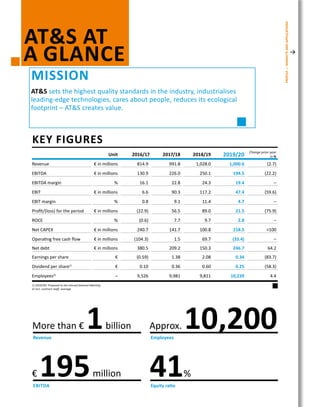

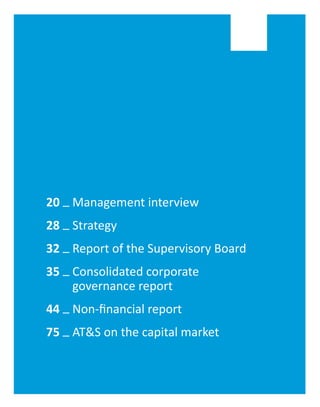

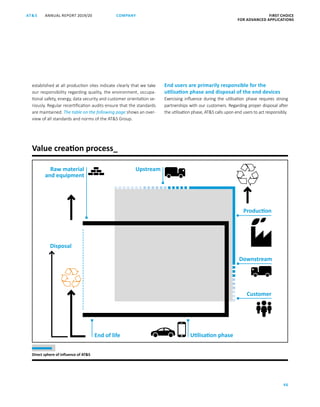

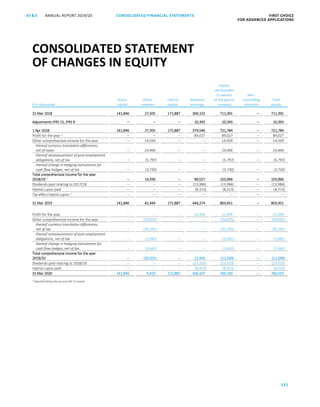

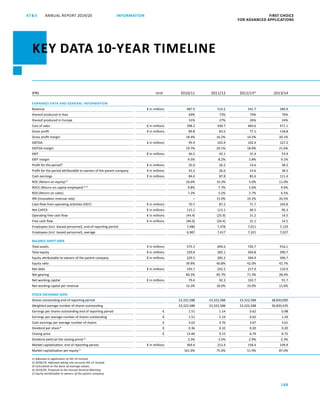

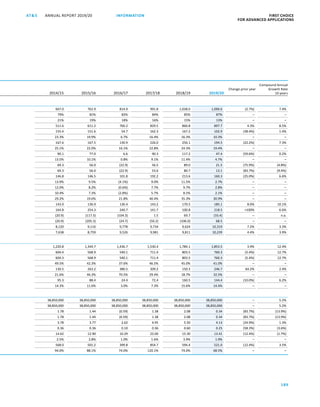

1) The document is an annual report from AT&S, a leading manufacturer of printed circuit boards and IC substrates, reporting on the 2019/20 fiscal year.

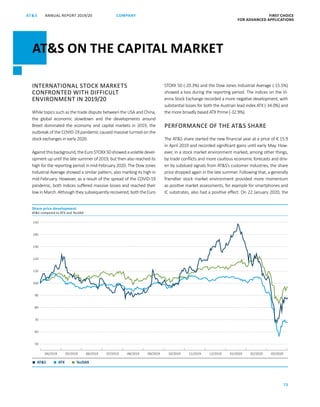

2) It highlights key figures such as revenue declining 2.7% year-over-year to €1 billion, EBITDA falling 22.2% to €195 million, and profit for the period declining 75.9% to €21.5 million.

3) AT&S discusses major trends in the industry like 5G mobile networks, increasing data volumes, and growing markets for IC substrates that the company is positioned to capture through expansion.