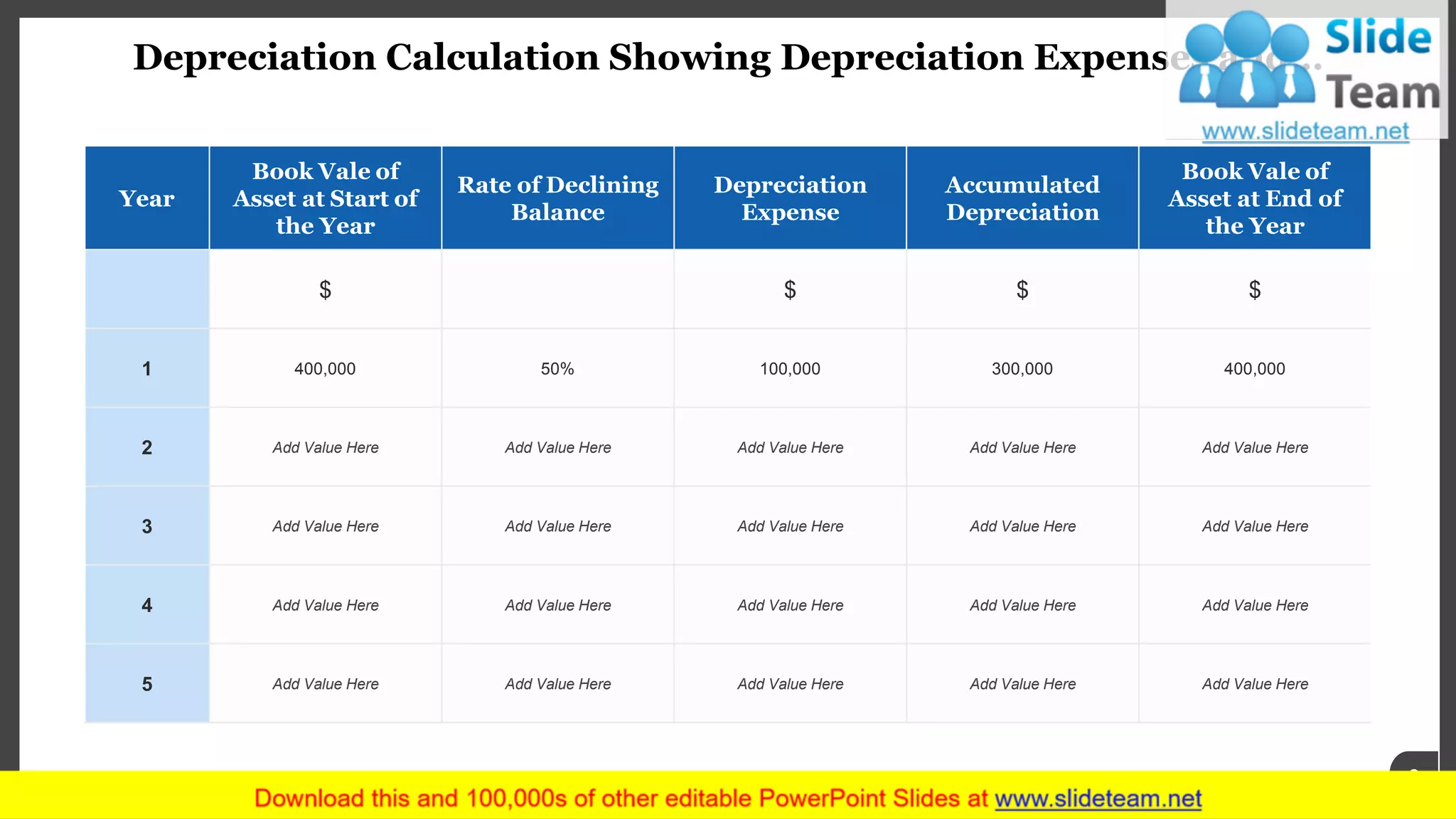

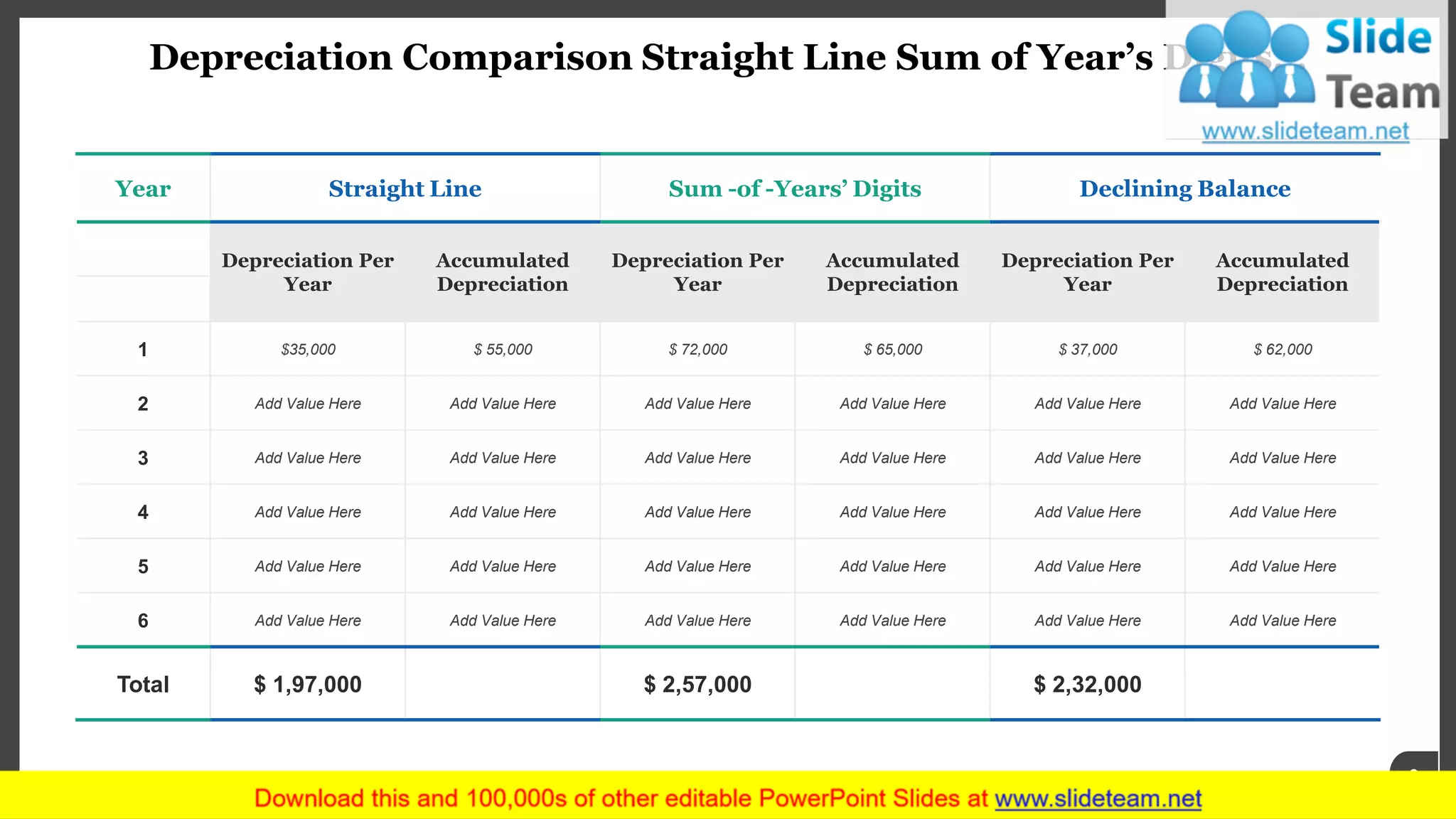

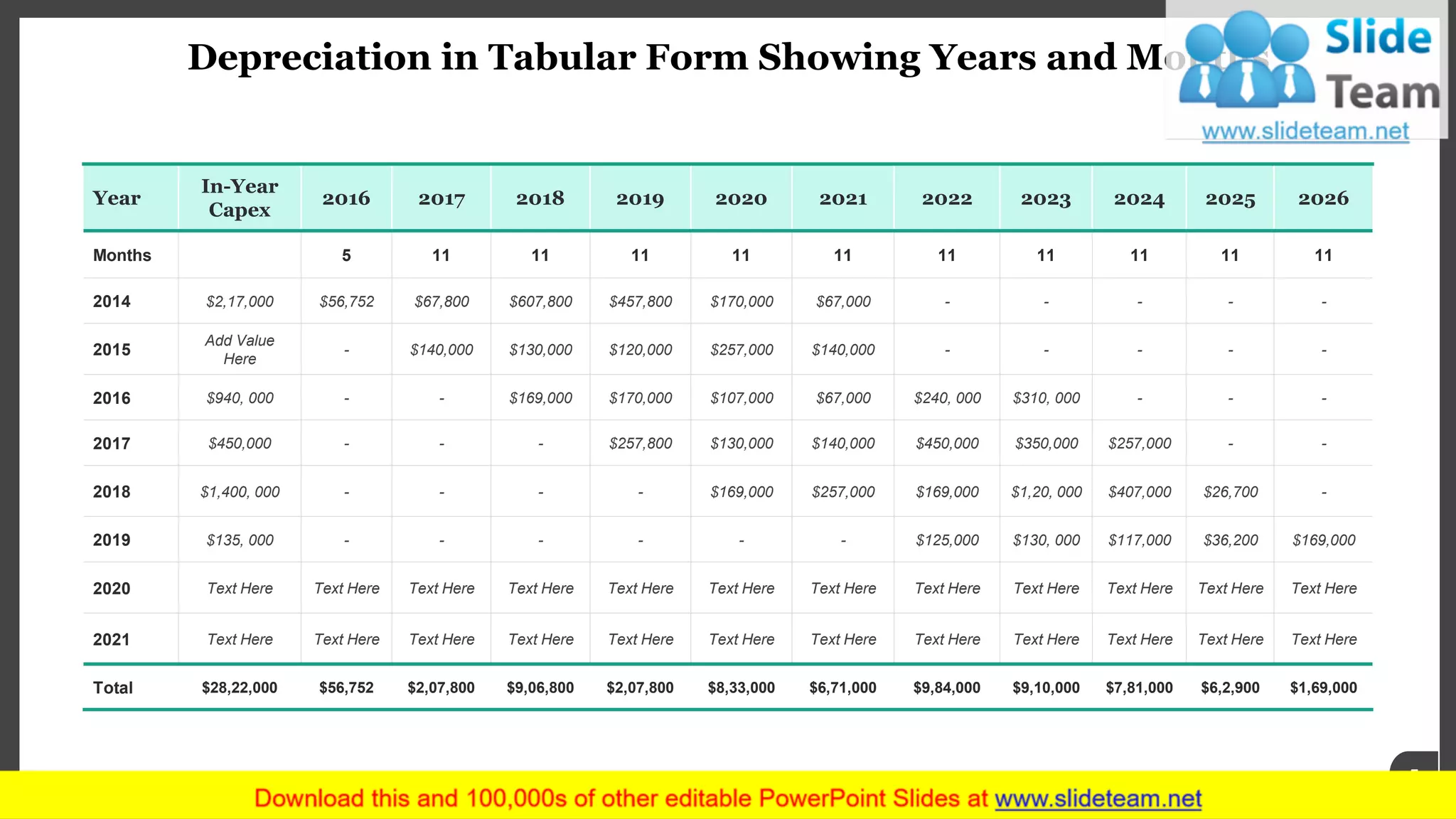

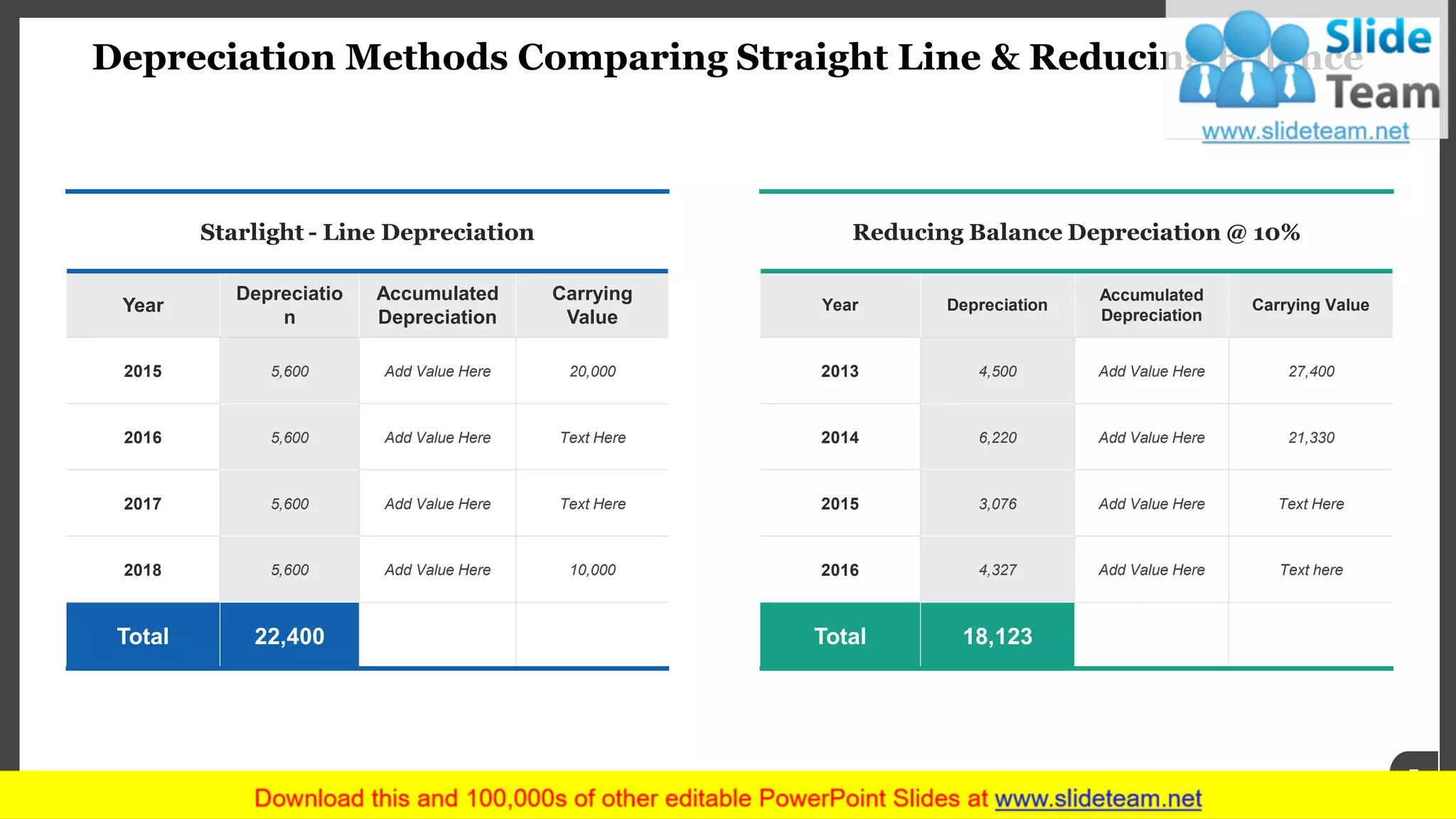

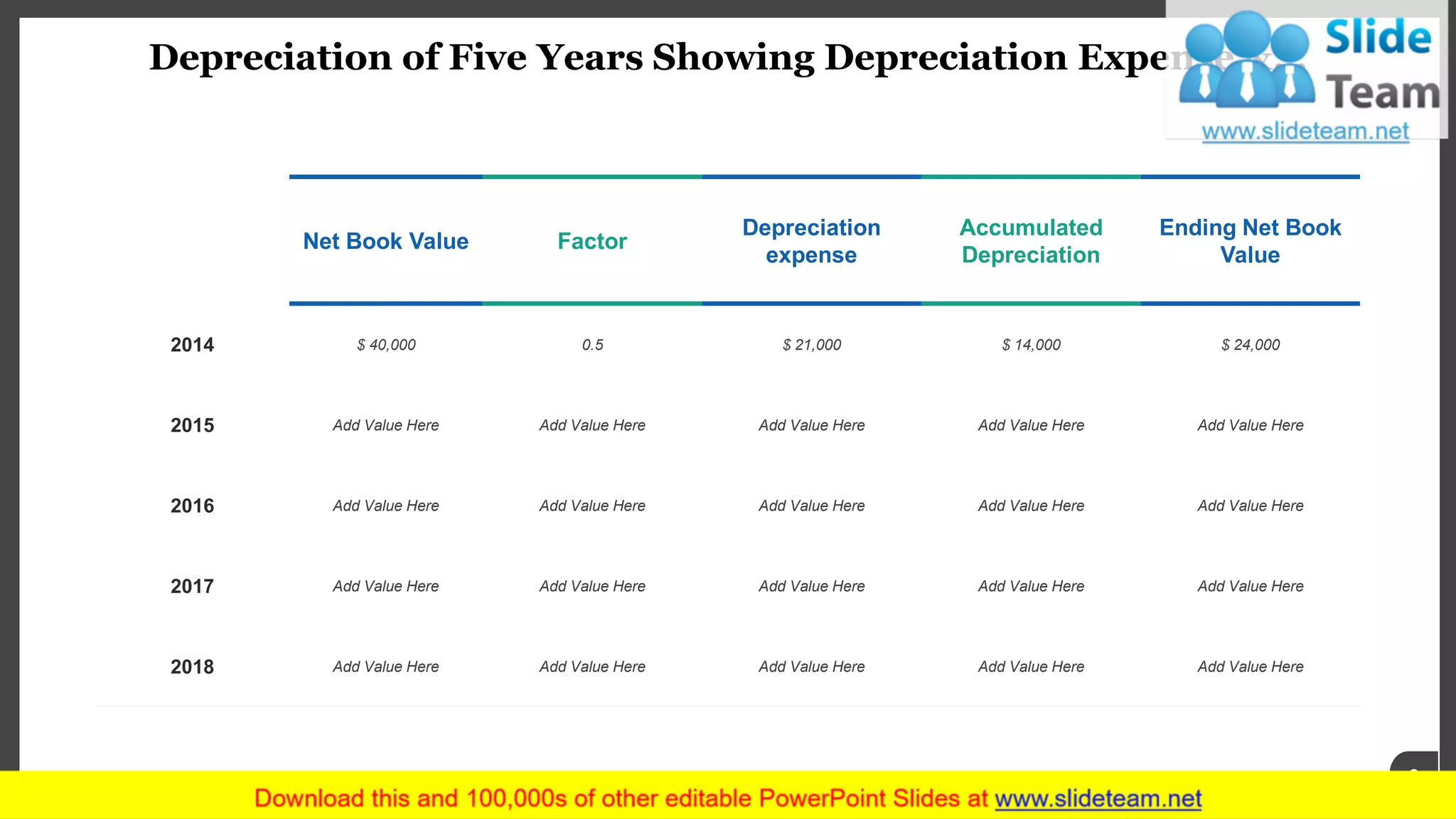

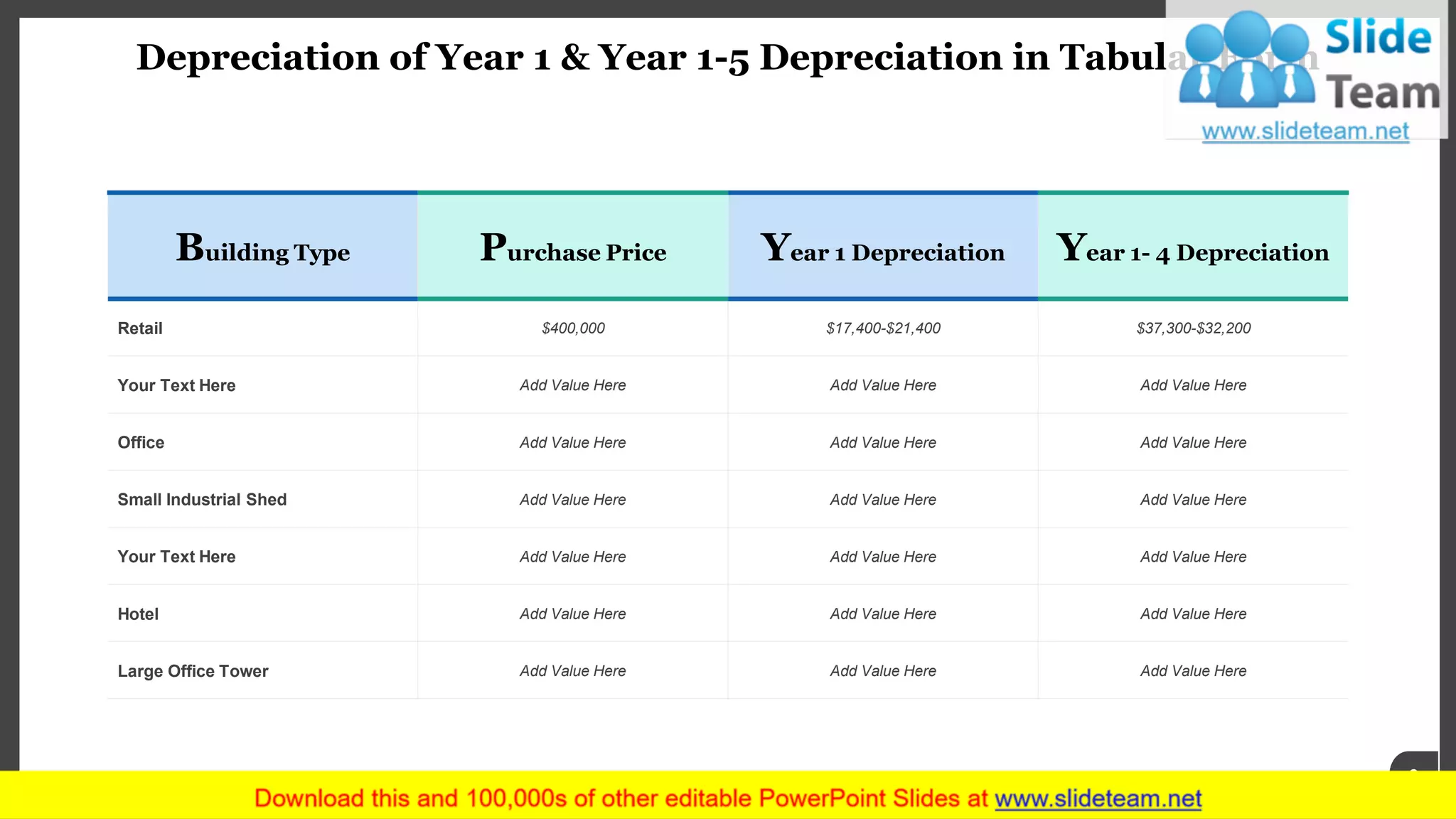

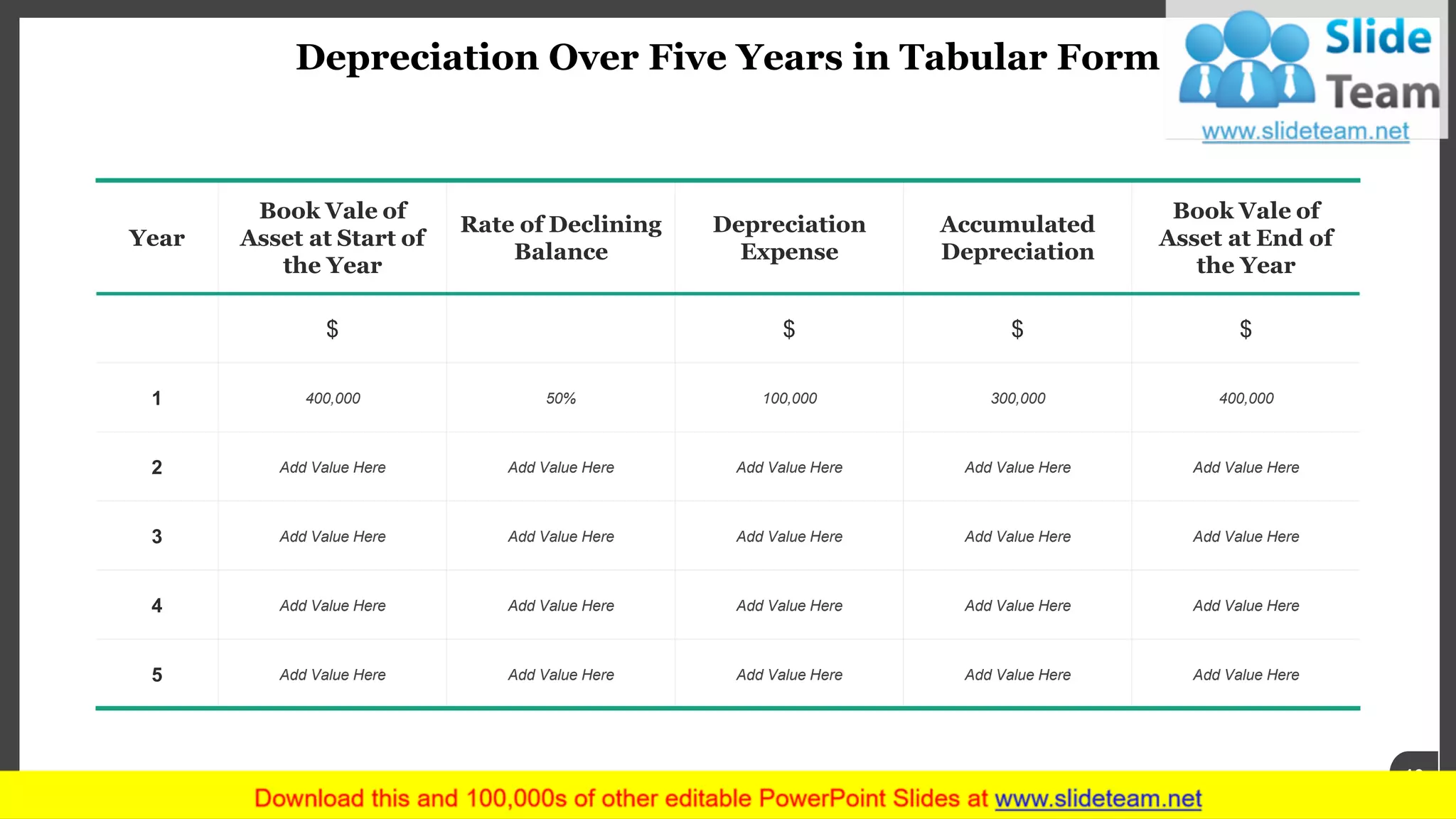

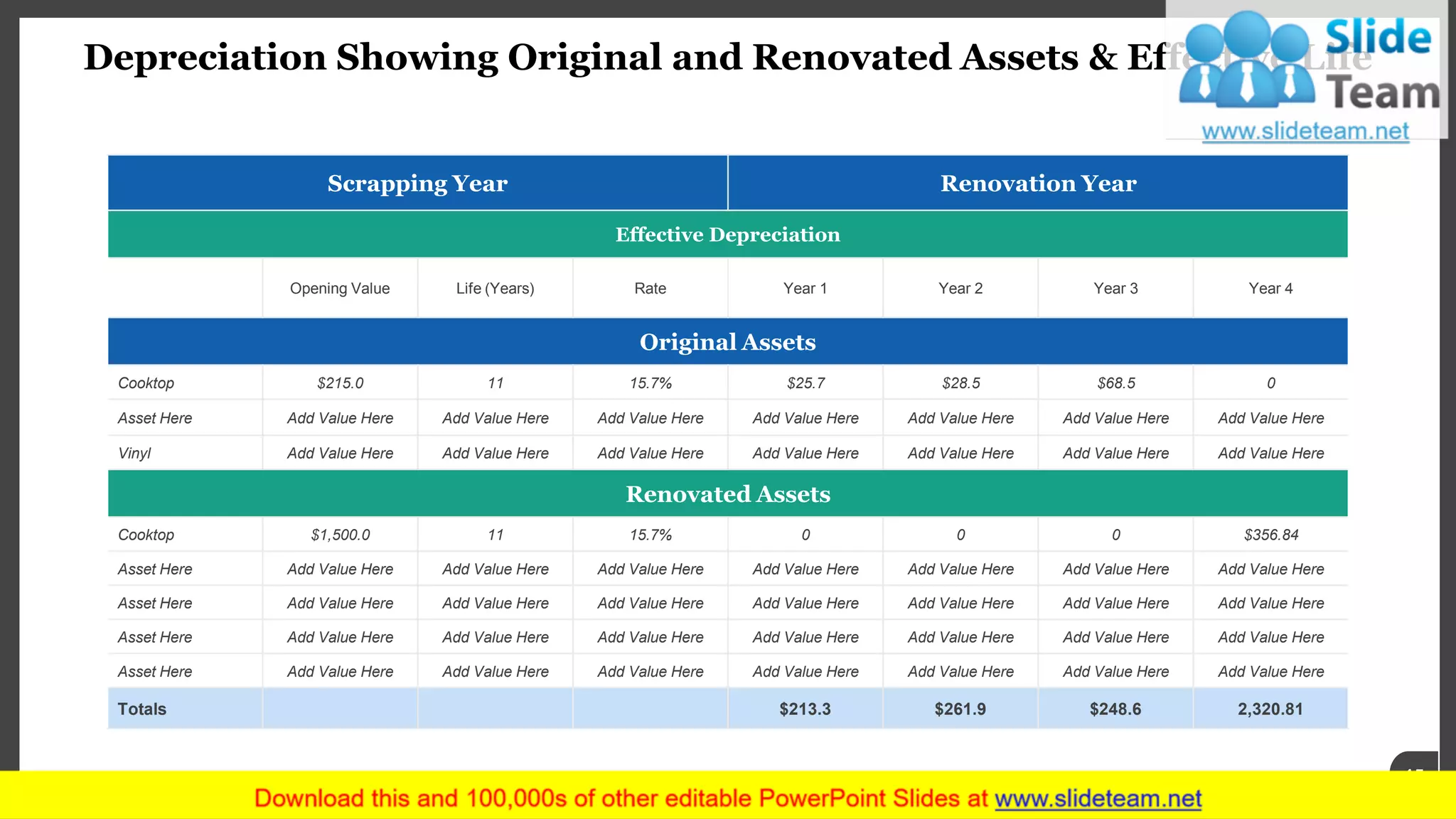

The document provides various depreciation calculation methods and schedules for assets over multiple years, including straight-line, declining balance, and sum-of-years' digits. It includes detailed tables showing depreciation expenses, accumulated depreciation, and remaining book values for different assets and scenarios. Additionally, it reflects on trends and forecasts of depreciation rates across different asset categories.