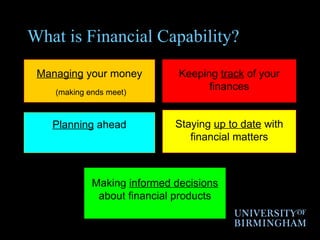

This document provides information and advice to students about developing financial capability and managing money, including budgeting, using credit cards responsibly, finding financial advice and support, and practical tips. The key goals are to help students understand basic financial management, take control of their finances, and provide hints for budgeting and managing money. Students are encouraged to open a student bank account, use cash machines without fees, regularly check statements, and report any fraud immediately. The golden rule for credit cards is to pay the full balance each month to avoid interest charges. Budgeting involves tracking income, expenses, and occasional costs to understand finances and cut unnecessary spending. Records of financial documents should be kept for tax purposes and to check for errors. The document