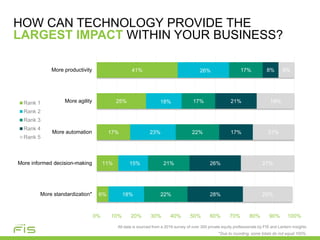

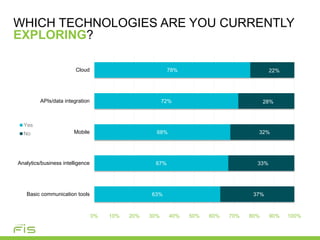

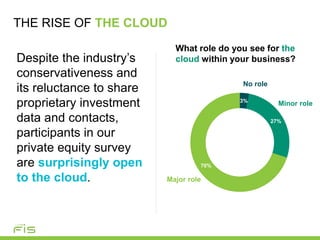

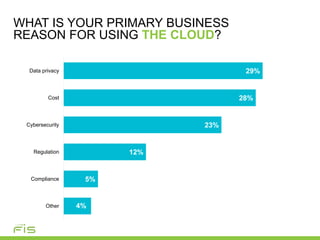

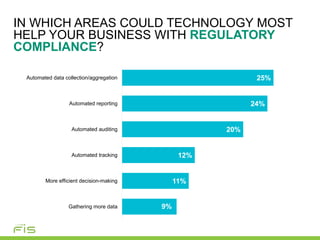

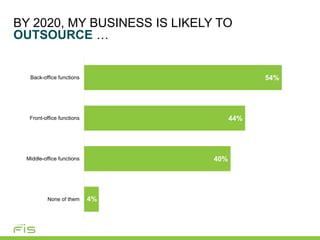

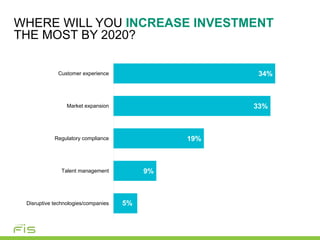

The document discusses how technology can enhance private equity operations by improving data management, reducing costs, and optimizing client experiences. It emphasizes the transition to cloud-based solutions for greater scalability and efficiency, highlighting the importance of automation and outsourcing to improve compliance and decision-making. The overall message is a push for private equity firms to adopt modern technologies to remain competitive and enhance their business operations.