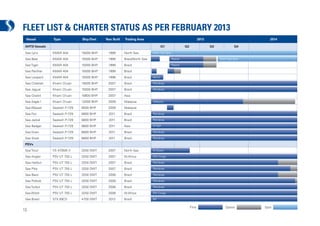

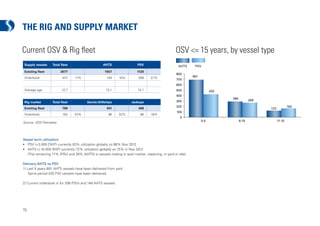

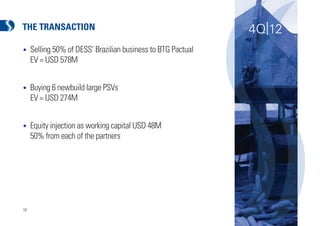

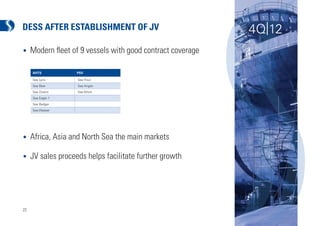

Deep Sea Supply Plc announced a joint venture in Brazil and new long-term contracts in Asia. While revenue increased in the fourth quarter of 2012, the soft North Sea spot market and late start to the Sea Brasil project reduced profits. Earnings per share turned positive after three consecutive quarters of losses.