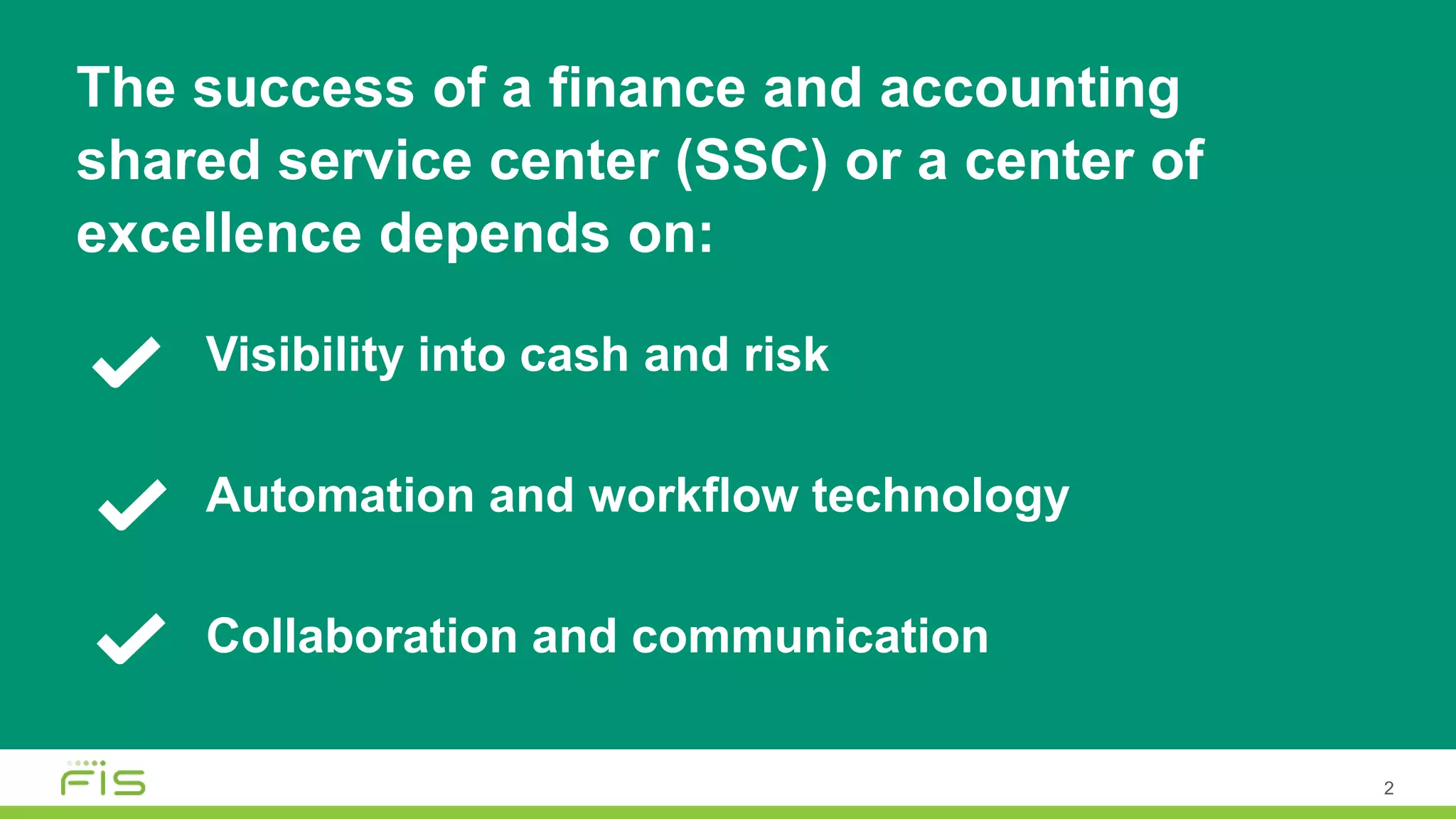

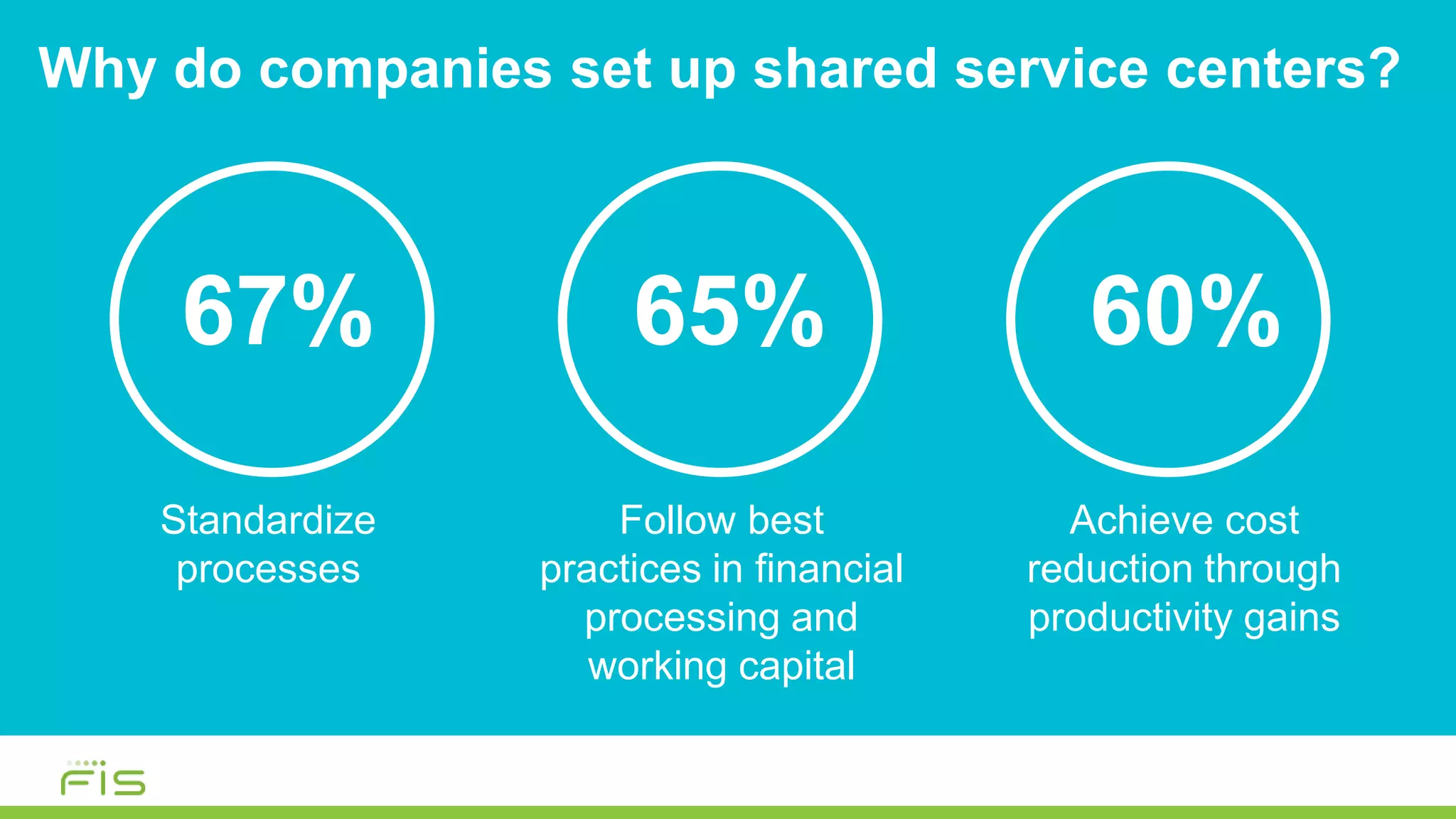

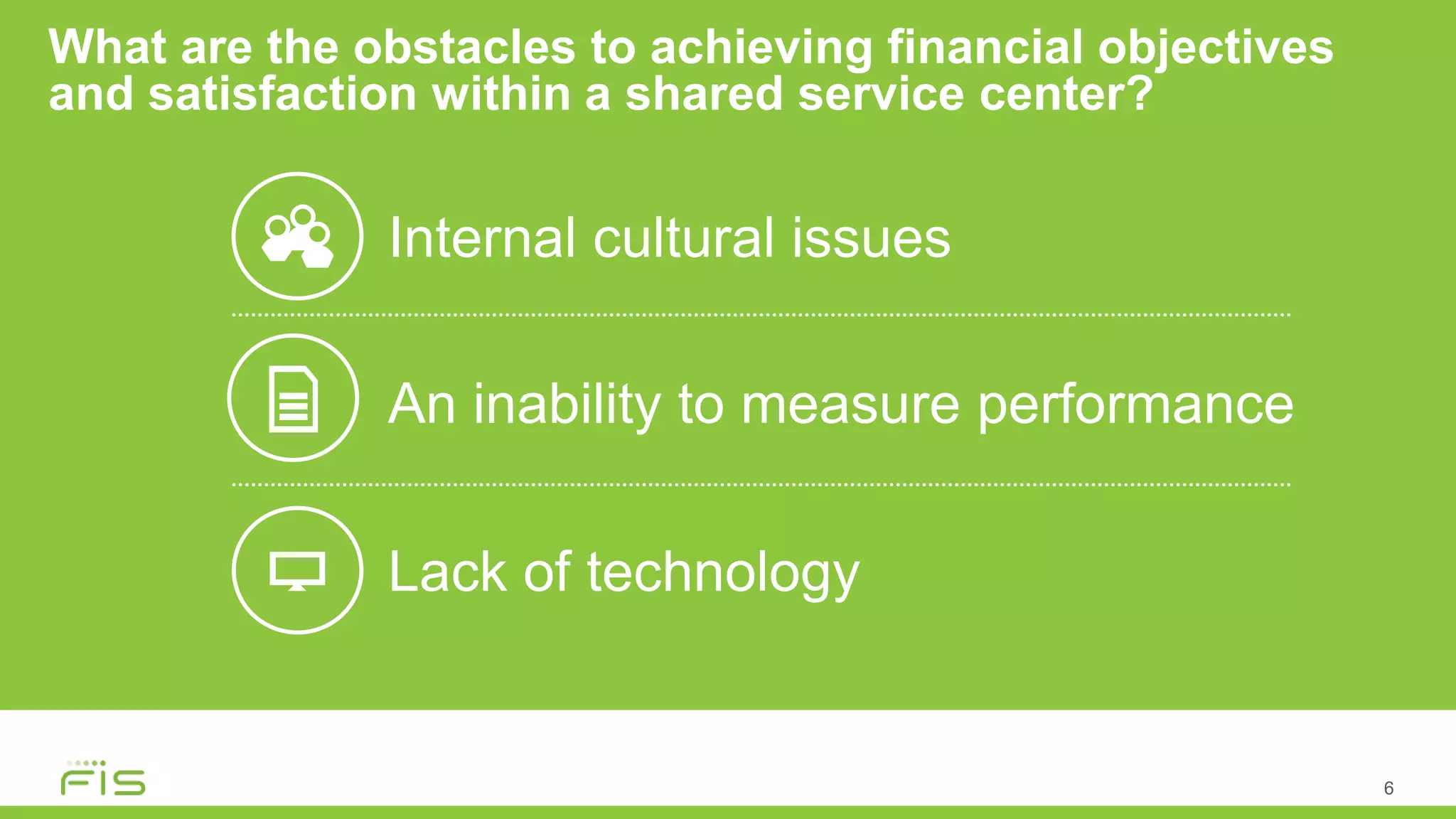

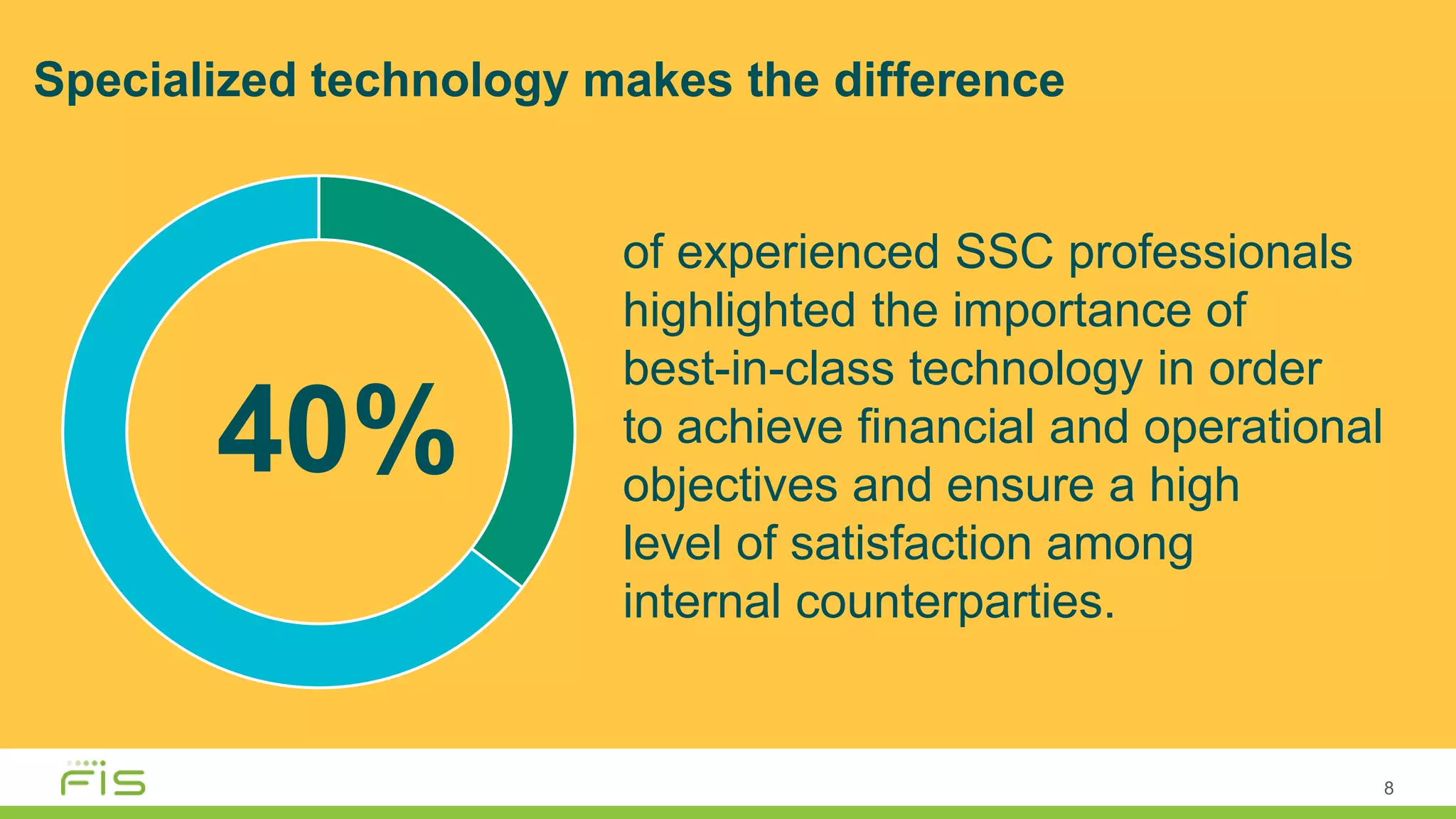

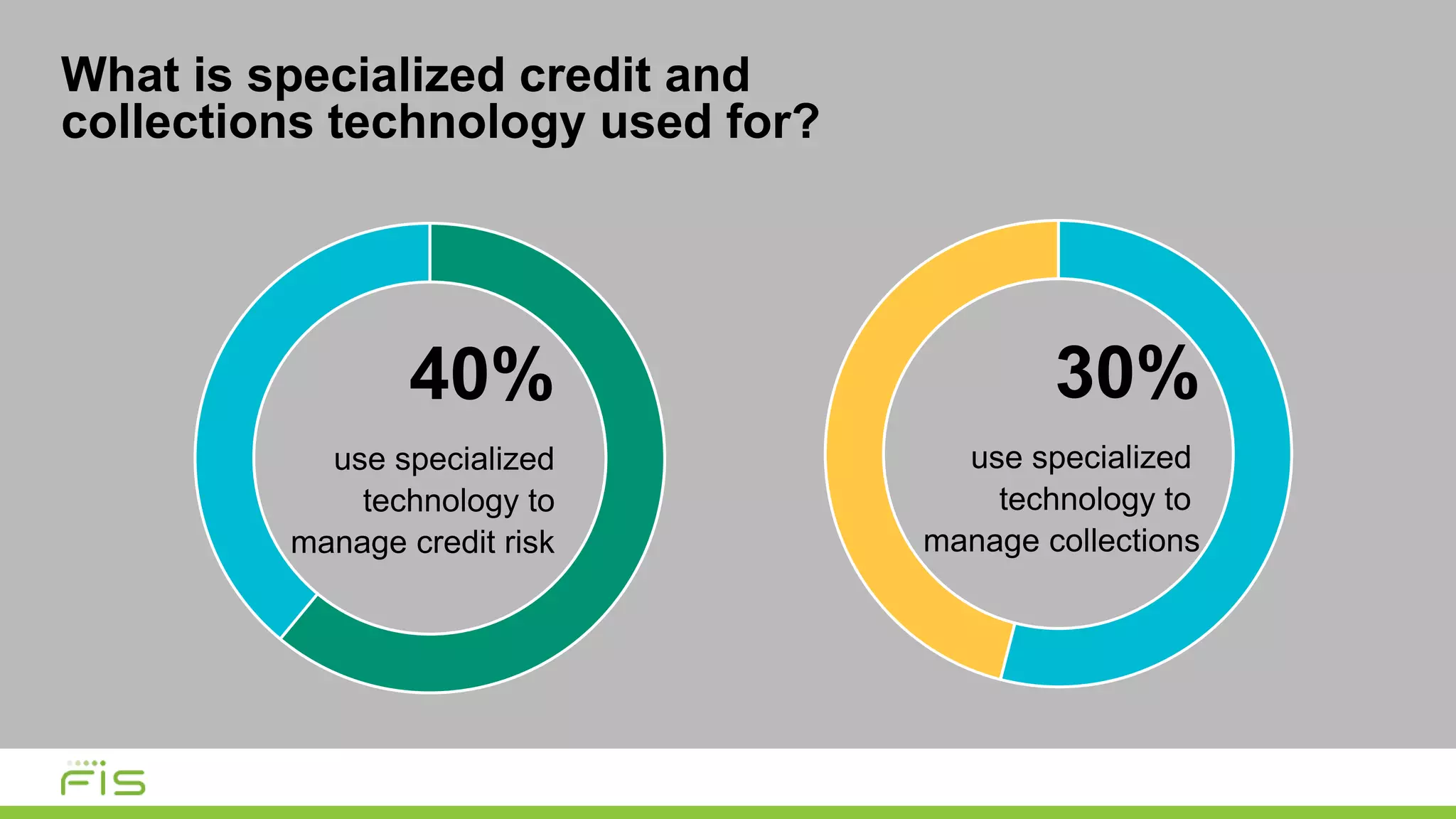

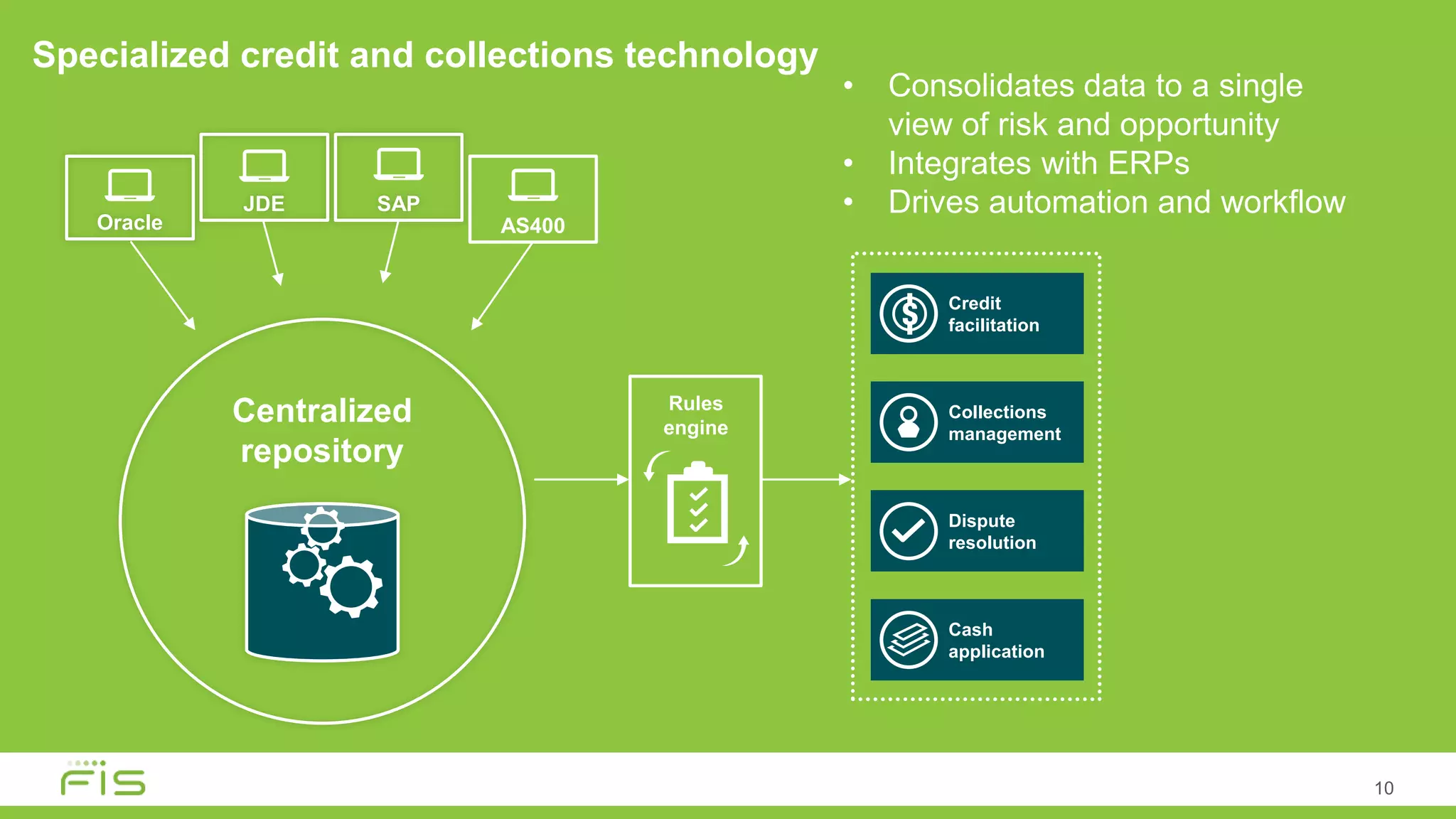

The document discusses the importance of optimizing credit and collections within shared service centers (SSCs) by leveraging specialized technology to achieve cost reduction and standardization. It highlights that many companies face obstacles such as cultural issues and inadequate technology, resulting in dissatisfaction with their SSC outcomes. Effective collaboration and centralized data management are emphasized as essential for improving performance and reporting in financial operations.