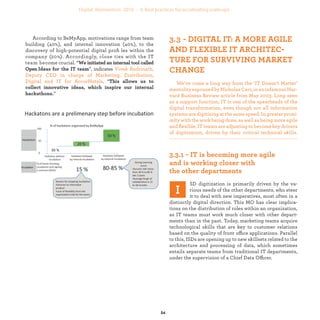

The document discusses the digital disruption of various economic sectors in 2016, highlighting the rapid growth of the digital economy and its impact on traditional businesses. It identifies key battles for companies, including customer relationships and data utilization, while emphasizing the necessity for adaptability and innovation in facing digital challenges posed by new entrants like GAFA (Google, Apple, Facebook, Amazon). The analysis is backed by insights from industry leaders and frameworks developed by the Boston Consulting Group and IBM, revealing disparities in disruption levels across sectors and suggesting that digital transformation presents both threats and opportunities for businesses.