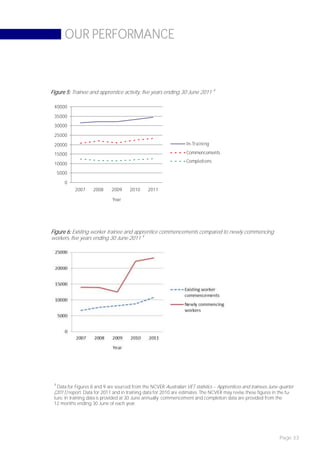

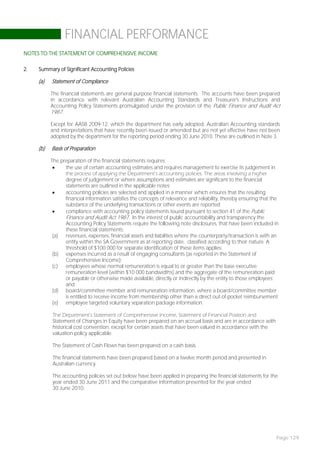

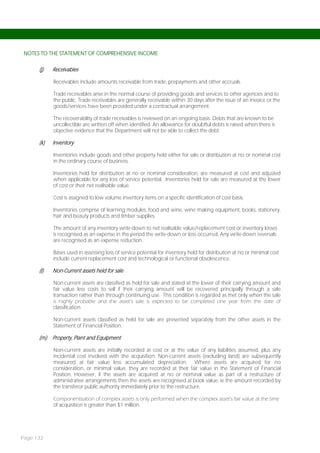

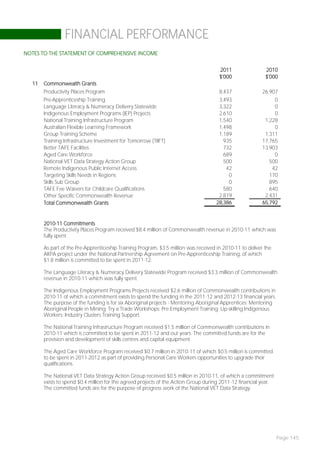

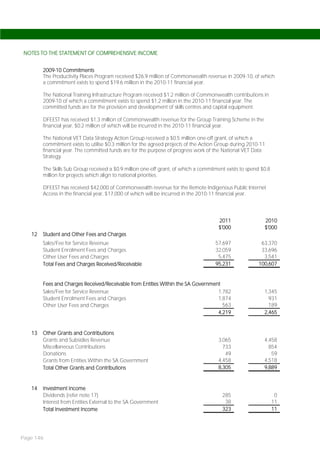

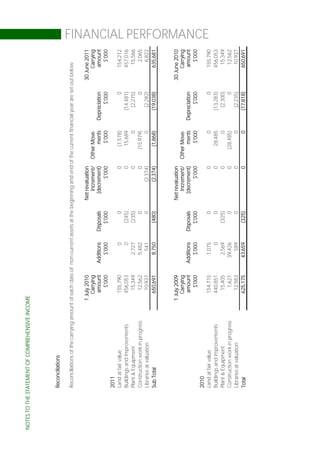

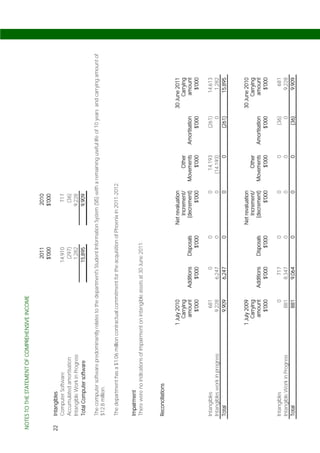

The 2011 Annual Report for the Department of Further Education, Employment, Science and Technology (DFEEST) outlines the organization's role in developing South Australia's workforce and enhancing education and training systems. Key highlights include the implementation of the 'Skills for All' reform, introduction of new training initiatives, significant funding allocations, and high student satisfaction ratings within TAFE SA. The report emphasizes collaboration with industry, development of infrastructure, and improvements in vocational education and training quality.