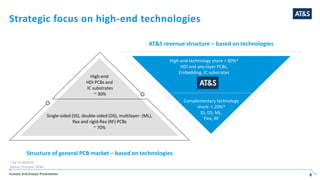

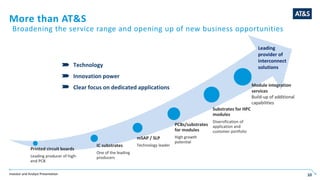

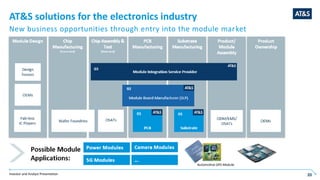

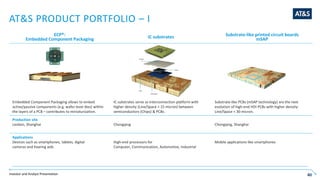

- AT&S is a leading provider of printed circuit boards and IC substrates for applications such as mobile devices, automotive, industrial, medical, and more.

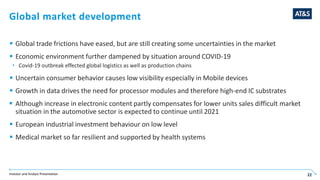

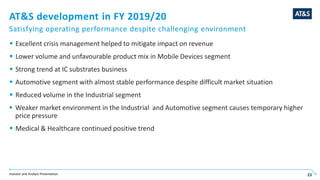

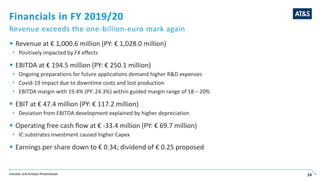

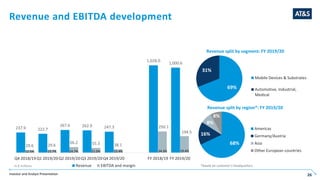

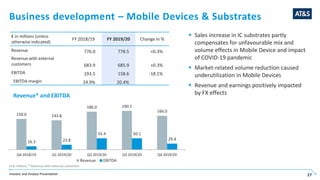

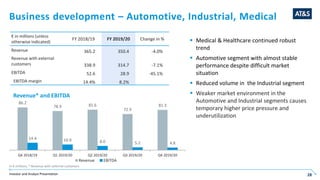

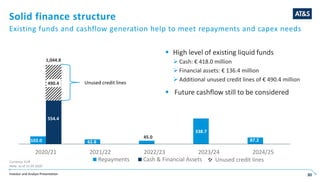

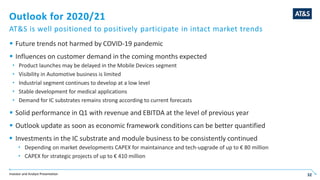

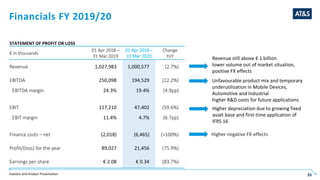

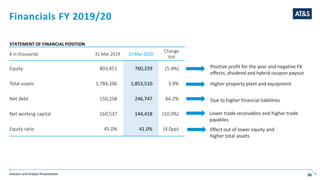

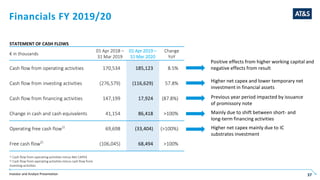

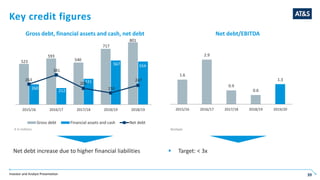

- In fiscal year 2019/20, AT&S achieved over €1 billion in revenue but saw declines in EBITDA and earnings per share due to lower sales volume, unfavorable product mix, and impacts of COVID-19.

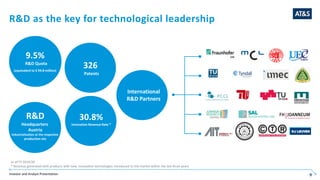

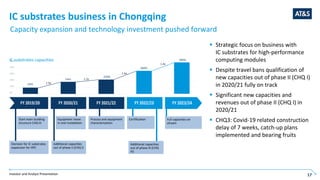

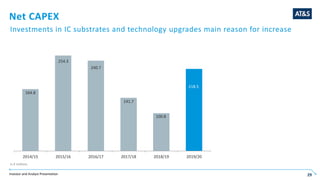

- However, AT&S remained profitable with an EBITDA margin within its guided range of 18-20% and continues investing in expanding IC substrate capacities for future growth opportunities in high-performance computing.