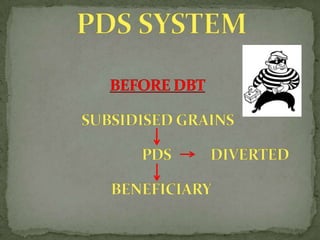

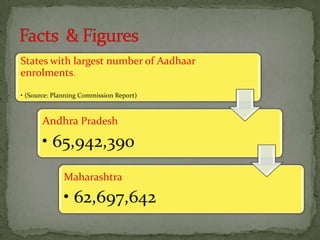

This document summarizes a study on direct benefit transfers in India. It explains that direct benefit transfer is a scheme launched in 2013 to directly transfer government benefits to citizens' bank accounts in order to reduce corruption and inefficiencies. However, it faces challenges in identifying beneficiaries as only 40% of Indians have bank accounts and the identification system relies on Aadhaar numbers, of which only half of citizens currently have. It also notes that expanding banking access and updating beneficiary lists are major hurdles to implementing the direct benefit transfer scheme nationwide.