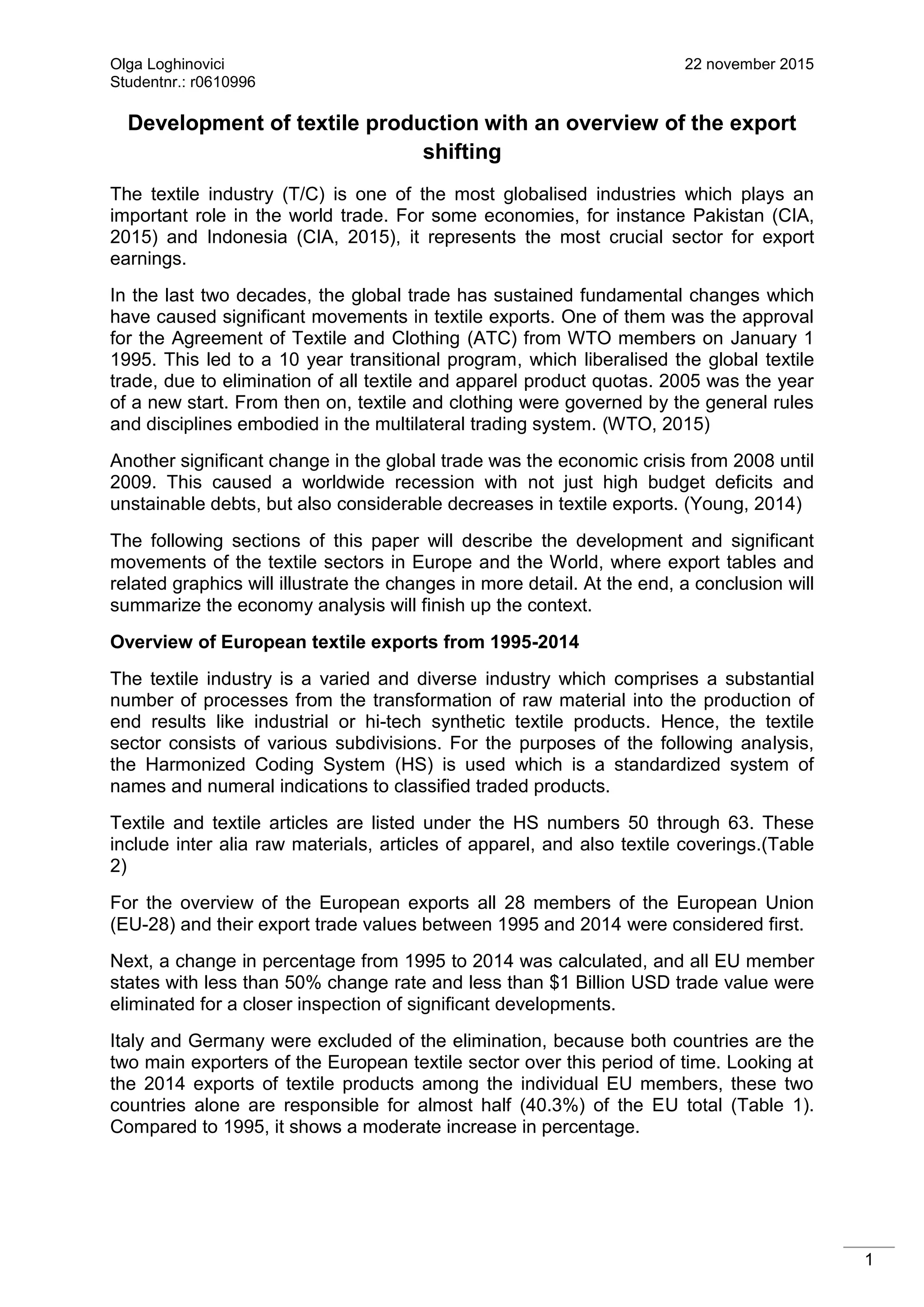

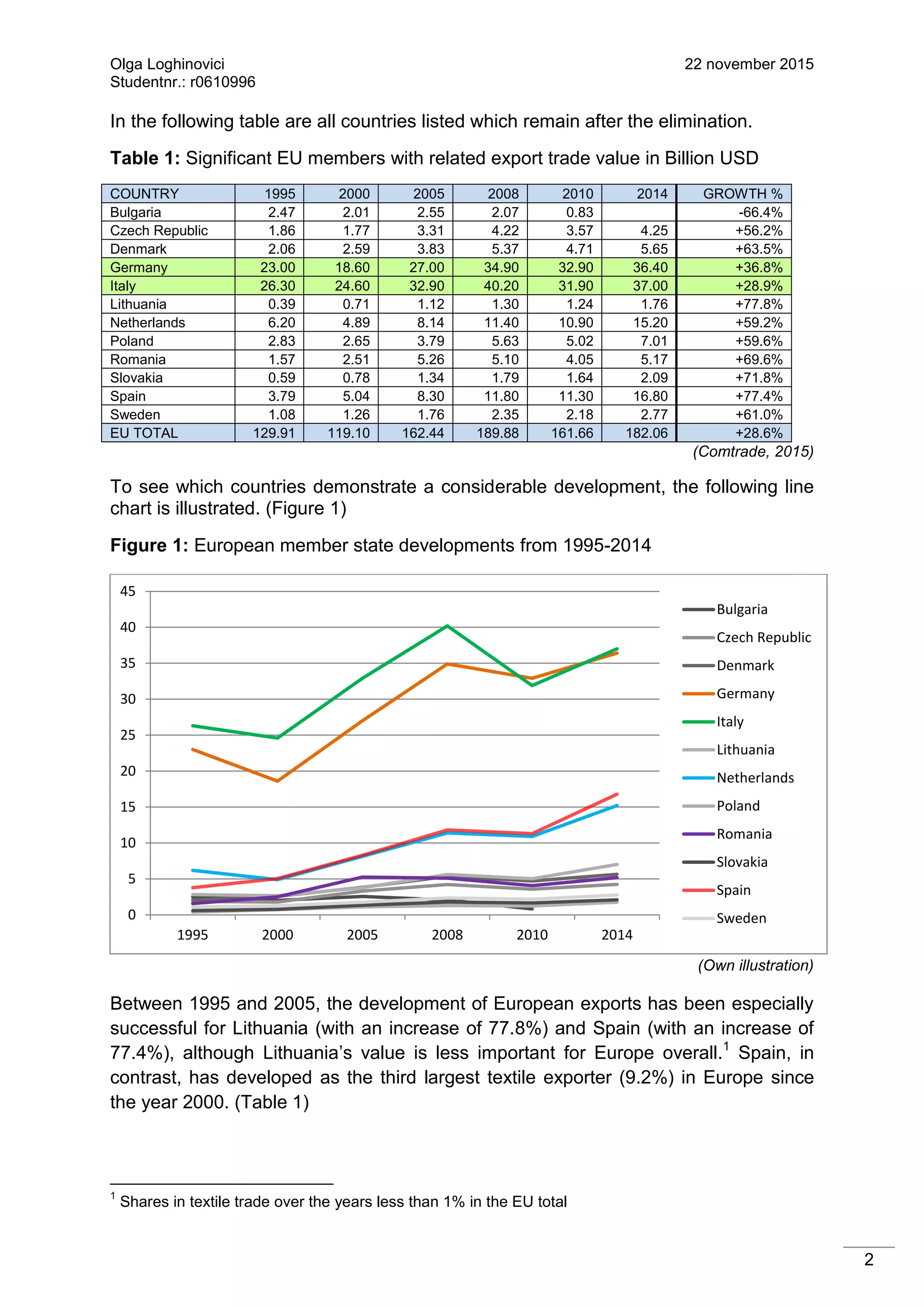

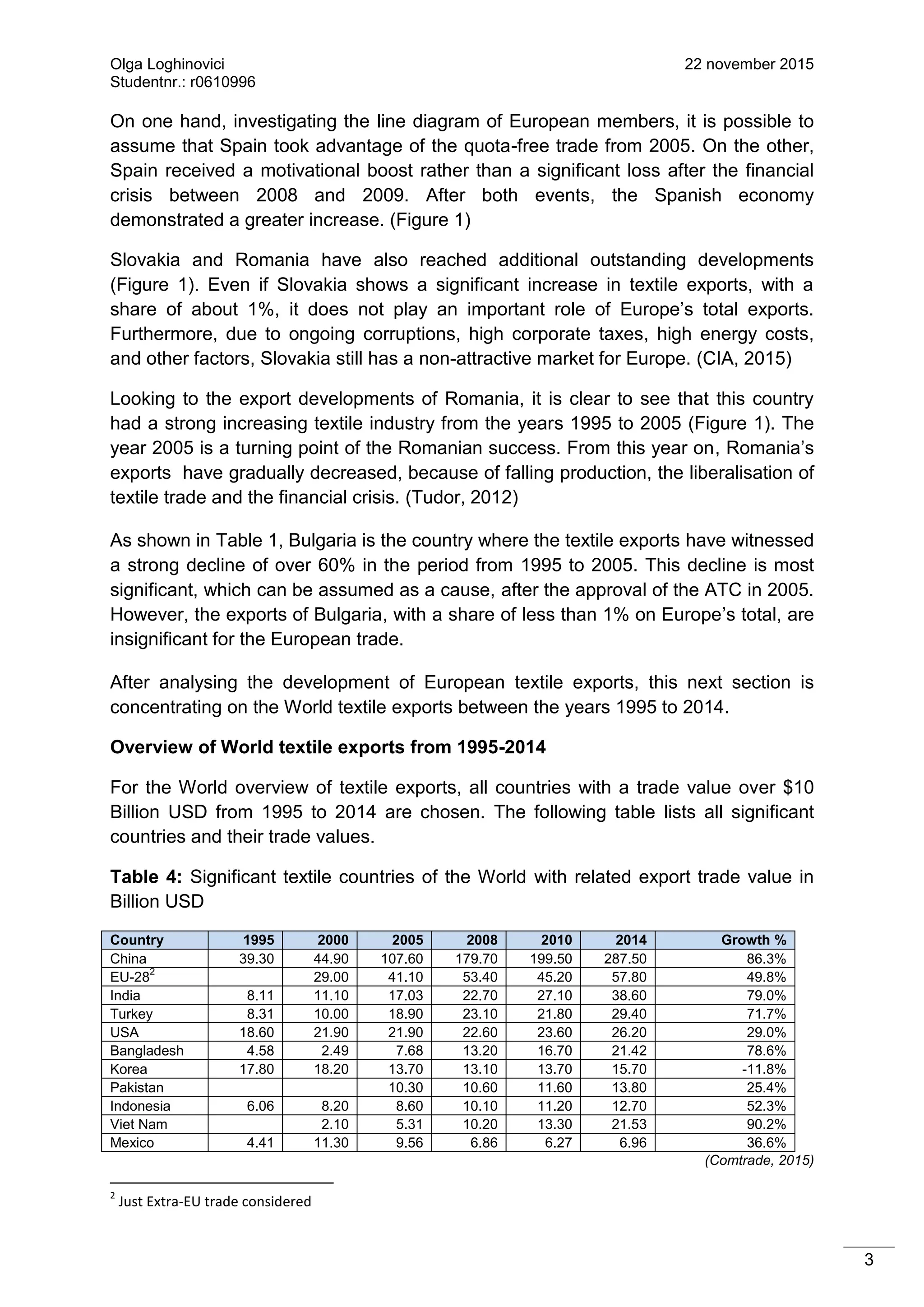

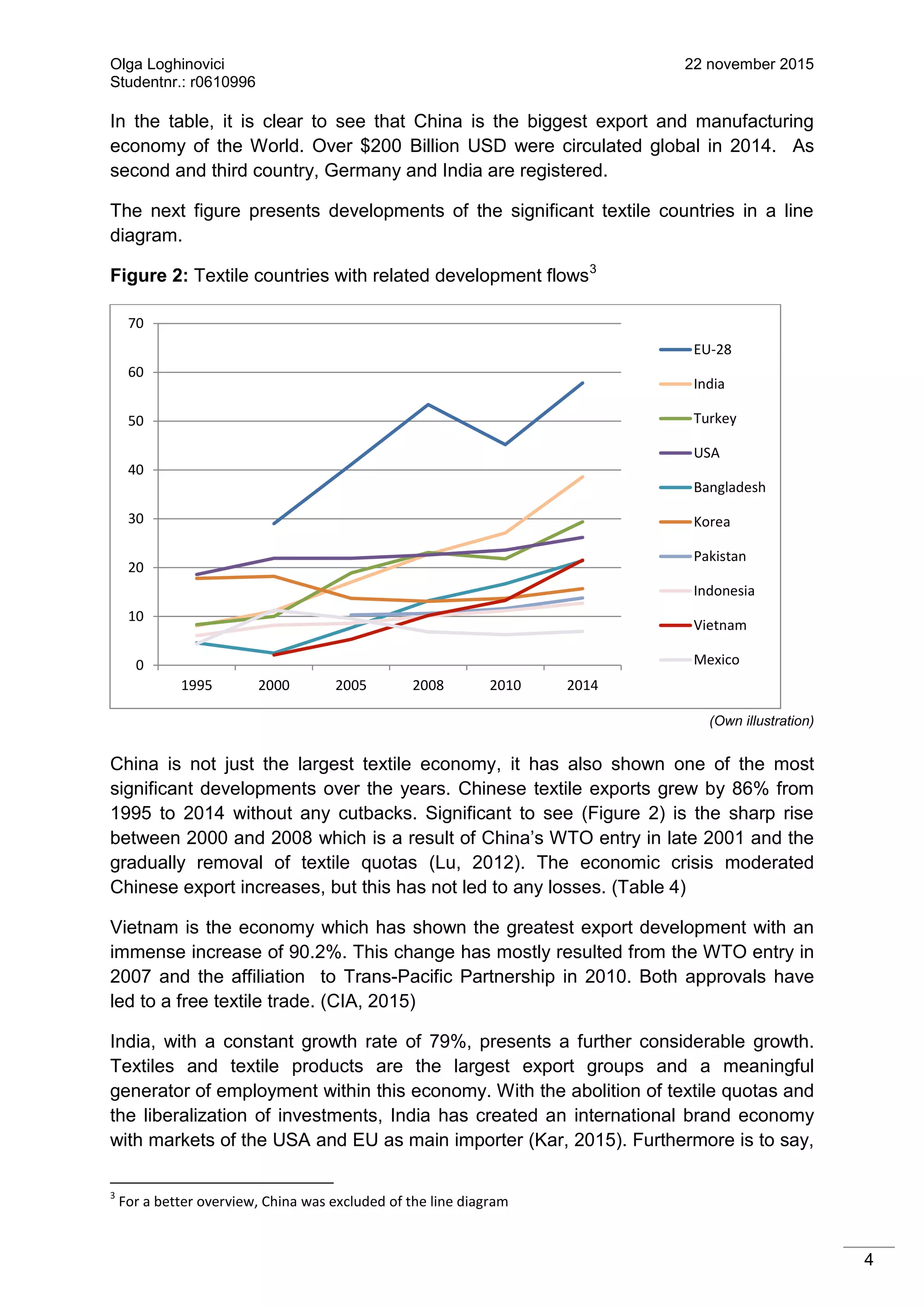

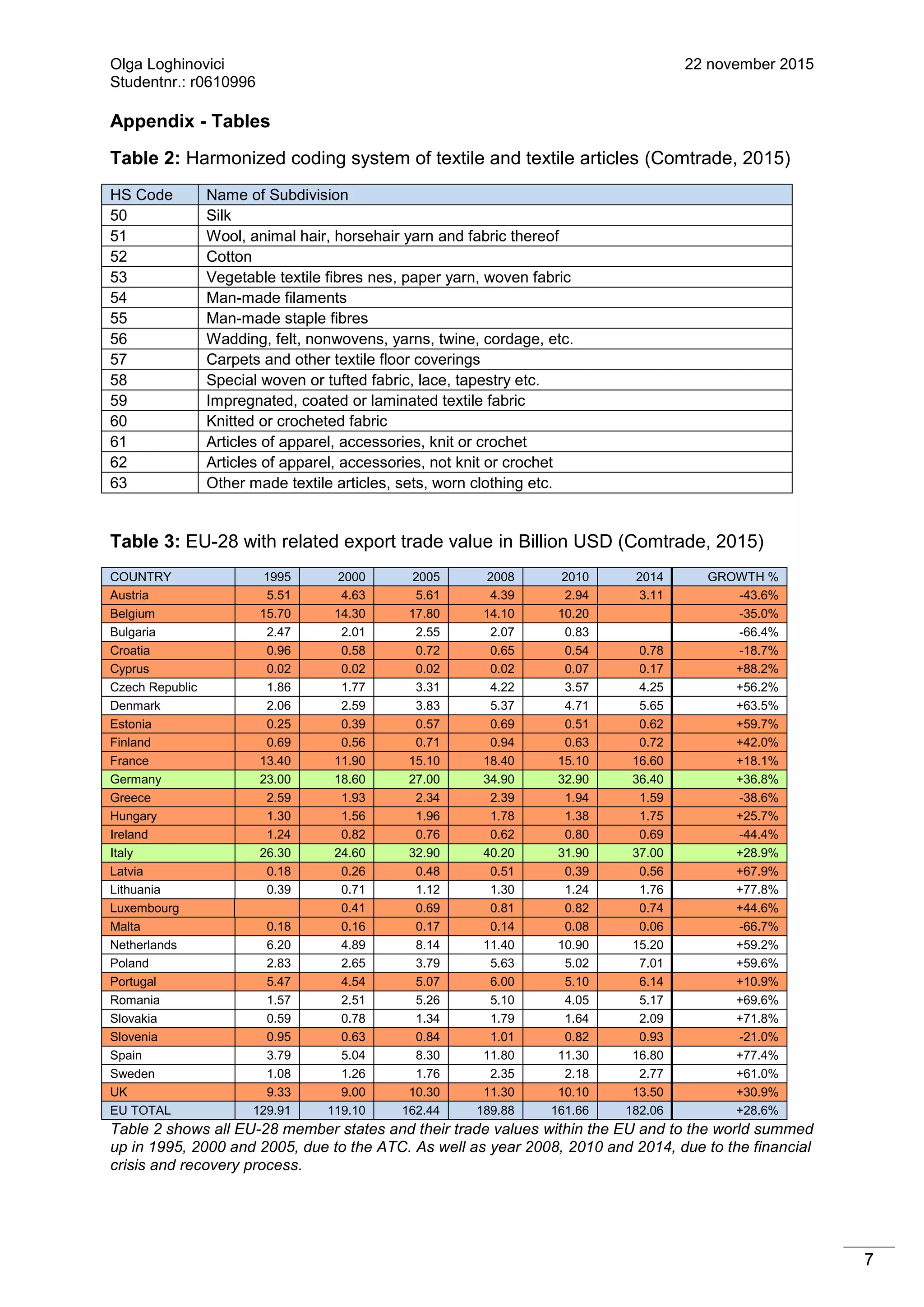

The document discusses the development of the global textile production industry, highlighting its significance and changes in export patterns from 1995 to 2014, particularly after the WTO's Agreement on Textiles and Clothing in 2005. It emphasizes the shifts in export values among various countries, with notable growth in Asian countries like China and Vietnam, while some European countries demonstrated moderate growth despite economic crises. The conclusion indicates a general trend of textile production moving towards Asian economies and Spain within Europe, while countries like Romania and Korea experienced declines in their textile export significance.