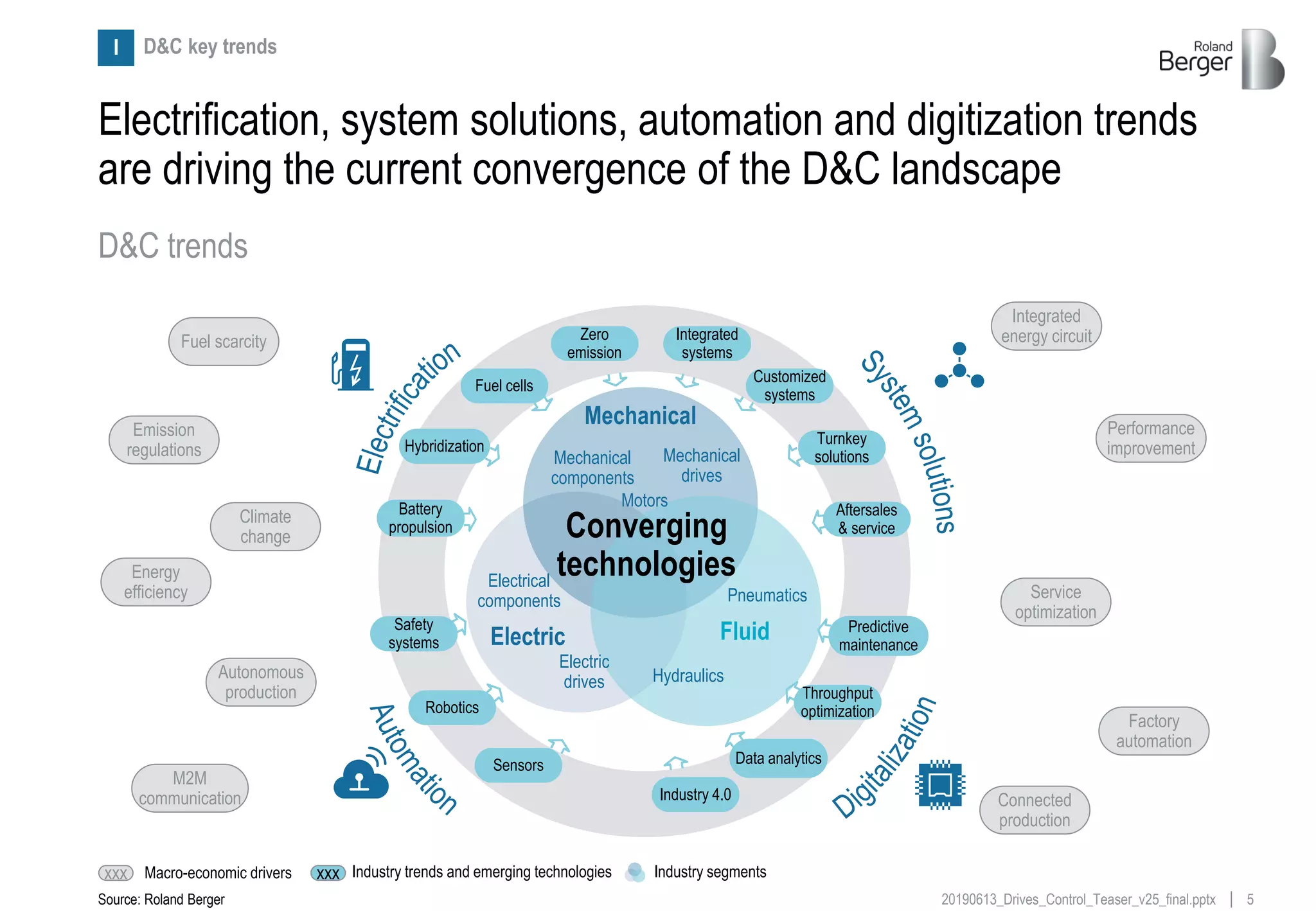

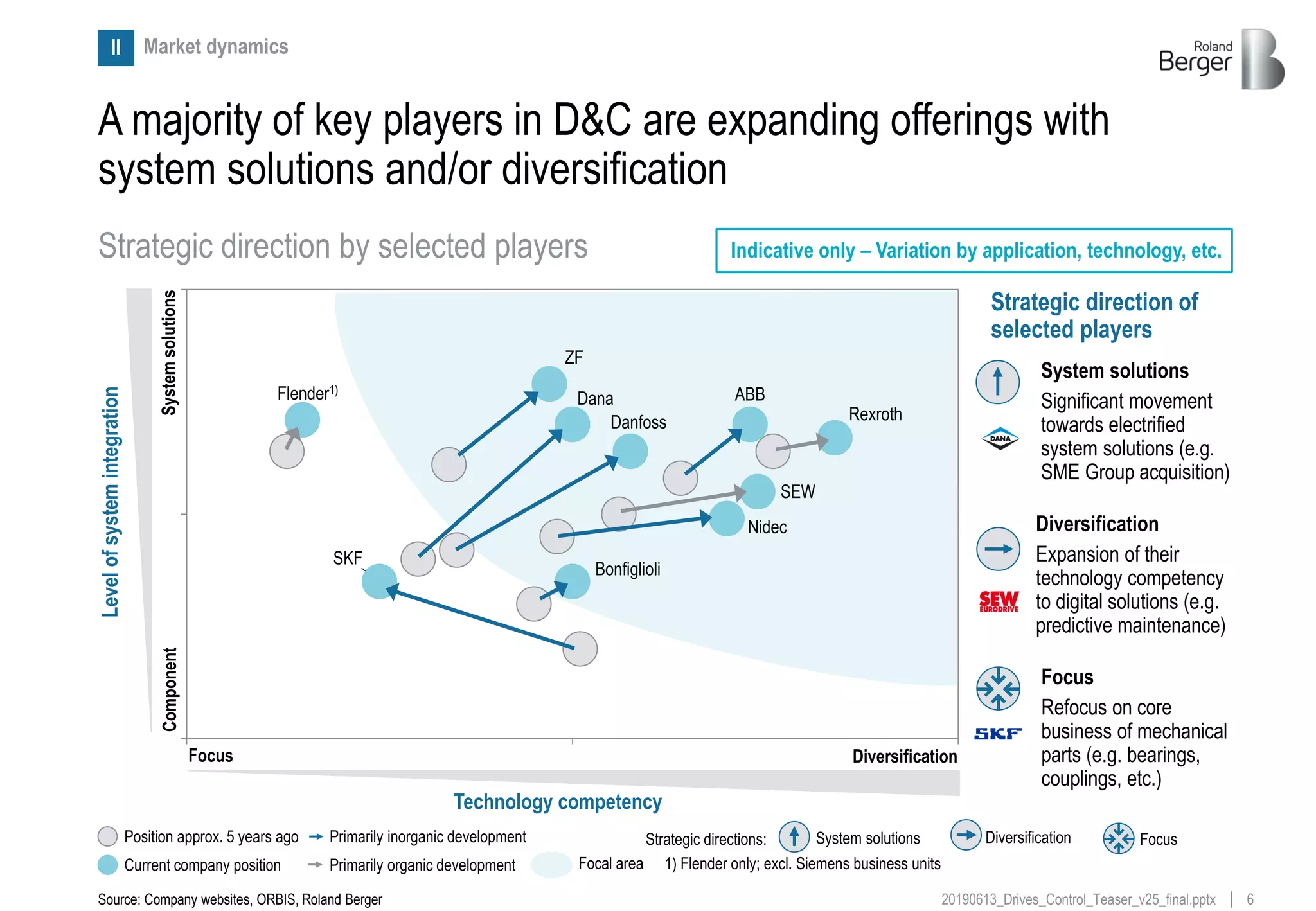

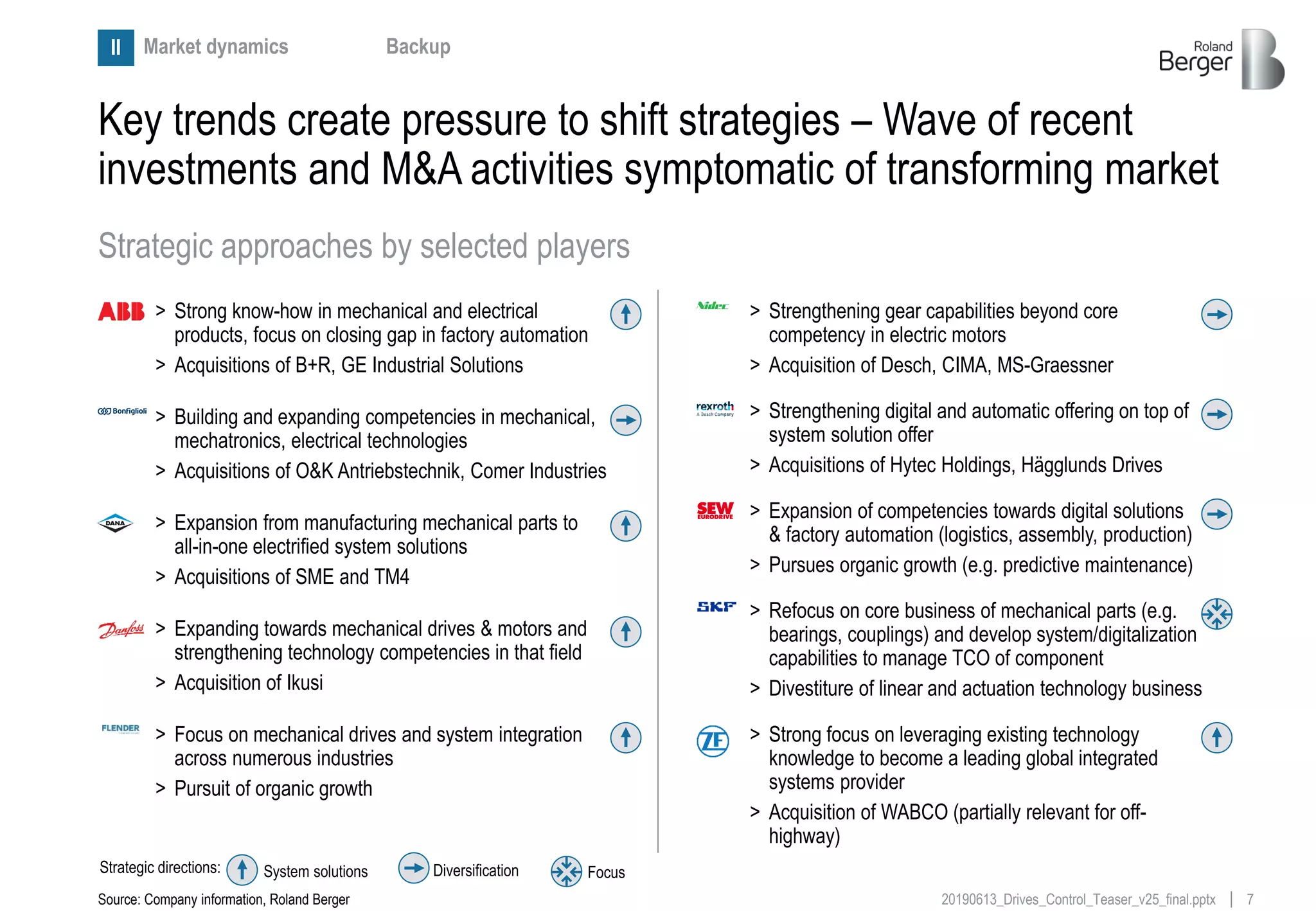

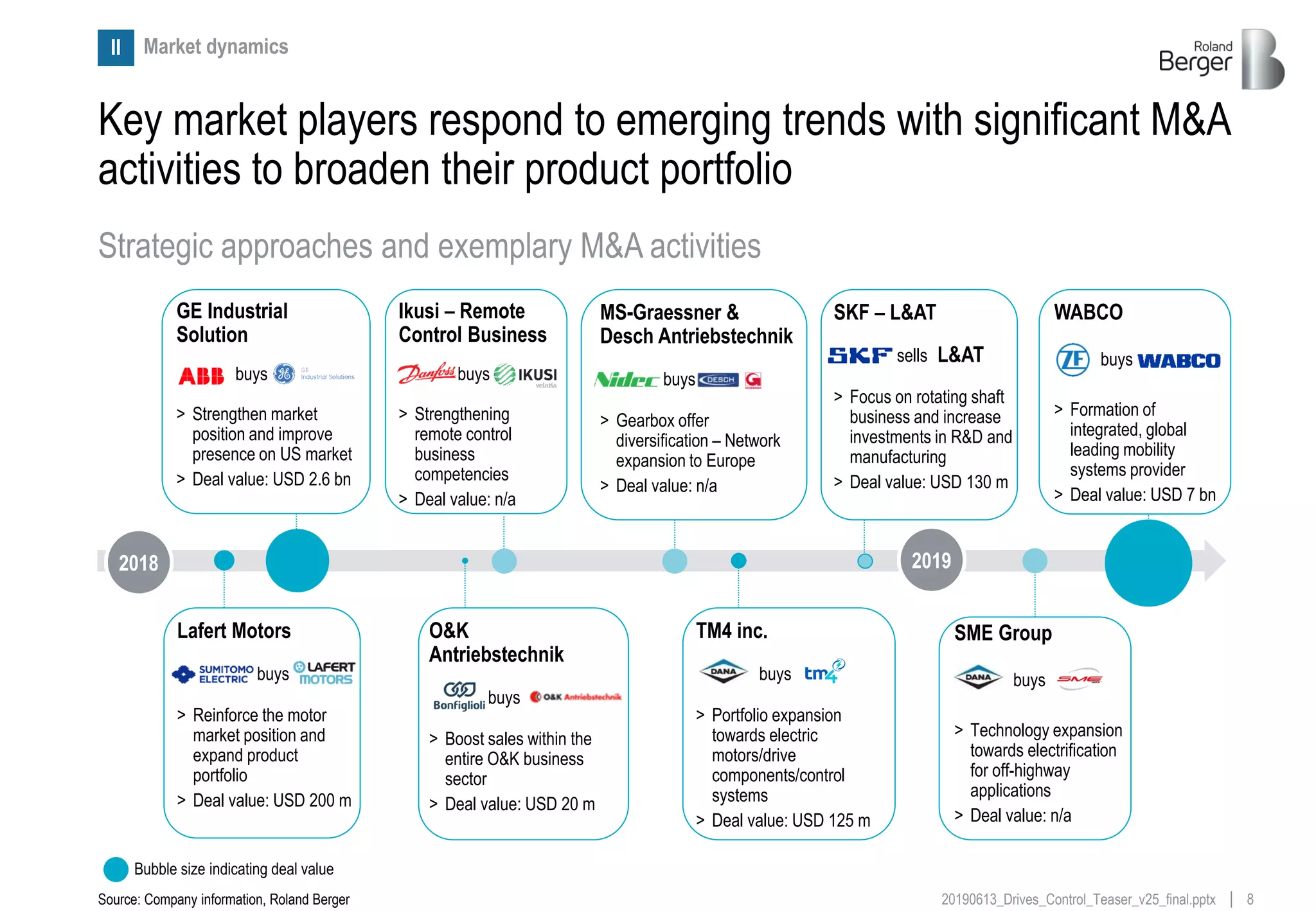

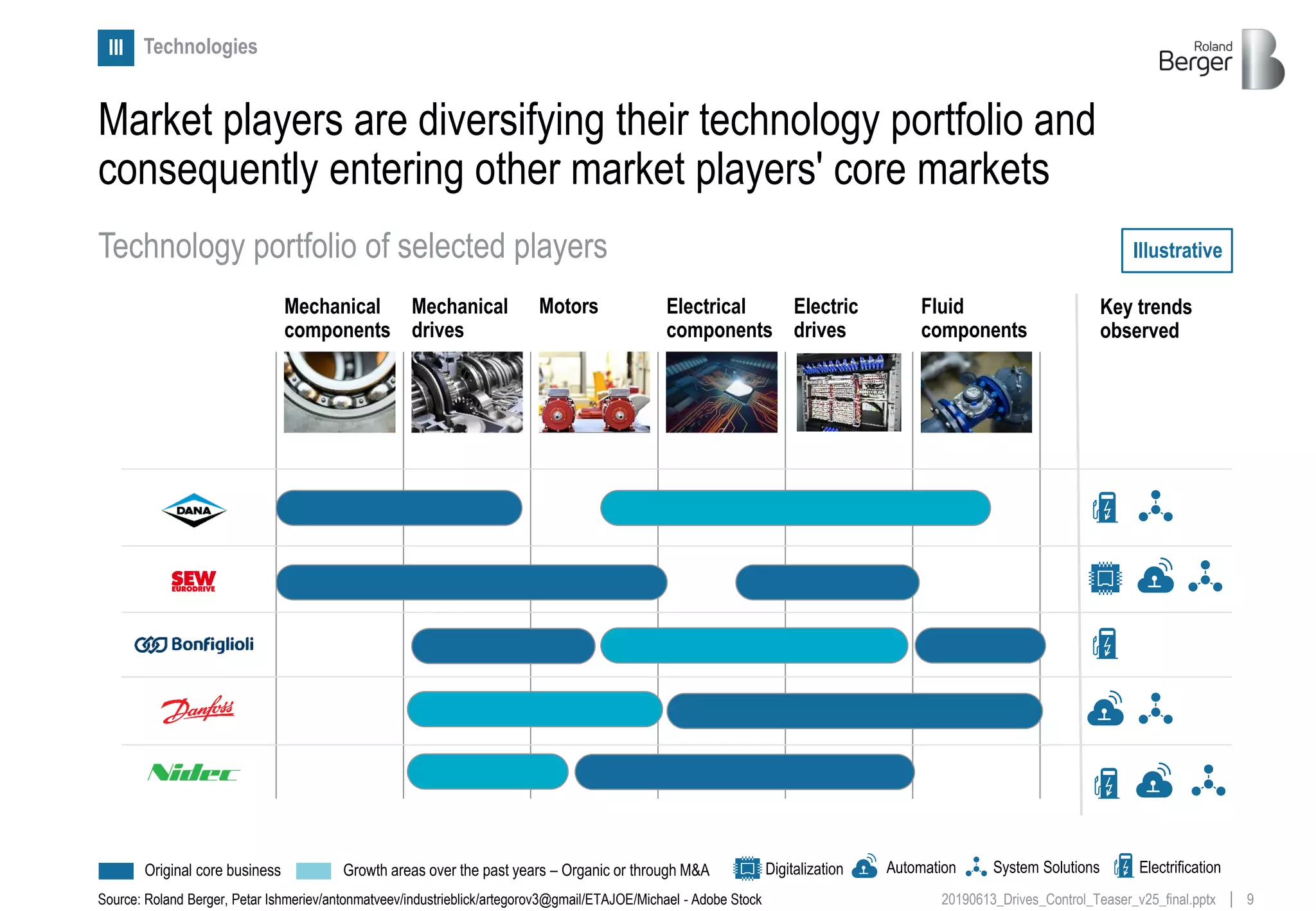

The document discusses key trends driving changes in the drives and controls (D&C) technology landscape: electrification, digitalization, system solutions, and automation. It notes that these trends are contributing to a convergence of mechanical, electric, and fluid systems segments. Leading players in D&C have responded by increasing M&A activity and adjusting their strategic priorities to position themselves in the new technology landscape. The document provides an overview of the D&C segments and trends impacting different end industries. It also discusses strategic considerations for D&C players in redefining their business models and operating models to address the changing landscape.

![1020190613_Drives_Control_Teaser_v25_final.pptx

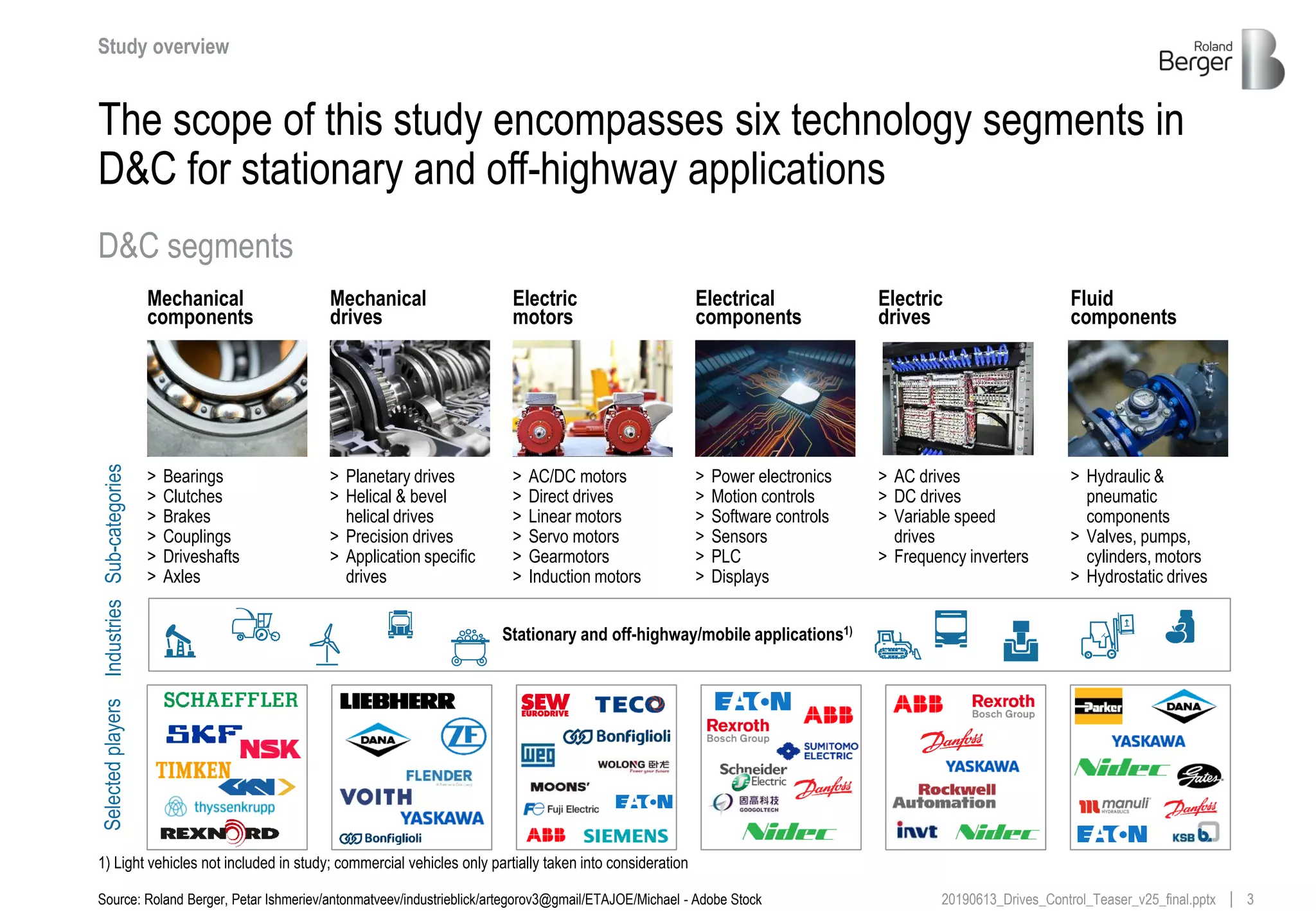

The construction equipment market shows greatest potential for

expansion by D&C players – Mining and material handling following

Source: Markets & Markets, Allied Market Research, Freedonia, Roland Berger

End industries (selection)

Equipment market:1) CAGR

'18-'23

D&C trend impact

Agriculture

Construction

Material

handling

194

258

5.9%

203

306

8.5%

2018 2023

74 95

139 182

5.5%

Value [USD bn]

Electrification System solutions Automation High Mid LowRelevance:

Trend description

Large agriculture equipment

OEMs prototyping electrified

and smart farming solutions

Construction players develop-

ing autonomous concepts and

electrified solutions

Limited operation ranges lead

to high and further increasing

electrification

End industriesIV

Mining 7.2%

Strong electrification efforts for

e.g. underground mining;

increasing automation efforts

Wind power 5.0%

Service efficiency potential

through optimized monitoring

particularly for offshore parks

n/a

1) All information targets the respective machinery equipment market 2) Considering the current situation and future development of the market as well as the impact of the D&C trends

StationaryMobile

107

162

Digitalization

Overall

potential2)

High LowPotential:](https://image.slidesharecdn.com/20190613drivescontrolbigchangesahead-190620071904/75/Drives-Control-Big-Changes-Ahead-10-2048.jpg)

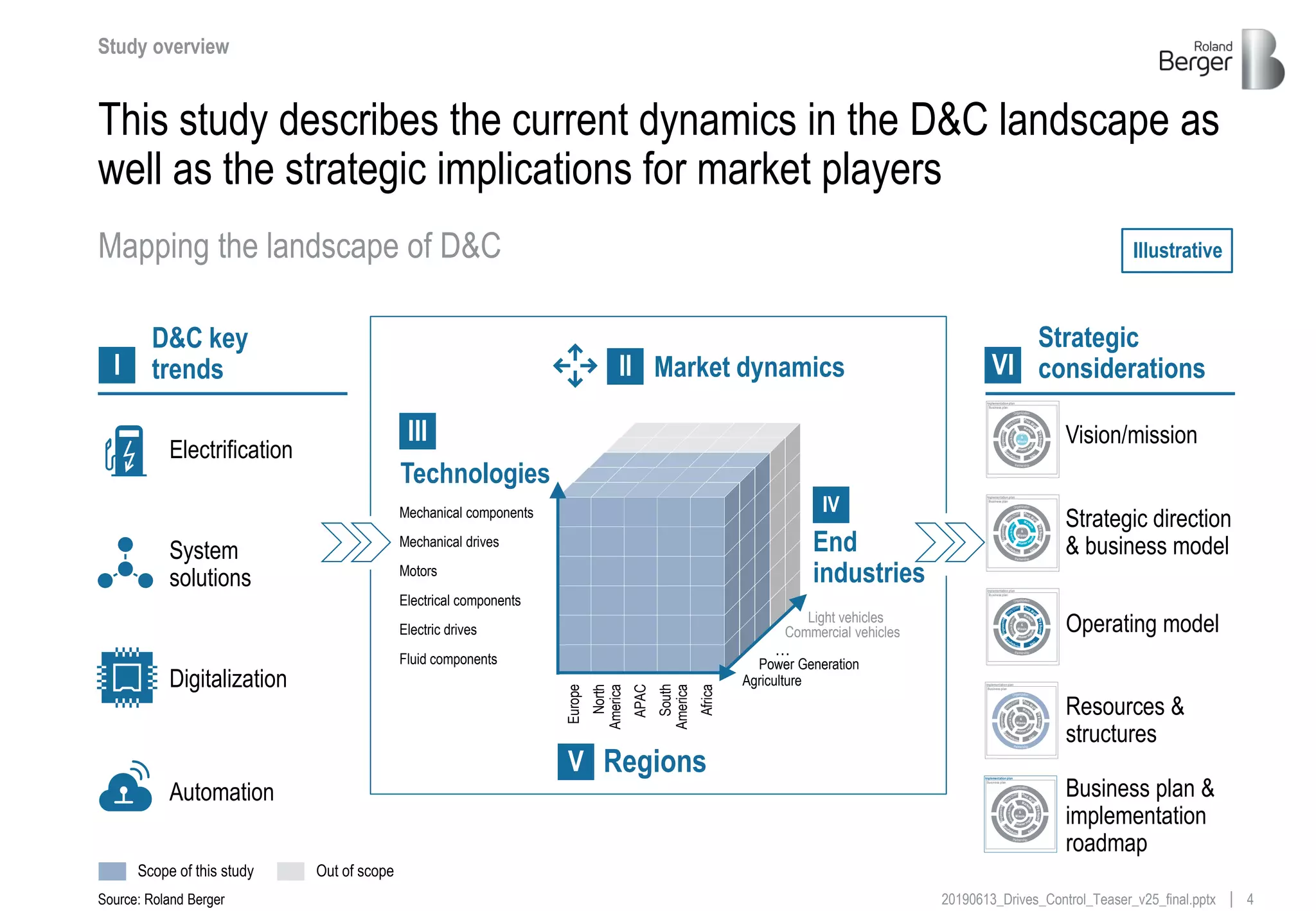

![1220190613_Drives_Control_Teaser_v25_final.pptx

Regional development highly dependent on end industry – Growth

generally above average in APAC region

RegionsV

73

17

62

42

80

2018

97

59

22

2023

194

2585.9%

5.4%

6.0%

APAC North America

7.2%

Europe

4.5%

South America, Middle East & Africa

CAGR

2018-23

Agriculture equipment1)

Regional split of selected end industries [USD bn]

58

73

107

63

41

58

41

2018

67

2023

203

3068.5%

7.4%

11.2%

4.5%

10.6%

CAGR

2018-23

Construction equipment1)

54

36

33

16

43

72

2018

45

22

2023

139

182

5.5%

5.4%

5.7%

4.0%

6.6%

CAGR

2018-23

Material handling equipment1)

xxx xxx xxx xxx

1) All information targets the respective machinery equipment market

> Large agricultural and farming market in

the US drives North American

agriculture equipment growth

> Strong infrastructure/construction

investment in APAC but also Middle

East drive the growth of the market

> Increasing cost of labor and infrastructure

drive growth of intralogistics in Middle

East, Asia and Europe

Source: Markets & Markets, Allied Market Research, Freedonia, Roland Berger](https://image.slidesharecdn.com/20190613drivescontrolbigchangesahead-190620071904/75/Drives-Control-Big-Changes-Ahead-12-2048.jpg)