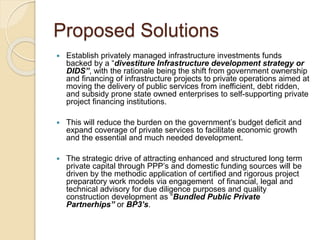

This document discusses Nigeria's infrastructure shortage and investment opportunities. It notes that Nigeria has inadequate infrastructure that inhibits economic growth. Data shows Nigeria has very low global infrastructure rankings, comparable to failed states. Nigeria's infrastructure master plan is estimated to require $2.9 trillion in investments. However, population growth is increasing demand for infrastructure investments. The document argues private investment in infrastructure funds and public-private partnerships could help close Nigeria's huge infrastructure funding gap and facilitate much needed development.